Most plumbing companies rely on word of mouth and hope. That’s not a strategy for lead generation for plumbers, that’s a gamble. The plumbing businesses pulling 40+ new service calls…

Table of Contents

Your technical expertise means nothing if nobody knows you exist.

Lead generation for accountants has shifted dramatically. Referrals alone no longer fill client pipelines the way they did ten years ago.

Today’s business owners search Google, browse LinkedIn, and compare CPAs online before picking up the phone.

Accounting firms that ignore digital marketing lose prospects to competitors who show up first.

This guide breaks down the client acquisition strategies that actually work: SEO, content marketing, referral programs, website optimization, and email nurturing.

You’ll learn which channels deliver qualified leads, what metrics to track, and which mistakes drain marketing budgets without results.

What is Lead Generation for Accountants

Lead generation for accountants is the process of attracting potential clients who need bookkeeping, tax preparation, or financial advisory services.

It covers every marketing activity that moves a stranger toward becoming a paying client.

CPAs and accounting firms use specific client acquisition strategies to identify business owners actively searching for financial expertise.

The goal is simple: fill your pipeline with qualified prospects who actually need what you offer.

Small business owners searching for “accounting services near me” represent one segment. High-net-worth individuals needing tax planning represent another.

Your lead generation approach determines which prospects find you first.

How Does Lead Generation Work for Accounting Firms

The process follows a predictable path: attract attention, capture contact information, qualify the prospect, then convert them into a client.

Most accounting firms struggle at step two. They get website visitors but fail to capture their information before they leave.

What Happens During the Lead Capture Process

A visitor lands on your website through Google search, LinkedIn, or a referral link. They browse your services page, maybe read a blog post about quarterly tax estimates.

Without a lead capture form, they leave and you never know they existed.

EmailTooltester research shows professional services (accounting, law, marketing) convert at 4.6%, the highest rate across all industries. B2B e-commerce sits at just 1.8%.

Why the gap?

Professional services convert better because prospects actively seek solutions to specific problems. Someone searching “tax planning for startups” knows they need help.

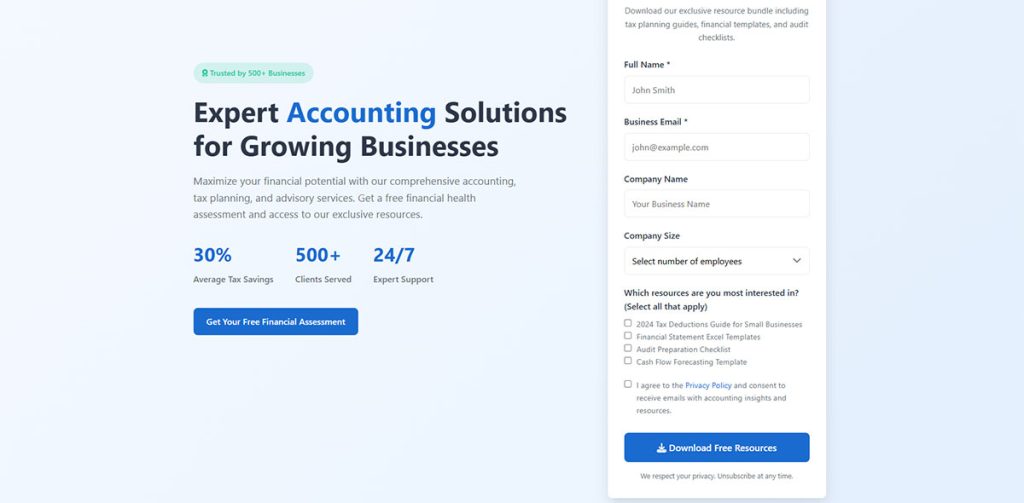

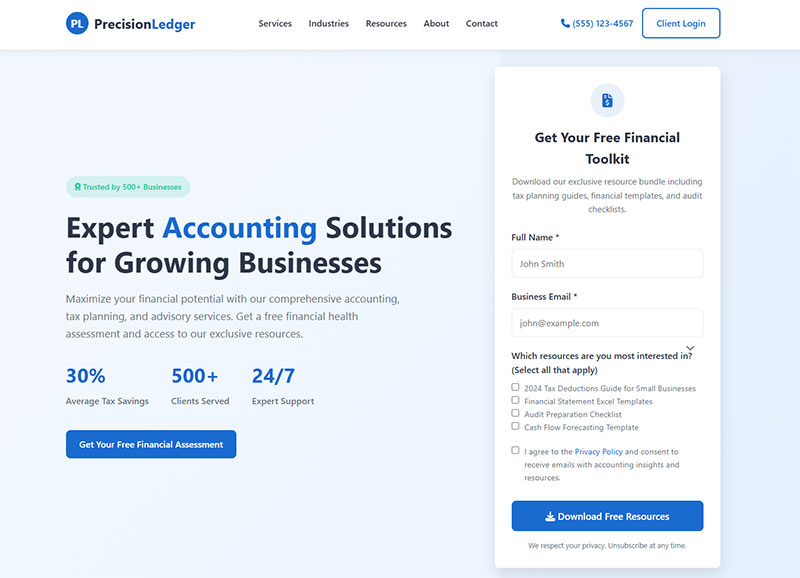

With proper website forms for lead generation, you exchange something valuable (a tax planning guide, free consultation) for their email address.

Calconic data shows accounting websites can reach conversion rates as high as 9.3%. But most firms convert far below this because they don’t optimize their capture process.

Elements that boost conversions:

- Clear value proposition above the form

- Testimonials near lead capture (Hotel Institute Montreux saw 50% increase in form submissions after adding testimonials above their form, according to VWO research)

- Mobile-optimized forms (Statista shows desktop converts at 2.8%, mobile at 2.8%, but tablets hit 3.1%)

- Minimum form fields (sites asking for phone numbers see 5-48% conversion drops per Enterprise Apps Today)

Alliance Interactive research reveals firms with regularly updated blogs generate 67% more leads than those without blogs. Content builds trust before visitors hit your contact form.

How Do Accounting Firms Qualify Their Leads

Not every inquiry deserves your time. A startup founder needing CFO services differs from someone wanting basic bookkeeping.

Growth List data shows only 20% of fresh leads result in sales. This underscores why qualification matters more than volume.

Lead scoring systems assign points based on:

- Company size

- Revenue range

- Service needs

- Engagement level (email opens, page visits, content downloads)

- Timeline to decision

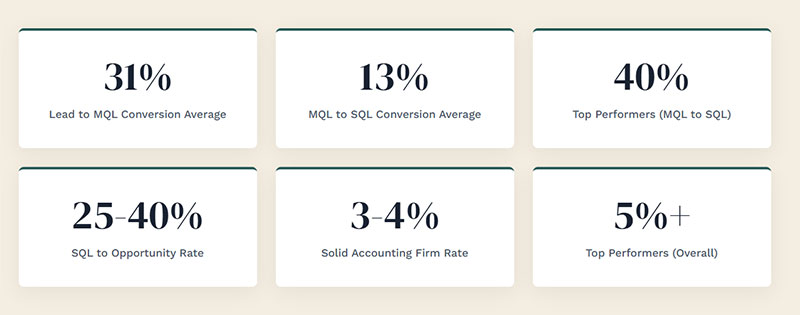

Qualification benchmarks from First Page Sage:

- Lead to MQL conversion: 31% average

- MQL to SQL conversion: 13% average, 40% for top performers

- SQL to Opportunity: 25-40%

Top performers using lead scoring see significantly better conversion rates. Ruler Analytics data shows the average conversion rate across industries is 2.9%, but accounting firms with proper qualification beat this by 50% or more.

HubSpot and Salesforce automate this process. Higher scores mean warmer prospects ready for a consultation call.

Databox research reveals the majority of leads score between 41-60 (40% of total). Only 10% achieve scores between 81-100, representing your hottest prospects.

Red flags that indicate poor-fit leads:

- Revenue too small to support your minimum engagement

- Industry outside your expertise

- Looking for services you don’t offer

- Unrealistic timeline expectations

- Price shopping without decision authority

What Role Does the Sales Funnel Play in Client Acquisition

Your lead generation funnel maps the journey from stranger to client.

Top of funnel: Attract attention

- Blog posts (Databox shows content marketing accounts for 51.5% of lead acquisition)

- Social media (66% of marketers generate leads spending just 6 hours weekly on social, per Scoop Market research)

- Paid ads (WordStream data shows average PPC conversion rate of 2.35%, but top 25% hit 5.31% or higher)

- SEO (Ruler Analytics shows organic search converts at 2.9% average)

Blogging Wizard reports 78% of businesses use email marketing as their primary lead generation tactic. It remains the most effective channel.

Middle of funnel: Build trust

- Email sequences (EmailTooltester data shows 48% of marketers consider email their most successful lead generation tactic)

- Webinars (ViB research shows 32% of B2B marketers find events and webinars most effective for generating leads)

- Case studies that demonstrate results

- Educational content about complex topics (AI-Bees data shows B2B blogs with educational content receive 52% more visitors than promotional content)

Email marketing delivers massive ROI. EmailTooltester research shows every $1 spent returns $36 (3,500% ROI). Retail and e-commerce hit 45:1 returns.

Litmus research confirms email open rates average 26.76%. Growth List data shows Mondays have highest open rates at 22%, while Tuesdays lead click-through rates at 2.4%.

Bottom of funnel: Close deals

- Consultation calls

- Proposals with clear pricing

- Engagement letters

- Contract signing

First Page Sage data shows that even websites like Salesforce convert less than 5% of traffic into qualified leads. The key is moving qualified leads efficiently through each stage.

Average time in each stage:

VIB research reveals B2B sales cycles for low-cost deals take up to 3 months. Higher-value accounting engagements can run 6-9 months from first contact to signed contract.

