Most surveys collect answers. Few collect anything useful. The difference comes down to the questions you ask. Vague prompts get vague responses. Specific, well-structured feedback survey questions get data you…

Table of Contents

A single question can predict whether your business grows or stalls.

NPS survey questions measure customer loyalty in seconds. Fred Reichheld developed this methodology at Bain & Company, and companies like Apple, Amazon, and Airbnb now use it to track satisfaction and forecast revenue.

But the wrong wording, bad timing, or poor follow-up questions waste everyone’s time.

This guide covers everything you need to collect actionable feedback: question types, industry-specific examples, distribution methods, and analysis techniques.

You will learn how to write questions that customers actually answer, avoid common mistakes that skew your data, and turn raw scores into real improvements.

What is an NPS Survey Question

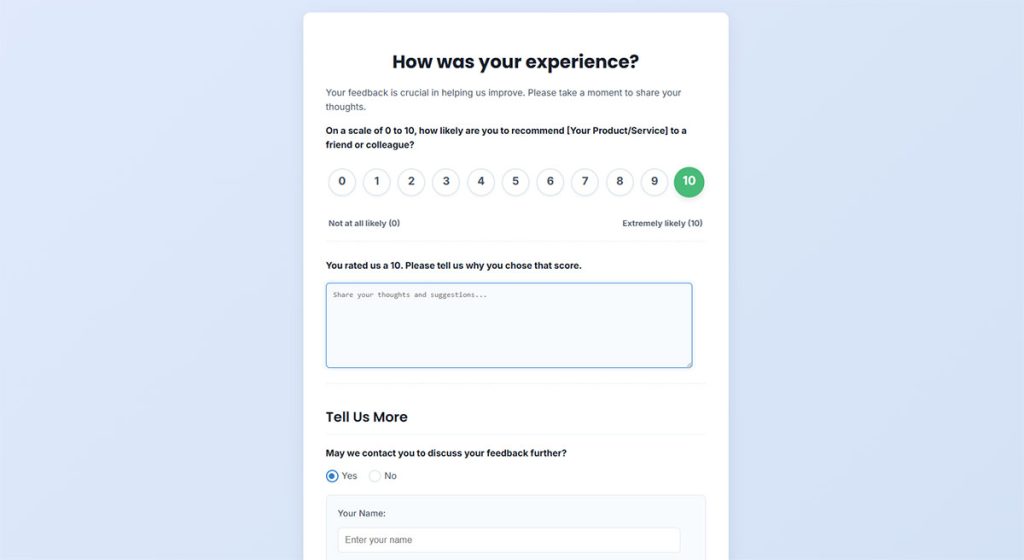

An NPS survey question is a feedback tool that measures customer loyalty using a 0-10 rating scale.

The standard question asks: “How likely are you to recommend [Company/Product/Service] to a friend or colleague?”

Fred Reichheld created this methodology in 2003 while working with Bain & Company. Satmetrix Systems holds the trademark.

Based on their responses, customers fall into three groups:

- Promoters (9-10) – loyal customers who actively recommend your brand

- Passives (7-8) – satisfied but not enthusiastic; vulnerable to competitors

- Detractors (0-6) – unhappy customers who can damage your reputation

This single question captures something that longer satisfaction surveys often miss: actual recommendation intent.

How Does NPS Work

Calculate your Net Promoter Score by subtracting the percentage of Detractors from the percentage of Promoters.

The formula: NPS = %Promoters – %Detractors

Scores range from -100 to +100. Here is what different ranges typically indicate:

- -100 to 0 – serious loyalty problems requiring immediate attention

- 0 to 30 – room for improvement; average for most industries

- 30 to 70 – strong customer loyalty; you are doing well

- 70 to 100 – exceptional; world-class customer experience

Passives do not factor into the calculation directly. They count toward your total respondent pool but neither help nor hurt your score.

When analyzing survey data, segment results by customer type, purchase history, or touchpoint to find patterns.

NPS Survey Questions

How likely are you to recommend our product/service to a friend or colleague? (0-10 scale)