This extended timeline makes nurturing critical. Growth List shows 63% of leads reaching out need more time to commit. Just 21% are immediately ready for sale.

Converting Leads Into Paying Clients

Ruler Analytics research shows finance and insurance (which includes accounting) boasts landing page conversion rates of 15.6%, compared to just 8.8% for agencies.

What separates top performers:

- Fast response times (respond within 5 minutes or lose the lead)

- Personalized outreach (not generic templates)

- Clear next steps at every stage

- Consistent follow-up (most leads need multiple touches)

Alliance Interactive data reveals websites with testimonials see up to 58% higher conversion rates. Trust signals matter when prospects evaluate accounting firms.

Pathmonk research shows banking and financial services websites typically convert between 2-5%. Investment and wealth management sees 1-3% conversion rates due to higher complexity.

For accounting firms specifically, conversion rates between 3-4% are solid. Top performers with optimized websites, fast follow-up, and strong qualification processes exceed 5%.

Conversion optimization checklist:

- Mobile-responsive website (mobile users represent 63% of organic search visits in the US, per Higher Visibility)

- Clear service descriptions with pricing transparency

- Lead magnets offering immediate value

- Automated email sequences for nurturing

- CRM integration for tracking every touchpoint

- Lead scoring to prioritize hottest prospects

Growth List data shows 61% of marketers cite generating high-quality leads as their biggest challenge. But firms that nail qualification, nurturing, and conversion see sustainable growth without constantly chasing new traffic.

Common Mistakes That Kill Conversions

Focusing on traffic instead of conversion

Enterprise Apps Today research shows 22% of firms aren’t satisfied with conversions because they don’t understand that average rates hover around 3%.

Getting 10,000 monthly visitors converting at 2% (200 leads) beats 20,000 visitors at 0.5% (100 leads). Optimize what you have before spending more on ads.

Neglecting email follow-up

Growth List reveals email is the top choice for 37% of participants when following up on leads, with phone calls at 36%. But most firms send one email and give up.

APSIS data shows 78% of businesses use email marketing for lead generation. But success requires consistent, valuable communication over time.

Poor website experience

Matomo research found average bounce rate across industries is 50.9%. Half your visitors leave without taking action.

Invesp data shows the top 10% of websites convert at 11% or higher, while average sites hit just 2.35%. The difference comes down to user experience, clear messaging, and strategic form placement.

Not qualifying leads

Sales So research shows only 27% of marketing leads are actually qualified, yet 61% of B2B marketers send all leads to sales. This wastes time on prospects who will never convert.

Growth List data confirms only 20% of fresh leads result in sales. Without qualification, your sales team burns hours on dead ends.

Benchmarking Your Performance

Website conversion rate targets:

- Basic accounting website: 2-3%

- Optimized accounting website: 4-6%

- Top performers with landing pages: 8-10%+

Lead-to-client conversion targets:

- Lead to MQL: 30-35%

- MQL to SQL: 15-20% (top performers hit 40%)

- SQL to consultation: 50-60%

- Consultation to client: 20-30%

First Page Sage shows professional services have strong conversion potential, but most firms underperform benchmarks due to poor qualification and slow follow-up.

Focus on moving qualified leads through your funnel faster rather than generating more unqualified traffic. ViB research shows 50% of B2B marketers didn’t meet their marketing goals in 2023, often because they prioritized volume over quality.

Which Digital Marketing Channels Generate Accounting Leads

Digital marketing for CPAs spans multiple channels. Some deliver quick results. Others build momentum over months.

The best accounting firm marketing strategies combine both approaches.

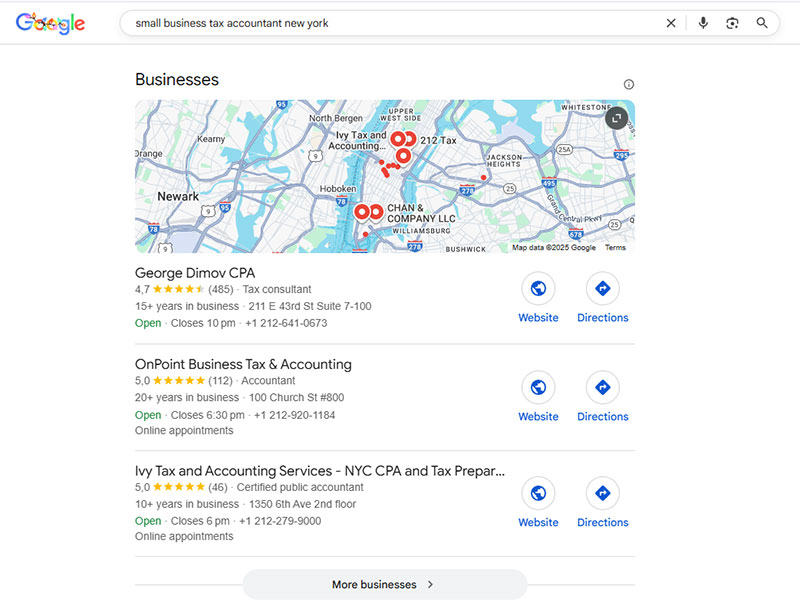

How Does SEO Attract Clients to Accounting Websites

Search engine optimization puts your firm in front of people actively searching for accounting help.

When someone types “CPA near me” or “small business tax accountant,” your website either appears or it doesn’t.

Why SEO matters for accounting firms:

CPA Site Solutions research shows the #1 organic search result in Google gets roughly 28% of all clicks. The top three results capture 54% of all clicks. The #1 position is 10 times more likely to get clicked than #10.

Get Cone data reveals 60% of marketers say inbound methods (SEO, blog content) are their highest quality source of leads. SEO beats paid advertising for sustained lead generation.

Marketing Scoop research shows over 72% of clients begin their professional service search online, with local search results playing a critical role in decision-making.

SEO takes 6-12 months to gain traction but delivers compounding returns. Content you publish today generates leads for years.

Reboot Online found that CPA Site Solutions’ SEO services deliver 300% ROI on average for accounting firms. Once first-page positions are secured, budget can immediately target even more keywords.

What Keywords Do Potential Accounting Clients Search For

High-intent searches include: “accountant for LLC,” “tax preparation services,” “bookkeeping for small business,” “CPA for startups.”

Target long-tail phrases like “how much does a small business accountant cost” to capture prospects earlier in their decision process.

Search volume examples:

CPA Site Solutions shows common keywords businesses search for include:

- “Accounting services” + city name

- “Best accounting firm in [city]”

- “Professional tax services in [city]”

- “Small business accountant near me”

Marketing Scoop data confirms Marketing Scoop reports websites ranking on Google’s first page load approximately 70% faster than lower-ranked competitors. Technical optimization matters.

Financial Cents reports that blogger Blake Oliver tracked blog posts and saw one topic drove 80% of his website traffic. When you find what resonates, double down with a content series.

How Does Local SEO Benefit Regional Accounting Practices

Google Business Profile optimization is non-negotiable for local business lead generation.

Claim your listing, add photos of your office, collect client reviews, post updates weekly. Local pack rankings drive phone calls directly.

Local SEO impact:

Financial Cents research shows Google automatically identifies user location to show relevant businesses, even when searchers don’t specify location in their query.

Search engines use proximity factors to show your business to searchers with local intent. Queries like “Bookkeeper near me” or “Accounting firm in Washington DC” trigger local results.

SEO.ai data shows even with a subpar website, KDP CPA managed to rank #1 locally with an optimized Google Business Profile.

NAP consistency matters:

SEO.ai research confirms NAP (Name, Address, Phone Number) consistency establishes reliability, improves local search visibility, and enhances user experience. Inconsistent information kills local rankings.

How Do PPC Campaigns Deliver Immediate Visibility for CPAs

Google Ads puts your firm at the top of search results immediately. You pay each time someone clicks.

PPC cost benchmarks for accounting:

Ninja Promo data shows average cost per lead across industries sits at $66.69. Legal services have notably high CPL at $144.03, while sectors like automotive repair hit just $27.94.

Digital Position research reveals average cost per click in the United States in 2024 is $4.18, though this varies significantly by industry and keyword competition.

Passive Secrets data confirms Google Ads average CPC is $2.69 for search ads and $0.63 for display ads. Average conversion rate is 3.75% for search, 0.77% for display.

Average cost per click for accounting keywords ranges from $8-25 depending on location and competition, per various industry reports.

Return on investment:

Store Growers shows average CPA across all industries in Google Search is $48.96. For ecommerce specifically, it’s $45.27.

Ninja Promo research reveals general Google Ads ROI averages $2 for every $1 spent, though this varies widely by campaign strategy and optimization.

PPC.io data shows typical cost-per-click on Google Search Network ranges between $1-5 depending on industry in 2024. High-intent keywords cost significantly more because you’re reaching people actively searching for your service.

PPC works best:

- During tax season when demand spikes

- When you need clients fast

- For testing new service offerings

- In competitive markets where SEO takes too long

It stops working the moment you stop paying. Passive Secrets confirms retail brands running Google search ads have seen 40-50% increase in average CPC over past five years.

What Social Media Platforms Work Best for Accountant Lead Generation

Not all platforms deserve your attention. B2B accounting services thrive on LinkedIn. Consumer tax prep does better on Facebook.

Pick one or two platforms maximum. Consistency beats presence everywhere.

Why is LinkedIn Effective for B2B Accounting Services

LinkedIn connects you directly with business owners, CFOs, and decision-makers who hire accountants.

LinkedIn’s B2B dominance:

Cognism research shows LinkedIn is 277% more effective at generating high-quality leads than Facebook and Twitter. This isn’t marketing hype; it’s measured performance data.

Snov.io confirms LinkedIn generates 80% of all B2B leads from social media, surpassing Facebook, X, and Instagram combined. The platform is considered the #1 channel for B2B lead generation, with 40% of B2B marketers claiming it’s most effective for high-quality leads.

Engage AI data reveals 40% of business marketers have analyzed that LinkedIn is most effective in generating quality leads. Nearly 65% of businesses have gained B2B leads through the platform.

Why the numbers work:

Sopro reports LinkedIn had over 1 billion users across 200 countries by end of 2024. The platform saw 12% increase in annual revenue, generating almost $70 billion.

Amra and Elma research shows approximately 40% of B2B marketers consider LinkedIn the most effective channel for high-quality lead generation. Marketers experience conversion rates up to 2x higher on LinkedIn compared to other platforms.

Over 80% of B2B marketers utilize LinkedIn for content marketing, making it the most popular B2B social media platform. About 84% of B2B marketers believe LinkedIn delivers best value for their organization.

LinkedIn’s audience:

Snov.io data shows 65 million B2B decision-makers use LinkedIn. That’s your target audience concentrated on one platform.

The B2B House reports 97% of B2B marketers use LinkedIn to promote their content. LinkedIn is 277% more effective for lead generation than Facebook and X.

Cognism confirms LinkedIn members possess 2 times the buying power of the average web audience. About 82% of B2B buyers will review your LinkedIn profile before accepting a meeting.

What works on LinkedIn:

- Share insights about tax law changes

- Comment on industry posts

- Connect with local business owners

- Post educational content consistently

- Use LinkedIn Lead Gen Forms (The B2B House shows these improve conversion rates significantly due to pre-populated fields that reduce friction)

Sopro research shows LinkedIn generated almost $6 billion in ad revenue last year. The platform’s IT industry alone has 30 million users, while 16 million software development professionals use the platform.

How Can Facebook Ads Target Small Business Owners

Facebook’s targeting lets you reach business owners by industry, revenue size, location, and behavior patterns.

A lead magnet offer (free tax checklist, year-end closing guide) paired with a simple form generates leads at $5-15 each.

Retargeting website visitors keeps your firm visible during their decision process.

Facebook targeting advantages:

- Demographic targeting (age, education, job title)

- Behavioral targeting (business page admins, small business owners)

- Interest targeting (accounting software, business management)

- Geographic targeting (local radius around your office)

- Lookalike audiences based on existing clients

Facebook works better for consumer-facing services like individual tax preparation. LinkedIn wins for B2B services.

Lead magnet performance:

CPA Site Solutions research reveals lead magnets convert significantly better than basic contact forms. Offering valuable content in exchange for email addresses builds trust before the sales conversation.

Examples that work for accounting firms:

- Tax planning guides (seasonal timing matters)

- Year-end closing checklists

- Expense tracking templates

- Industry-specific financial benchmarks

- Quarterly tax estimate calculators

Alliance Interactive data shows websites with clear value propositions and lead magnets can reach conversion rates of 8-10%+ compared to 2-3% for basic sites.

What Content Marketing Strategies Attract Accounting Clients

Content marketing costs 62% less than traditional advertising while generating three times more leads according to Demand Metric.

The key: create resources that solve real problems your prospects face.

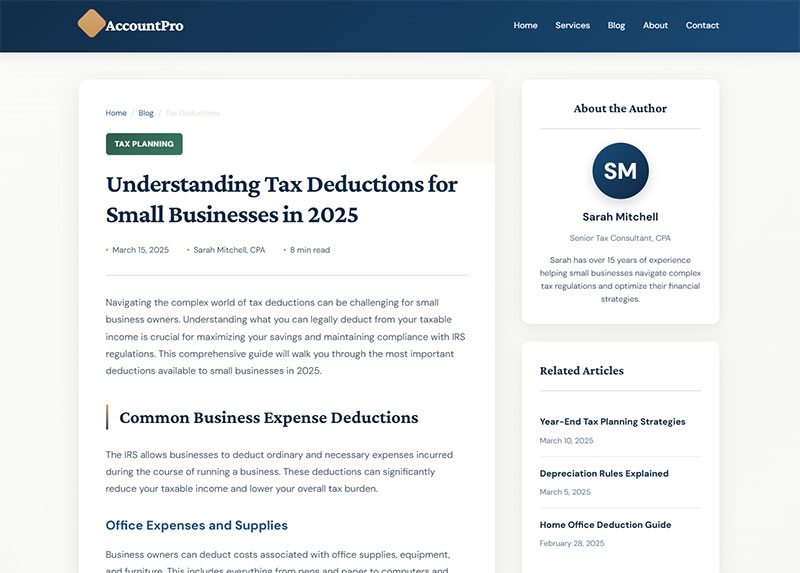

How Do Blog Posts Generate Organic Traffic for Accounting Firms

Every blog post is an indexed page that can rank in Google and bring visitors for years.

Blogging statistics for accounting firms:

CPA Site Solutions research reveals compelling numbers about professional service searches:

- 84% of potential clients research accounting firms online before making contact

- 67% start their search for financial services on Google

- 71% of B2B buyers consume 3-5 pieces of content before engaging with a firm

- 92% of accounting clients trust organic search results over paid ads

A 2023 survey of over 1,000 business decision-makers found 72% evaluate accounting service providers through online research.

Demand Metric data shows companies that maintain a blog generate 67% more leads than those that don’t. Warmly research confirms companies publishing at least 16 blog posts monthly generate 4.5x more leads than those publishing 4 or fewer.

Content marketing effectiveness:

EmailTooltester shows 90% of marketers use content marketing as part of their lead generation strategy. However, 45% say attracting quality leads is one of their biggest challenges.

Yodel Pop data reveals more than 70% of businesses emphasize content marketing as a fundamental strategy to reach and engage audiences effectively.

Growth List reports companies publishing 16 or more blogs every month can expect their leads to multiply by 3.5 times compared to businesses producing four or fewer blogs.

What to write about:

Write about topics your ideal clients search: “S Corporation vs LLC taxes,” “quarterly estimated tax deadlines,” “what records to keep for IRS audit.”

One well-researched article about Form 1040 changes can generate hundreds of leads during tax season.

Financial Cents tells the story of blogger Blake Oliver, who tracked all blog posts and identified one topic that resonated. He wrote a series of eight articles about that topic, and those eight blog posts ended up driving 80% of traffic to his website.

Blog post performance benchmarks:

HubSpot data shows blog posts (19.47%) were the fourth most popular content format used by marketers in 2024, following short-form video (29.18%), images (28.95%), and interviews (21.64%).

Orbit Media research reveals the average blog post length is 1,400 words, more than 77% longer than ten years ago. Editor Ninja shows B2B sites with educational content on blogs get 52% more organic traffic than B2B companies with just company-focused content.

Growth List research confirms those who utilize blogs as a marketing tool increase their likelihood of realizing positive returns on investment thirteenfold.

What Lead Magnets Convert Website Visitors into Prospects

A lead magnet trades valuable content for contact information. It’s the bridge between anonymous visitor and known prospect.

Accounting firms see the best results with practical, immediately usable resources.

Lead magnet conversion performance:

CPA Site Solutions research shows lead magnets are extremely effective for lead generation. When structured properly, they dramatically outperform basic contact forms.

Agency Jet data confirms accountants can enhance their content marketing strategies by offering premium materials such as ebooks or downloadable financial templates. These resources not only demonstrate the firm’s expertise but also work effectively as lead-generation tools.

Yodel Pop research shows these resources are excellent for lead generation. Create simple, useful tools like a tax preparation checklist or a financial health worksheet. Offer these as free downloads in exchange for email addresses.

Which Free Resources Do Potential Accounting Clients Download

Tax planning guides perform well year-round. Specific titles like “2024 Tax Deductions for Small Business Owners” outperform generic guides.

Other high-converting lead magnet ideas for accountants:

- Financial statement templates in Microsoft Excel format

- Audit preparation checklists

- Year-end closing guides with deadlines

- Industry-specific benchmarking reports

- QuickBooks or Xero setup tutorials

Gate these resources behind simple lead capture forms asking for name, email, and company size.

Lead magnet types that convert:

CPA Site Solutions compiled 20 eye-catching lead magnet ideas specifically for accounting firms. These include:

- Tax deduction checklists

- Financial planning guides

- Industry-specific benchmarking reports

- Cash flow forecasting templates

- Expense tracking systems

- Audit readiness guides

- Financial template bundles

Agency Jet recommends lead magnets could be resources like industry-specific tax deduction checklists or financial planning guides, which hold high perceived value for prospective clients and motivate them to engage with the firm.

Interactive tools:

Yodel Pop research shows incorporating tools like tax calculators or investment return estimators on your website assists visitors with their specific financial queries. These enhance user engagement and time spent on site, improving overall SEO and establishing your firm as a helpful resource.

How Do Webinars and Online Workshops Position Accountants as Experts

Live webinars let prospects experience your expertise before hiring you. They see how you explain complex tax concepts.

Webinar lead generation statistics:

Aevent research reveals webinar landing pages can reach conversion rates up to 51%, indicating their high effectiveness in attracting leads.

Ring Central data shows 73% of marketers identify webinars as an effective source of quality leads. Conversion rates for webinars are often way higher than for other content types, converting between 5% and 20% of viewers into buyers.

Hubilo reports successful webinars see 20% to 40% of webinar attendees entering the sales pipeline as qualified leads. The average conversion rate was 56%, meaning more than half of all webinar participants completed a desired action.

Webinar effectiveness compared to other channels:

Gudsho data shows compared to other online presentations, webinars have an impressive average conversion rate of 55%.

Mandala System confirms 73% of B2B webinar attendees become leads. For B2C webinars, lead generation ranges between 20% and 40%.

ViB Tech research reveals if marketers could only pick one lead generation strategy, 31% would pick events and webinars as their most effective channel for 2024. And 37% said it was their most valuable channel.