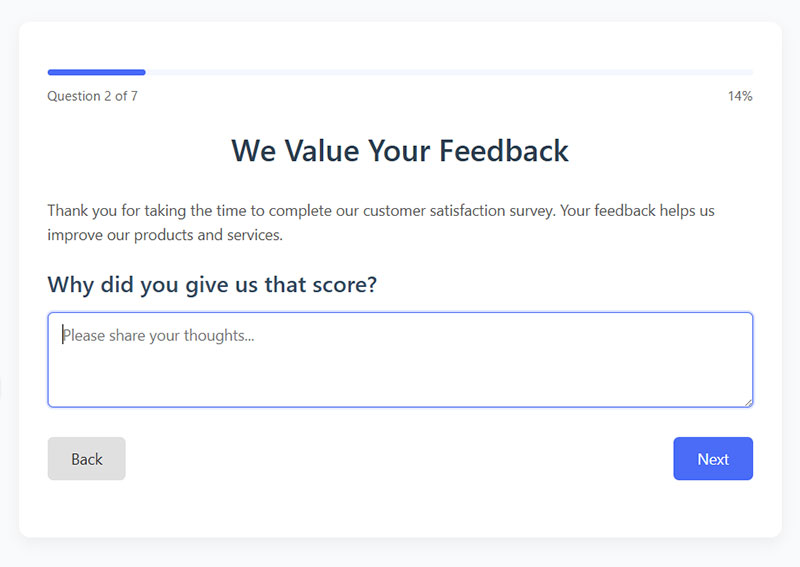

Follow-up Questions

Reason for Score

Question: Why did you give us that score?

Type: Open-ended text field

Purpose: Captures qualitative feedback explaining the numerical rating, providing context for the NPS score.

When to Ask: Immediately after the core NPS question.

Improvement Area

Question: What’s one thing we could improve?

Type: Open-ended text field

Purpose: Identifies specific pain points or opportunities for enhancement from the customer’s perspective.

When to Ask: After the core NPS question to capture actionable feedback.

Most Valuable Feature

Question: Which feature brings you the most value?

Type: Open-ended text field or dropdown with feature list

Purpose: Highlights product strengths and identifies which features drive customer satisfaction.

When to Ask: Mid-survey after establishing their overall sentiment.

Initial Problem

Question: What problem were you trying to solve when you chose us?

Type: Open-ended text field

Purpose: Reveals customer jobs-to-be-done and checks if your product is solving their core needs.

When to Ask: In the middle section of the survey to understand initial motivations.

Recommendation Factors

Question: What would make you more likely to recommend us?

Type: Open-ended text field

Purpose: Identifies gaps between current and ideal experience that would turn customers into promoters.

When to Ask: After the core NPS question for detractors and passives.

Expectations Match

Question: Did our product meet your expectations?

Type: Multiple choice (Exceeded expectations, Met expectations, Somewhat met expectations, Did not meet expectations)

Purpose: Measures expectation alignment and potential satisfaction gaps.

When to Ask: Early in the survey to establish overall impression.

Alternatives Considered

Question: What alternative solutions did you consider?

Type: Open-ended text field or multi-select with common competitors

Purpose: Reveals competitive landscape and your unique selling points compared to alternatives.

When to Ask: Mid-survey to understand competitive positioning.

Ease of Use Rating

Question: How easy was our product to use?

Type: Multiple Choice (1-5 scale from “Very difficult” to “Very easy”)

Purpose: Measures perceived usability and identifies potential friction points.

When to Ask: After customers have used the product for some time.

Desired Feature

Question: What feature do you wish we had?

Type: Open-ended text field

Purpose: Reveals unmet needs and potential product roadmap priorities.

When to Ask: Mid to late survey to capture feature requests.

Retention Reason

Question: What’s the main reason you continue using our product?

Type: Open-ended text field

Purpose: Identifies core value proposition from customer perspective and retention drivers.

When to Ask: After establishing usage patterns, mid-survey.

Segment-specific Questions

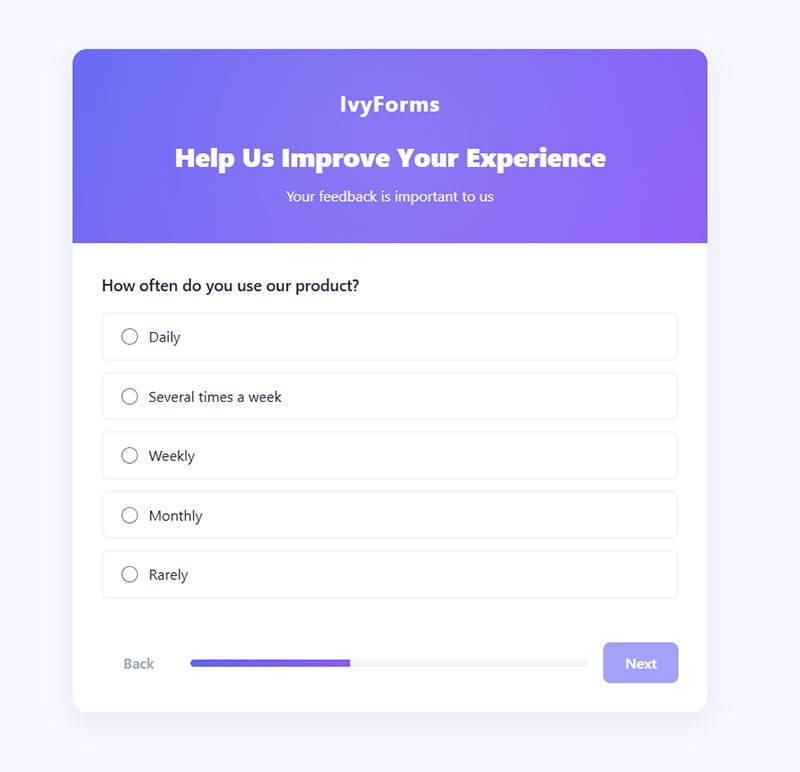

Usage Frequency

Question: How often do you use our product?