Why webinars work so well:

Live Webinar data shows 95% of respondents agreed that webinars were key to their lead generation and marketing efforts. 73% of B2B marketers say webinars are the best way to generate high-quality leads.

Get Contrast research confirms approximately 40% of marketers track leads generated as their main webinar metric because leads offer immediate, easy-to-measure results.

Hubilo reports webinars are considered cost-effective by marketers as they help lower the cost-per-lead. The average cost per lead for a webinar is approximately $72, significantly lower compared to other lead generation methods like public relations ($294) and trade show leads ($811).

Webinar attendance and timing:

ViB Tech data shows for B2B marketers in tech, average webinar attendance rate is 37.5%. In 2024, 55% of marketers confirm that average webinar attendance rates are around 35-40%.

Gudsho research reveals the best time to host a webinar is during business hours, with 50-55% response rate during these times compared to just 25-30% outside regular hours.

Ring Central confirms you can expect between 35% to 45% of those who registered to actually turn up to the live version of the webinar. Many registrants who miss the live broadcast will check out the on-demand replay.

Topics that attract attendance:

Topics that attract attendance: “Tax Strategies Before Year-End,” “Cash Flow Management for Growing Businesses,” “IRS Audit: What to Expect.”

Financial Cents recommends providing value through content such as blog posts, whitepapers, and webinars to establish yourself as an expert in your field and attract high-quality leads.

Follow-up strategy:

Use webinar registration forms to capture attendee information. Follow up within 24 hours while engagement is high.

Univid data shows webinars with a clear call-to-action (CTA) button active see 22% average conversion rate from attendee to clicked CTA. Smaller webinars (50-100 attendees) yield highest CTA conversion rates at 26%.

Content repurposing value:

Mandala System research reveals B2B marketers receive 6.3 new pieces of content from each webinar on average. Marketers save between 4 and 10 hours per webinar and create 20% more content by using AI tools.

Get Contrast data shows in 2024, Repurpose AI was used 5,328 times across 3,632 webinars to automatically generate blog posts, articles, and campaign materials directly from webinar transcripts. This saves over 13,000 hours or roughly $650,000 in copywriting labor.

Each webinar becomes blog posts, social media content, email newsletters, and short video clips. One 60-minute session generates months of marketing material.

Content Marketing ROI

Cost comparison:

WP Forms research confirms content marketing is a highly effective inbound marketing tactic, generating three times as many prospective leads as outbound marketing and costs 62% less.

Hubilo shows webinars eliminate expenses like venue rental, travel, and printed materials. Whether you have 10 or 1,000 attendees, the cost remains relatively stable. Recordings can be repurposed for on-demand viewing, social media snippets, or training materials.

Long-term value:

CPA Site Solutions data reveals blogging builds momentum gradually with cumulative results. Though ROI measurement requires more sophisticated tracking, the long-term results prove impressive for accounting firms.

Agency Jet confirms content marketing revolves around developing and sharing insightful material to establish expertise, promote brand awareness, and attract potential clients interested in accounting services.

The versatility of content types (blog posts, white papers, podcasts, videos) allows accounting firms to tailor their content to the preferences of their target audience, increasing its value and relevance.

How Do Referral Programs Increase Client Acquisition for Accountants

Referrals convert at higher rates than any other channel. The prospect arrives pre-sold on your expertise. Yet most accounting firms leave referrals to chance instead of building systematic programs.

Why Referrals Outperform Other Channels

Finances Online research shows referral leads have 30% higher conversion rates than other marketing channels and 16% higher lifetime value.

Firework data reveals brands with referral programs see 3x the conversion rate compared to other strategies. Even better: 70% of marketers report lower cost per acquisition than any other channel.

Key performance metrics:

- People are 4x more likely to buy when referred by a friend (Win Savvy)

- Word-of-mouth drives $6 trillion in annual consumer spending (Meetanshi)

- 74% of consumers cite word-of-mouth as a key purchase influencer (Win Savvy)

- 93% of B2B buyers trust word-of-mouth over other advertising (Firework)

Referral Statistics for Accounting Firms

Clearly Rated confirms the AICPA position: referrals consistently rank as the top source of new business for professional services.

By the numbers:

- 89% of firms attribute majority of new business to referrals

- 79% of top-performing CPA firms get referrals from existing tax clients (AICPA 2022 Survey)

- 48% of wealth managers identify client referrals as their primary source (FA Magazine)

- Professional services referrals convert at 5.5% (Ruler Analytics)

What Incentive Structures Motivate Existing Clients to Refer

Cash rewards work but feel transactional. Service credits, gift cards, or charitable donations in the client’s name often perform better. The AICPA recommends keeping referral incentives modest to maintain professional standards.

What drives referrals:

Meetanshi shows 50% of consumers are motivated by monetary rewards, but 82% want some form of incentive. The key: make it valuable without feeling like a bribe.

Prefinery data: A $50 referral incentive generated $496,000 in new revenue (14.5x ROI) for online mattress brands. Small investments yield massive returns.

Incentive options that work:

- Service credits toward future work

- Gift cards to premium retailers

- Charitable donations in client’s name

- Tiered rewards based on referral value

- Non-monetary recognition (case studies, exclusive events)

Timing beats amount every time:

Ask after delivering wins: tax savings, catching errors, early return completion.

RQ research confirms timing requests when clients are happiest dramatically improves response rates. Use Net Promoter Score data to identify the perfect moment.

The participation gap:

Firework reveals 83% of customers willing to refer after positive experiences, but only 29% actually do. The solution: actively encourage referrals through systematic requests.

Win Savvy shows referred customers are 5x more likely to refer others, creating a self-sustaining cycle. They also spend 200% more than average customers.

Performance benchmarks:

- Global average referral rate: 2.35% (Prefinery)

- Top performers: 22.25% (Farm Hounds example)

- Referred customers: 18% more loyal than traditional advertising leads (Finances Online)

- Referred customers: 4x more likely to refer others (Finances Online)

How Can CPAs Partner with Complementary Businesses for Cross-Referrals

Strategic partnerships multiply your reach without advertising spend.

Why partnerships work:

Fixyr Marketing confirms the most successful referral programs rely on strategic partnerships that create mutually beneficial lead generation for both sides.

Firework shows referrals account for 65% of all new business opportunities. Meetanshi adds that 91% of B2B buyers are influenced by word-of-mouth when making purchasing decisions.

Best partner types:

- Business attorneys and estate planning lawyers

- Financial advisors and wealth managers

- Insurance agents (life, business, liability)

- Real estate professionals working with investors

- Business consultants and coaches

- Payroll service providers

Revenue potential examples:

Summit CPA Group model: 10% first-year fee + 2% annually for next 5 years (20% total)

Basis 365 program: Monthly client fees $1,000-$10,000, partners earn ongoing rewards

BILL Accountant Program: $500 per client referral + co-marketing opportunities

Making partnerships work:

Create formal referral agreements. Track which partners send quality leads and prioritize those relationships.

RQ emphasizes referral management technology streamlines the process, generating more referrals while reducing workload. Treat professional connections like any marketing channel with systematic plans.

Clearly Rated shows 77% of CPA firms would consider switching providers based on a recommendation. Focus on flagship clients (top 20% revenue contributors) who connect you to high-value networks.

Build Systems, Don’t Hope for Referrals

Firework data shows referral marketing reduces customer churn by 16% when paired with excellent service. Win Savvy adds that referred customers have 37% higher retention rates and 16% higher lifetime value.

Key program elements:

- Clear rewards and incentives

- Transparent communication

- Easy referral process (email, social media, direct links)

- Automated tracking and follow-up

- Regular monitoring and optimization

Firework research confirms offering attractive rewards increases referral activity by up to 25%. Making the process seamless drives participation.

The bottom line:

Demand Sage shows 82% of small businesses claim referrals as their primary customer source. For accounting firms, Clearly Rated reports this number climbs even higher with systematic approaches.

Stop leaving referrals to chance. Build a formal program, track results, and watch your client acquisition costs drop while quality rises.

What Website Features Convert Visitors into Accounting Leads

Your website works 24/7. But only if it’s built to capture leads, not just display information.

Most accounting firm websites look professional yet generate zero inquiries. The missing piece: strategic conversion elements.

Accounting Website Conversion Benchmarks

Calconic data shows professional services (including accounting) achieve the highest conversion rates at 9.3%. Ruler Analytics confirms professional services and finance lead all industries at 4.6% average conversion rate.

Invesp reports the B2B professional services industry converts at 4.6%, significantly higher than B2B ecommerce (1.8%) or B2C (2.1%).

What this means:

If 1,000 people visit your accounting website monthly, top performers convert 93 into leads. Average firms get 46 leads. Poor sites? Maybe 10-20.

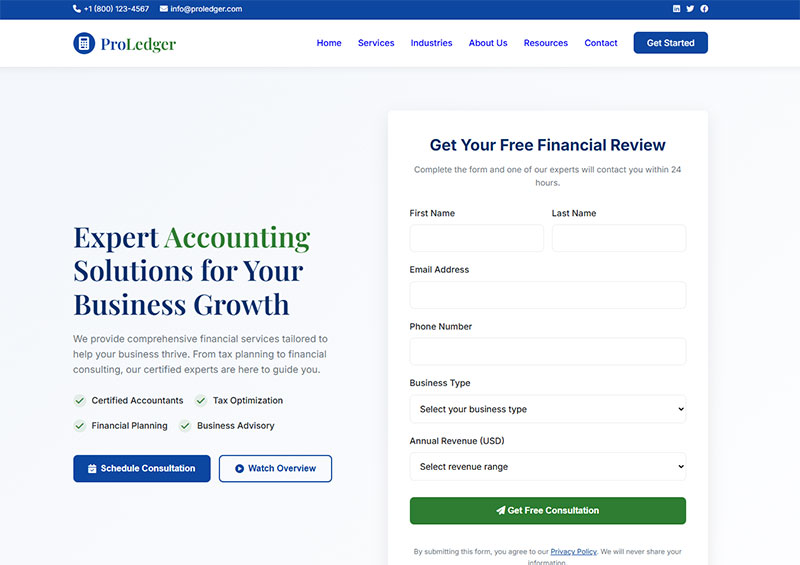

How Should Contact Forms Be Designed for Maximum Conversions

Shorter forms convert better. Name, email, phone, and “how can we help” covers the basics.

Form length statistics:

Quick Sprout research shows reducing a form from 4 fields to 3 can increase conversion rate by almost 50%. HubSpot data reveals 30% of marketers get highest conversion rates from forms with exactly 4 fields.

Ileeline reports pages with 3 form fields have 25% more conversion than other page types.

Critical form optimization tips:

WP Forms data confirms simple design tricks (placing labels above fields, matching input field size to expected answer length) increase conversion by reducing friction.

Apply form validation to catch errors before submission. Nothing kills momentum like a failed form.

Every additional field drops conversion rates. Zuko Analytics shows password fields have 10.5% abandonment rate, while email (6.4%) and phone number (6.3%) also cause significant drop-offs.

What to ask for initially vs. later:

- Initial form: Name, email, phone, basic service need

- Follow-up call: Company revenue, industry specifics, detailed requirements

Ask for company revenue or industry on the follow-up call, not the initial contact form.

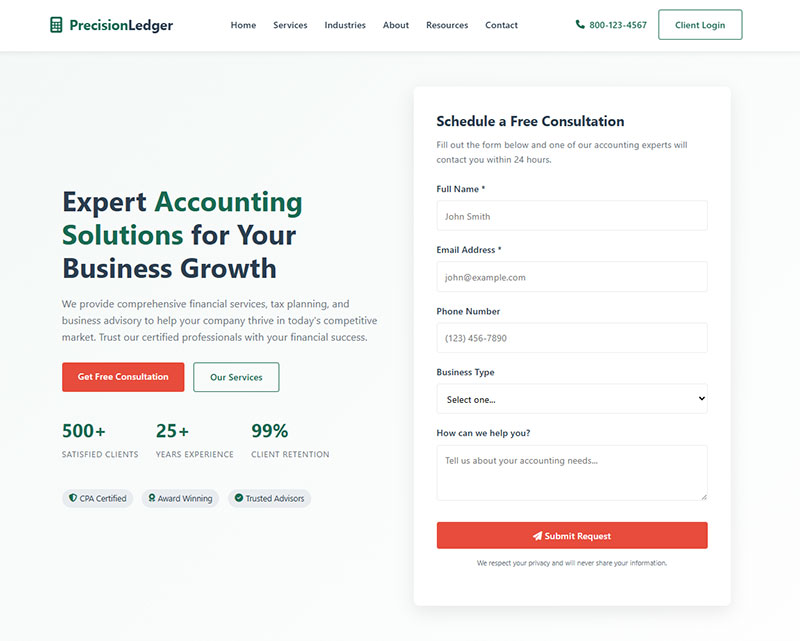

What Homepage Elements Build Trust with Potential Clients

Above the fold: clear headline stating who you serve, one primary call-to-action, trust indicators.

The 3-5 second rule:

VWO research reveals visitors make quick judgments about webpages within the first few seconds of landing. Your hero section determines whether they stay or leave.

CPA Site Solutions confirms accounting website design can make or break conversion. First impressions are design-related, and you only have seconds to make a good one.

Why Do Client Testimonials and Case Studies Matter

Social proof reduces perceived risk. A testimonial from a local business owner saying “they saved us $40,000 in taxes” outweighs any marketing claim.

Testimonial effectiveness data:

VWO research shows Buildium (property management software) increased free-trial sign-ups by 22% just by improving testimonial headings on their homepage.

Having at least 50 reviews signals social proof and reliability. When potential customers see substantial reviews, it instills confidence in online buyers.

Place testimonials near contact forms and pricing information where hesitation peaks.

VWO confirms experimenting with trust-building elements like client testimonials, industry certifications, and success stories can positively impact conversion rates on B2B websites.

How Does Mobile Optimization Affect Lead Capture Rates

Higher Visibility shows in the U.S., mobile devices account for roughly 63% of organic search visits.

Mobile conversion benchmarks:

Statista data reveals average conversion rates: Desktop 2.8%, Tablets 3.1%, Mobile 2.8%. While mobile matches desktop, Ileeline reports desktop still leads at 4.14%, tablets at 3.36%, mobile at 1.53% for highest performance sites.

Why mobile matters despite lower conversion:

Thrive Themes shows 63% of traffic comes from mobile devices. Forms that work on desktop often fail on phones.

Invesp confirms mobile-optimized landing pages can improve conversion rates by 27%. Landing pages with load time under 3 seconds have 32% higher conversion rates.

Mobile form best practices:

Follow mobile form best practices:

- Large tap targets (buttons easy to press with thumbs)

- Single-column layouts for natural flow

- Minimal typing required

- Autofill functionality (Zuko Analytics shows autofill increases conversion by 10%+)

- Real-time validation to catch errors as users type

Dash Clicks emphasizes mobile forms should ask only for most necessary information. Use input types that are mobile-friendly (numerical inputs for phone numbers, date pickers for birthdays).

Test your consultation booking process on a phone. If it frustrates you, it’s losing leads.

Page Speed Impact on Conversions

Invesp reveals just a 1-second delay in site loading time hurts conversions by up to 7%.

Landing pages with load time under 3 seconds have 32% higher conversion rate. Flexhire recommends aiming for load time under 3 seconds to keep users engaged and reduce bounce rates.

Trust Elements That Boost Conversions

VWO research on professional service companies shows strategically testing elements like:

- “Schedule a Consultation” button design and placement

- Client testimonials

- Industry certifications

- Success stories and case studies

Delaware-Harvard Business Service tweaked navigation bar and CTA text, increasing completed orders by 15.68%.

Call-to-Action Optimization

Thrive Themes data shows CTA buttons surrounded by more white space can increase conversion rates by over 200%.

Personalized CTAs targeting specific visitor types boost conversions significantly. Make CTAs unmissable with contrasting colors, clear language, and strategic positioning.

Ensure buttons are large enough for easy tapping on mobile devices. Place them where they’re easily accessible to thumbs.

Content Above the Fold

WP Forms research shows forms and content placed above the fold capture 57% of page-viewing time.

Put your most important conversion elements (headline, value proposition, primary CTA) where visitors see them immediately without scrolling.

Multi-Step vs. Single-Step Forms

HubSpot data reveals multi-step forms have 86% higher conversion rates, yet only 40% of marketers use them.

Breaking longer forms into steps makes them less daunting while maintaining data collection. Users feel progress and are more likely to complete.

A/B Testing Impact

HubSpot shows marketers who run A/B tests on forms report conversion rates 10% higher on average than those who don’t test.

Only 36% of marketers run user tests on their forms, leaving massive optimization opportunities untapped.

How Does Email Marketing Nurture Accounting Leads

Most prospects aren’t ready to hire an accountant today. Email keeps you visible until they are.

Why The Buyer Journey Takes Time

RAIN Group data shows it takes 8 touches on average to get an initial meeting or conversion. Zendesk confirms 80% of new leads never convert into sales without proper nurturing.

Artisan research reveals most customer journeys now have 11.1 touchpoints across different platforms. Data Dab shows 60% of the B2B buyer’s journey happens before they ever talk to a sales rep.

Email Marketing ROI For Accounting Firms

HubSpot reports email marketing delivers $42 for every $1 spent for accounting firms, with professional services often seeing even higher returns. Future Firm research confirms email marketing generates $36 for every $1 spent on average.

Email Monday reveals 59% of B2B marketers rate email as their most effective channel for prospecting. Prospect Wallet shows 52% of consumers made a purchase directly from an email in the last year.

B2B email performance benchmarks:

- Open rate: 15.14% (Statista) to 39.5% (HubSpot)

- Click-through rate: 2.44% (Email Uplers)

- Conversion rate: 2.5% (Ruler Analytics)

- B2B click rate: 3.18% vs. B2C 2.09% (Optin Monster)

Sopro research shows email open rates have almost doubled, rising from 18.7% in 2016 to 35.9% in 2024.

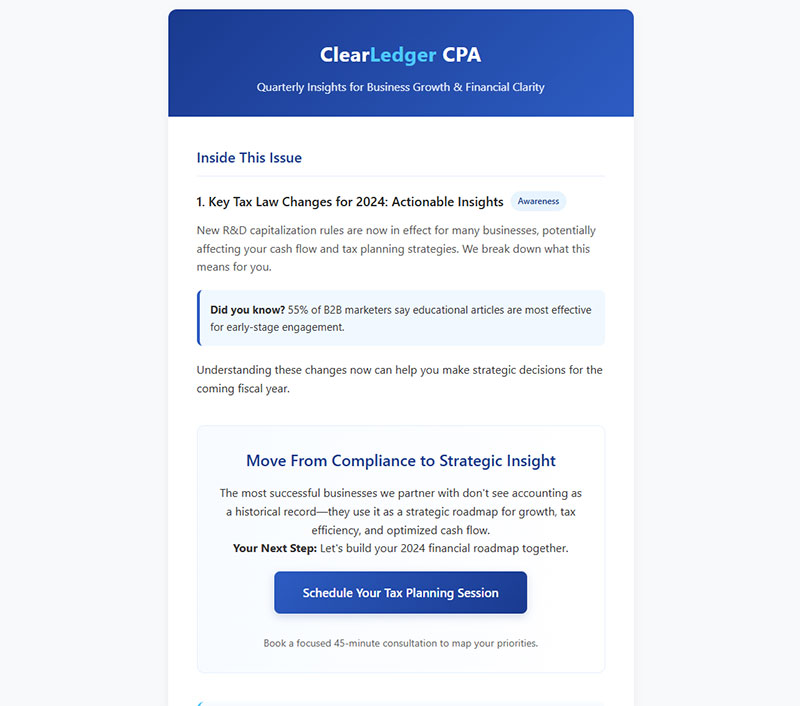

What Email Sequences Move Prospects Through the Sales Pipeline

Welcome sequence (days 1-7):

Deliver the promised lead magnet, introduce your firm, share one helpful resource.