Type: Multiple choice (Daily, Several times a week, Weekly, Monthly, Rarely)

Purpose: Segments users by engagement level and helps correlate satisfaction with usage patterns.

When to Ask: Early in the survey to establish usage context.

Team Usage

Question: Which team or department uses our product most?

Type: Multiple choice (Marketing, Sales, Product, IT/Tech, Customer Support, etc.)

Purpose: Identifies which business functions find the most value in your product.

When to Ask: Early in the survey for segmentation purposes.

Primary Goal

Question: What’s your primary goal when using our product?

Type: Multiple choice or open-ended text field

Purpose: Reveals use cases and helps segment users by intent.

When to Ask: Early in the survey to understand context.

Objectives Achievement

Question: Has our product helped you achieve your objectives?

Type: Multiple choice (Yes, completely; Yes, partially; No, not really; No, not at all)

Purpose: Measures perceived value and overall success from the customer’s perspective.

When to Ask: Mid-survey after establishing their goals.

Missing Elements

Question: What’s missing from our current offering?

Type: Open-ended text field

Purpose: Identifies gaps in your product offering and potential expansion opportunities.

When to Ask: Later in the survey after customers have shared their experience.

Organization Users

Question: How many people in your organization use our product?

Type: Multiple choice ranges (1-5, 6-20, 21-50, 51-100, 101+)

Purpose: Segments by deployment size and identifies expansion opportunities.

When to Ask: Early to mid-survey for segmentation.

Industry

Question: Which industry are you in?

Type: Dropdown with common industries

Purpose: Segments customers by industry to identify vertical-specific insights.

When to Ask: Early in the survey for segmentation.

Job Role

Question: What’s your job role or title?

Type: Open-ended text field or dropdown with common roles

Purpose: Segments by persona and helps understand who uses your product.

When to Ask: Early in the survey for segmentation.

Organization Size

Question: How large is your organization?

Type: Multiple choice (1-10, 11-50, 51-200, 201-1000, 1000+ employees)

Purpose: Segments by company size to identify patterns in different market segments.

When to Ask: Early in the survey for segmentation.

Feature Usage

Question: Which specific features do you use most frequently?

Type: Multi-select checkbox with common features

Purpose: Identifies which features drive the most engagement and value.

When to Ask: Mid-survey after establishing overall usage.

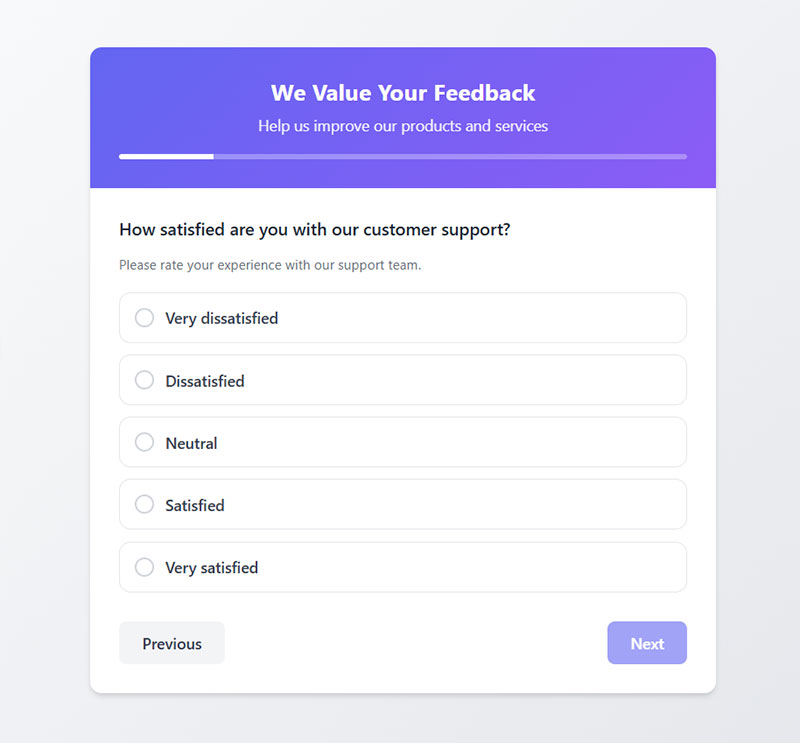

Customer Experience Questions

Support Satisfaction

Question: How satisfied