RevvGrowth emphasizes first impressions matter. A well-crafted welcome series sets the tone for your relationship. Typically 2-4 emails that introduce your brand, highlight key offerings, and encourage further engagement.

Nurture sequence (ongoing):

Monthly newsletter with tax tips, deadline reminders, regulatory updates from the IRS.

Optin Monster shows 71% of B2B marketers use email newsletters for content marketing strategy. Content Marketing Institute’s 2024 report found 71% cite email engagement as the most important performance metric.

Nurture email effectiveness:

Sender data reveals lead nurturing emails get up to 10x the response rate compared to standalone email blasts. Salesmate confirms lead nurturing emails get 4 to 10 times more responses than generic campaigns.

Invesp shows leads nurtured through email end up making purchases that are 47% larger than un-nurtured ones. HubSpot notes nurtured leads make purchases up to 23% faster.

Reactivation sequence:

Target cold leads before tax season with “schedule your consultation now” messaging.

Artisan case study shows a large communications company used multi-touch email nurturing to re-engage old leads. The campaign produced 10% higher conversion rate compared to new leads.

Sequence length and timing:

Data Dab recommends nurturing over 8-12 weeks with 4-8 emails total. For first 2-3 emails, focus on delivering value, then move to more promotional.

Emercury suggests weekly or bi-weekly emails at the start, then every 2-3 weeks as you continue nurturing.

How Often Should Accounting Firms Send Marketing Emails

Weekly feels aggressive for accounting. Bi-weekly or monthly works better for most firms.

Exception: tax season

Increase frequency January through April when urgency peaks. HubSpot notes email marketing tools allow tax deadline automation triggered by federal, state, and local tax calendars.

Frequency best practices:

HubSpot confirms frequency depends on the audience. Weekly emails thrive in some industries, others burn out fast. Start small, stay consistent, and listen to unsubscribe signals.

Funnel warns sending too many emails can be counterproductive. You need to be very gentle with leads since people can enter your nurturing track multiple ways.

Unsubscribe benchmarks:

Email Uplers shows average unsubscribe rate in B2B is 0.24%. HubSpot confirms unsubscribe rate below 0.5% per campaign is acceptable.

What Content Should Accounting Newsletters Include

Mix educational content (tax law changes, GAAP updates) with firm news and client success stories.

Content that moves prospects forward:

Sender shows 55% of B2B marketers say articles are the most effective content for moving prospects through the sales funnel. Aligning content with prospect’s stage in buyer’s journey can boost conversion rates by 72%.

Artisan recommends mapping content to funnel stages:

- Early-stage (Awareness): Educational content about challenges (“5 Signs Your Business Needs Better Tax Planning”)

- Mid-stage (Consideration): Solution evaluation content (case studies, comparison guides)

- Late-stage (Decision): Demo invitations, consultation scheduling

Include one clear call-to-action per email. “Schedule a tax planning session” beats three competing links.

RevvGrowth warns every email should have clear purpose and compelling CTA that guides recipients toward next step. Multiple CTAs create decision paralysis.

Personalization and Segmentation Drive Results

Book Your Data shows businesses employing A/B testing see 37% higher ROI than businesses that don’t. HubSpot confirms personalized emails improve click-through rates by 14% and conversion rates by 10%.

Personalization statistics:

Prospect Wallet data shows personalized emails have 18.8% open rate compared to 12.1% for non-personalized. Campaign Monitor found segmented campaigns led to 760% revenue boost.

Popupsmart reveals 71% of consumers expect personalized interactions from brands. 76% get frustrated when brand interactions aren’t personalized.

Prospect Wallet confirms 59% of consumers say marketing emails influence their purchase decisions. Over 50% purchase from an email at least once a month.

Segmentation strategies:

Chameleon Sales Group emphasizes segmentation by role. Executives get ROI-driven messaging, while managers get tactical tips. Emercury notes you won’t send the same pitch to a startup CMO and a mid-market lead.

Popupsmart stresses segments should be dynamic, allowing prospects to move between segments as behaviors evolve.

Email Automation Benefits

HubSpot shows automated emails drove 37% of all email-generated sales in 2024, despite accounting for just 2% of email volume. Automated emails drive 320% more revenue than non-automated ones.

Automation advantages:

- Increased revenue (17%)

- Consistent touchpoints without manual effort

- Timely follow-ups based on behavior

- Scalable nurturing across large lists

HubSpot confirms 67% of emails are opened on mobile devices. Configure triggered follow-ups based on behavior. Send reminder emails to non-openers after 2-3 days with different subject lines.

Best sending days:

Powered by Search reveals the best days for email opens and clicks are Tuesday and Wednesday.

Growing Your Email List

Use subscription forms on your blog to grow your list organically.

List quality over size:

HubSpot recommends cleaning your list quarterly. Remove inactive subscribers. Focus on quality over size.

Sopro data shows 77% of B2B buyers prefer email as their main contact method. Email remains the one channel every professional uses.

Measuring Email Performance

Track these key metrics (RevvGrowth):

- Open rates

- Click-through rates

- Conversion rates

- Unsubscribe rates

Sender reveals lead nurturing emails generate 8% CTR compared to general email sends at 3% CTR.

Chameleon Sales Group emphasizes if open rate is low, test subject lines. If CTR is weak, experiment with CTA placement.

What Offline Methods Still Generate Leads for Accounting Firms

Digital dominates the conversation, but face-to-face interactions still close deals.

The highest-value clients often come through relationships, not Google searches.

Why Offline Networking Still Matters

Selling Signals reveals 79% of business professionals say in-person meetings are the most important way to meet new clients and sell business. Team Referral Network data shows 75% of customers either require or prefer in-person meetings.

Face-to-face advantages:

- 44% say face-to-face networking creates better environment for timely decision-making

- 40% say less opportunity for unnecessary distractions

- 39% say higher-quality decision making

- 49% believe in-person meetings allow for more complex and strategic thinking

Team Referral Network confirms 75% of professionals like in-person conferences because they lead to more social interaction and bonding with clients and coworkers.

Referrals Drive High-Value Leads

Tru Universe reports referrals are 36x more valuable than cold calls and 4x more valuable than web leads. One offline word of mouth impression drives sales at least 5x more than one paid ad.

Referral effectiveness statistics:

- Referral marketing generates 3-5x higher conversion rates than any other channel (Annex Cloud)

- 65% of new business comes from referrals (New York Times)

- Word of mouth is primary factor behind 20-50% of all purchasing decisions (McKinsey)

- 91% of B2B referrals influence customers by word of mouth (Think Impact)

HubSpot confirms referral marketing generates three times as many leads as traditional outbound marketing methods.

Referral conversion and value:

Tru Universe shows leads from referrals have 30% higher conversion rate than leads from other marketing methods. Lifetime value of a new referral customer is 16% higher than average customer (Wharton School of Business).

Texas Tech research reveals 83% of consumers are willing to refer after positive experience, yet only 29% actually do without prompting.

Lead Source Breakdown

Databox analysis shows referrals account for 30% of lead sources, second only to SEO. This emphasizes the power of word-of-mouth and trusted recommendations.

EditorNinja confirms referral marketing generates 3-5x higher conversion rates than any other channel.

How Do Networking Events Connect Accountants with Potential Clients

Chamber of Commerce meetings, Rotary clubs, industry associations put you in rooms with business owners.

Networking best practices:

Bring business cards. Follow up within 48 hours. Connect on LinkedIn to stay visible.

LinkedIn research emphasizes asking for referrals at least every 6-8 weeks as people you know will have met new people during that period. Set up incentive for when people refer you to new client.

Networking locations:

- Private networking events in your industry

- Chamber of Commerce meetings

- Rotary clubs

- Industry associations

- Business after-hours events

What Role Do Industry Conferences Play in Lead Generation

AICPA conferences attract accountants, not clients. Target conferences where your ideal clients gather.

Construction industry events for contractors. Medical practice management conferences for healthcare providers.

Conference targeting strategy:

NerdyJoe reports events and webinars can be effective for lead generation because they provide opportunity for businesses to connect with potential customers in more personal and interactive way.

Hinge Marketing confirms online marketing and traditional marketing (like face-to-face networking and tradeshow marketing) make powerful combination. Add in traditional tactics and you have formidable strategy for building preference.

Conference follow-up:

Selling Signals emphasizes timing matters. Follow up within 48 hours while the connection is fresh. Move leads from cold to warm through consistent touchpoints.

How Can Local Community Involvement Build Accounting Client Pipelines

Sponsor a Little League team. Offer free tax prep for nonprofit. Teach small business workshop at library.

Community presence builds recognition and trust that advertising cannot buy.

Sponsorship benefits for accounting firms:

CPA Practice Advisor recommends sponsor local events to support community and put firm in front of potential local clients. Consider sponsoring booths at:

- Farmer’s markets

- Art fairs

- Music festivals

- Charity runs

- Golf tournaments

Rank Strikers confirms getting involved in local community by sponsoring local events helps build relationships and generate leads.

Workshop and educational events:

CPA Practice Advisor suggests host free educational workshops on:

- Financial wellness

- Tax planning

- Small business accounting

Hold these in local libraries, community centers, or virtually to reach broader audience.

Charity event participation:

Join or sponsor charity events. This shows firm’s commitment to community and improves brand image.

Double The Donation notes helping nonprofits gives companies chance to demonstrate community involvement and attract new customers. Nonprofit’s supporters can be converted into corporate sponsor’s customers.

Community involvement ROI:

CPA Site Solutions confirms participation in community events showcases firm’s achievements and involvement. Updated news section showing community participation helps attract local clients.

Rank Strikers emphasizes offering free consultations to potential clients showcases expertise and builds trust.

Combining Online and Offline Methods

Hinge Marketing confirms online lead generation and traditional marketing make powerful combination. Add traditional tactics like face-to-face networking and tradeshow marketing to online techniques for formidable strategy.

Integration strategies:

- Follow up networking contacts via LinkedIn

- Share community involvement on social media

- Blog about sponsored events

- Email workshop attendees with additional resources

Zip Sprout recommends writing blog post round-up of community events you’re sponsoring. Help publicize organizations or events on social media channels for more local support.

Measuring Offline Lead Generation

Track these metrics:

- Referrals received per quarter

- Networking event attendance and follow-up conversion rate

- Sponsored event leads generated

- Workshop attendee conversion to consultations

- Community involvement mentions and inquiries

Book Tix emphasizes strategically approaching potential sponsors and effectively communicating value of your involvement unlocks new avenues of support.

How Do CRM Systems Improve Lead Management for Accountants

Client relationship management software prevents leads from falling through cracks.

Without a system, promising prospects get forgotten after one unreturned call.

CRM Impact on Accounting Firm Performance

Revenue and productivity gains:

CRM.org reveals CRM implementation drives average increase of 29% in sales revenue. Companies see 34% boost in sales productivity after implementing CRM.

Kixie reports for every dollar invested in CRM software, businesses expect average return of $8.71, making CRM one of the most profitable investments.

Sales cycle and lead cost improvements:

CRM.org shows 34% of businesses find CRM systems shorten average sales cycle by 8-14 days. When businesses use CRM, lead cost can reduce by as much as 23%.

Lead conversion rates can increase by up to 300% with well-utilized CRM through consistent follow-up and sophisticated nurturing.

Speed to Lead: Why Response Time Matters

Voiso and Lead Response Management Study data reveals contacting leads within five minutes makes you 100 times more likely to connect than waiting an hour.

Critical response time statistics:

- Leads contacted within 5 minutes are 21x more likely to convert than those contacted after 30 minutes

- Responding within 1 minute boosts conversion rates by 391% (Velocify)

- 78% of customers buy from the first company that responds (Voiso)

- Harvard Business Review: Companies 7x more likely to qualify lead when responding within first hour

Rep.ai confirms only 37% of businesses respond within the hour. Ricochet 360 reports average response time for web leads is 17 hours.

The 5-minute rule:

Lead Angel emphasizes sales teams should follow up with leads within five minutes. Quick responses keep leads engaged and improve conversion rates.

LeanData notes top-performing companies respond within five minutes of lead submission. After 30 minutes, conversion probability drops sharply.

What Features Should Accounting Firms Look for in CRM Software

Contact management, email integration, task reminders, pipeline visualization, reporting dashboards.

Essential CRM features for accountants:

TaxDome emphasizes accounting-specific CRMs should include:

- Automated workflows and task management

- Client data centralization and document storage

- Email syncing (automatically links client emails to accounts)

- Built-in communication tools (SMS, secure messaging)

- Customizable proposals and engagement letters

- Integration with accounting software (QuickBooks, tax programs)

Popular CRM options:

Canopy case study shows Keith Jones, CPA reduced average tax resolution case time by 75% after implementing accounting-specific CRM.

CRM Adoption and AI Integration

Kixie reveals 91% of companies with 10+ employees now use CRM software. There’s notable 12.6% year-on-year growth in CRM adoption.

65% of businesses implement CRM within their first five years of operation, indicating early adoption critical for growth.

AI-powered CRM benefits:

- AI-enhanced CRMs improve lead conversion rates by up to 30% (Gartner)

- AI improves sales forecast accuracy by over 40%

- Businesses using generative AI in CRM are 83% more likely to exceed sales goals

- AI contributes to 30-50% faster response times to customer inquiries

CRM.org shows 51% of businesses identify generative AI (chatbots, predictive analytics, content creation) as top CRM trend for 2024.

How Does Automation Reduce Lead Response Time

Speed matters. Leads contacted within 5 minutes are 21x more likely to convert than those contacted after 30 minutes.

Automation capabilities:

Automate instant email responses, consultation booking links, and follow-up task creation.

Time to Reply emphasizes implementing automation through CRM tools like HubSpot or Salesforce to automate initial responses and lead routing.

Automatic lead distribution:

Voiso recommends CRM integrations assign leads instantly. CRM like Salesforce or Zoho can automatically route leads based on geography, availability, or expertise.

Lead Angel shows lead scoring ranks prospects based on behavior and intent, so sales teams can engage high-potential leads immediately while lower-priority ones enter nurturing sequences.

Task and follow-up automation:

Census confirms automation tools help:

- Set up alerts for immediate notifications for new leads

- Establish SLAs (Service Level Agreements) defining acceptable response times

- Monitor and measure lead response time metrics

- Automate follow-up sequences based on lead behavior

Use form builders with conditional logic to route different lead types to appropriate team members automatically.

Mobile CRM Benefits

CRM.org reveals 65% of salespeople using mobile CRM meet their sales quotas, compared to only 22% who don’t.

Kixie shows 70% of businesses use mobile CRM systems to enhance sales strategies. Businesses leveraging mobile CRM platforms are 150% more likely to exceed their sales goals.

Mobile CRM software market projected to grow from $28.43 billion in 2024 to $31.61 billion in 2025.

Overcoming CRM Implementation Challenges

Common obstacles:

- High lead volume straining resources

- Manual lead distribution causing delays

- Technology limitations from outdated systems

- Training gaps for sales team

Accelo notes around 62% of accounting firms use CRM system, but fewer than 5% use one regularly.

Implementation best practices:

Time to Reply recommends:

- Provide regular training on effective lead response management

- Leverage technology like chatbots and AI-powered tools

- Utilize CRM to track all lead interactions and follow-up activities

- Set clear guidelines around acceptable response times

- Sync alerts across email, CRM, and mobile apps

Measuring CRM Success

Key metrics to track:

- Lead response time (from submission to first contact)

- Lead qualification rates

- Conversion rates by source

- Sales cycle length

- Customer acquisition cost

LeanData emphasizes measure from moment lead created in CRM to first documented rep touchpoint. Analyze fastest, median, and slowest response times to identify bottlenecks.

What Metrics Should Accounting Firms Track for Lead Generation

Guessing doesn’t scale. Data tells you where to invest more and what to cut.

How is Cost Per Lead Calculated for Accounting Services

Total marketing spend divided by number of leads generated. Simple formula, often ignored.

CPL formula:

CPL = Total Marketing Spend ÷ Number of Leads Generated

First Page Sage defines Cost Per Lead (CPL) as gross marketing cost expended to acquire a lead for your business.

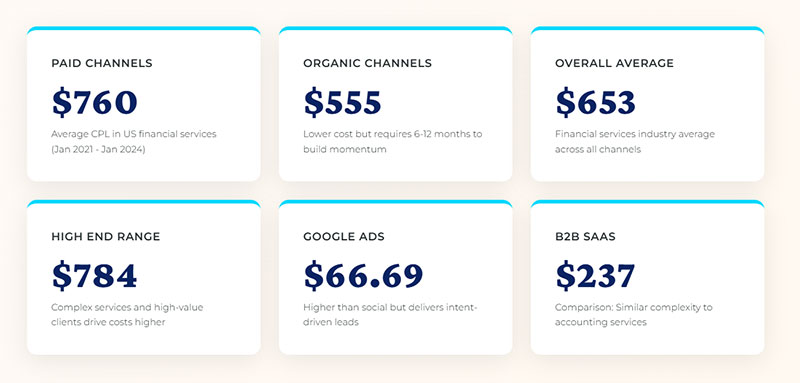

Financial services CPL benchmarks:

Statista reports between January 2021 and January 2024, average CPL in financial services industry in US:

- Paid channels: $760

- Organic channels: $555

Ippei shows average cost per lead in financial services is $653. Sopro data reveals financial services CPL could go as high as $784.

Why the high cost?

Sopro explains financial sector involves complex decision-making, regulatory considerations, and need for high trust levels. Legal clients are cautious, research-heavy, and risk-averse.

Track by channel:

Your LinkedIn ads might cost $50 per lead while SEO delivers them at $15.

Flyweel case study shows regional accounting firm generated leads from Google Search Ads at $60 CPL. However, over 75% were unqualified (students, individuals seeking tax help vs. target SMBs). Effective cost-per-qualified-lead was astronomical $240.

After optimization:

Agency focused on precise long-tail keywords (“accounting services for manufacturing companies”) and added in-market audience segments. This improved lead quality dramatically.

Channel-specific CPL ranges:

Amra and Elma reports:

- Google Ads: Average $66.69 (higher than social but intent-driven)

- B2B overall: $40-$300 depending on sector and funnel stage

- B2B SaaS: Average $237

What Conversion Rates Should CPAs Expect from Different Channels

Conversion rate benchmarks for professional services:

- Website visitor to lead: 2-5%

- Lead to consultation: 20-30%

- Consultation to client: 40-60%

- Referral lead to client: 50-70%

Industry conversion benchmarks:

Email Tooltester confirms professional services (including accounting, law, marketing) have highest conversion rate at 4.6%. B2B ecommerce (1.8%) and B2C (2.1%) are industries with lowest conversion rates.

Ruler Analytics data shows:

- Professional services overall: 4.6% average conversion rate

- Professional services paid search: 5.0%

- Professional services organic search: Strong performance (B2B services perform better than B2C)

Lead progression rates:

First Page Sage reveals across professional services:

- Marketing Qualified Lead (MQL) to Sales Qualified Lead (SQL): 13% average

- Top performers: 40% MQL to SQL conversion

If your numbers fall below these ranges:

Diagnose where the funnel breaks. Track each stage:

- Website traffic to lead capture

- Lead to consultation booked

- Consultation attended

- Consultation to proposal sent

- Proposal to signed client

How Do Firms Measure Return on Marketing Investment

Track client lifetime value, not just initial engagement fees.

A $500 marketing cost to acquire a client worth $15,000 over five years represents 30x ROI.

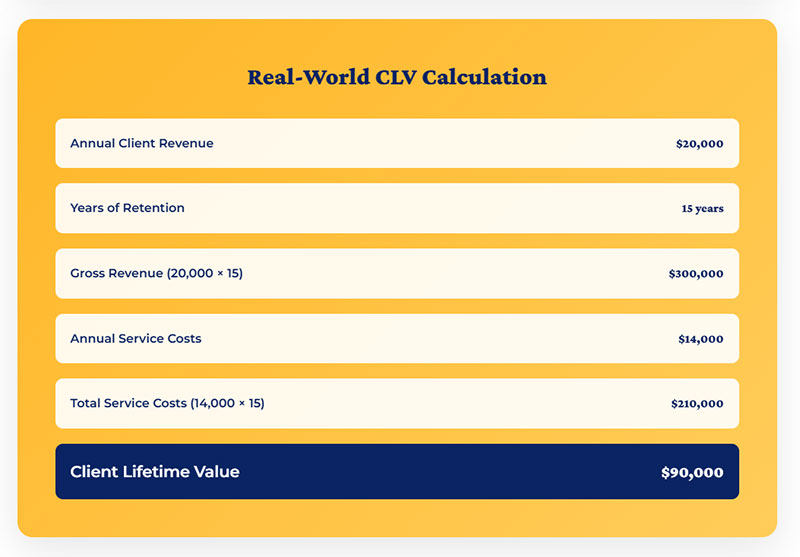

Calculating Client Lifetime Value (CLV):

Beaton formula for B2B professional services firms:

CLV = (Average Purchase Value × Purchase Frequency) × Client Relationship Lifespan – Acquisition Cost

More detailed accounting CLV formula:

LinkedIn accounting perspective shows:

CLV = (Client Revenue Per Year × Average Years of Retention) – Total Cost of Acquiring and Serving Client

Example calculation:

Client generating $20,000 annually, retained for 15 years, with annual service costs of $14,000:

- Gross revenue: $20,000 × 15 = $300,000

- Service costs: $14,000 × 15 = $210,000

- CLV = $300,000 – $210,000 = $90,000

Why CLV matters for accounting firms:

LinkedIn emphasizes around 70% of client base will be open to moving to another provider if they perceive better value and service. Monitoring CLV over time indicates how well firm meets client expectations.

Advisor Perspectives confirms CLV accounts for everything business knows about client and calculates average revenue and profit client contributes throughout lifetime of relationship.

CLV-to-CAC ratio:

First Page Sage notes CLV, along with Customer Acquisition Cost (CAC), is the most important metric for informing decisions on marketing investments.

Qualtrics explains customer lifetime value only makes sense if you also take customer acquisition cost into account. If CLV is $1,000 but CAC is more than $1,000, you’re losing money.

Connecting Marketing Data to Revenue

Google Analytics shows traffic sources. Your CRM tracks lead-to-client conversion. Connect the two.

Attribution tracking:

Salesforce Ben recommends tracking CLV by:

- Industry

- Lead source

- Account size

- Geographic location

- Time since last purchase

Innovation Partners emphasizes moving beyond simple historical CLV to predictive model using AI-derived scores for client engagement, referral probability, and predicted retention.

Professional services ROI amplification:

Innovation Partners notes for law or consulting firm where single new enterprise client can generate millions in fees over lifetime, 10% lift in conversion rate creates exponential financial ROI.

Key metrics to track:

- Cost Per Lead (CPL) by channel

- Conversion rates at each funnel stage

- Lead quality (qualified vs. unqualified)

- Client Acquisition Cost (CAC)

- Customer Lifetime Value (CLV)

- CLV-to-CAC ratio (healthy ratio: 3:1 or higher)

- Lead response time (impacts conversion dramatically)

- Channel ROI (revenue generated per dollar spent by channel)

Using CLV for Strategic Decisions

Client retention focus:

Advisor Perspectives confirms generating more revenue from existing clients is less expensive than acquiring new ones. Measuring CLV allows you to know which clients are more important to firm’s profitability.

LinkedIn emphasizes at any time, around 70% of your client base will be open to moving to another provider. Quality and perceived value of service have direct relationship to how long client stays.

Resource allocation:

Beaton recommends assigning dedicated account managers to highest-value clients, developing personalized approach for those relationships, and building consistency into their service.

Advisor Perspectives notes knowing CLV allows better decisions regarding resource allocation and tradeoff between service to existing clients and new client acquisition.

Marketing budget optimization:

LinkedIn explains once you know Cost Per Lead of target client type, you can create marketing budget that provides desired annual ROI. Reducing CPL by systematizing lead generation gives scope to increase marketing budget.

Focus Digital confirms primary lever to raise LTV in short term without changing products or pricing is to lower Customer Acquisition Cost. Best way to lower CAC is shift to organic-based marketing strategy.

Predictive CLV Models

HubSpot notes predictive CLV algorithms factor in customer data, statistical modeling, and scenario analysis. This model helps identify:

- Most valuable customers

- Products/services bringing most sales

- How to improve customer retention

While predictive models require data preparation and analysis, they offer detailed insights for measurable ROI.

Common Lead Generation Mistakes Accounting Firms Make

Knowing what doesn’t work saves time and money. These patterns repeat across struggling firms.

Why Do Generic Marketing Messages Fail for Accounting Services

“Full-service accounting firm serving all your needs” says nothing. It describes everyone.

Specificity wins. “Tax planning for contractors and construction businesses” attracts the right prospects.

Why niche positioning works:

HubSpot research confirms 96% of B2B buyers prefer personalized experiences, with 44% saying significantly. When prospects research specific solutions, they look for firms speaking directly to their industry challenges.

Niche positioning feels limiting but actually increases inbound leads from your ideal clients. Prospects searching “accounting for construction companies” skip generic firms entirely.

Ineffective vs. effective messaging:

- Generic: “We provide comprehensive accounting services”

- Specific: “We help construction companies manage job costing, WIP reporting, and contractor compliance”

- Generic: “Full-service CPA firm”

- Specific: “Tax planning and S-corp optimization for e-commerce businesses with $1M+ revenue”

How Does Poor Follow-Up Cost Firms Potential Clients

Peak Sales Recruiting reveals 48% of salespeople never even make a single follow-up attempt after cold call. This is how firms lose winnable business.

Critical follow-up statistics:

Lusha data shows 80% of sales require five follow-up calls after initial contact. Yet Peak Sales confirms only 8% of salespeople have more than five follow-up touches.

Conversion breakdown by contact attempt:

- 2% of sales made on first contact

- 3% on second contact

- 5% on third contact

- 10% on fourth contact

- 80% between fifth and twelfth contact

Growth List emphasizes 60% of customers say “no” four times before saying “yes,” yet most reps stop after only two attempts.

Speed to lead impact:

Qwilr research shows engaging leads within 60 seconds of inquiry can boost conversion rates by almost 400%. Lusha confirms companies show almost 400% improvement in conversion if they call leads within one minute.

ZoomInfo data reveals following up with web leads within 5 minutes makes you 9 times more likely to engage with them. Peak Sales notes 35-50% of sales go to vendor that responds first.

That consultation request from Tuesday?

Without a system, it sits in your inbox while the prospect hires your competitor.

Follow-up email effectiveness:

Yesware reports 70% of sales reps only send one email to prospects, giving up 25% chance of getting a response. First follow-up email can result in 220% surge in reply rates.

Growth List shows sending two follow-up emails is most effective approach for B2B outreach. Cold email campaigns with three total emails have 9.2% reply rate.

Set reminders. Use email sequences.

Treat every lead like the $10,000+ engagement it could become.

Fit Small Business notes CRM software like HubSpot supports reps completing follow-up activities. These products offer tools for creating sales reports to track rep activity and evaluate lead conversion rates.

Automation Reduces Follow-Up Failures

Peak Sales confirms only 35% of time is spent selling; rest is admin, CRM entry, and prospecting. Automation frees reps for actual selling.

AI-powered follow-up benefits:

Fit Small Business reports 28% of salespeople say increasing confidence is top priority when working with buyers who use AI for product research. AI allows sales reps to automate outreach, data management, and insights-gathering activities.

What Happens When Accountants Neglect Their Online Presence

84% of potential clients research accounting firms online before making contact (this is industry-standard behavior for professional services buyers).

Research before contact:

HubSpot confirms 96% of prospects research companies and products before engaging with sales representative. 71% of prospects prefer independent research over talking to rep.

An outdated website, empty Google Business Profile, or zero reviews signals “we don’t care about new clients.”

Your digital presence either builds credibility or destroys it. There’s no neutral.

Professionals shopping for accounting services check:

- Website quality and currency: Outdated copyright dates, broken links, missing service details

- Google Business Profile: Hours, reviews, photos, response to reviews

- Online reviews: Quantity, recency, and firm responses

- Professional presence: LinkedIn profiles, industry associations

- Content and expertise: Blog posts, resources, demonstration of knowledge

Review response matters: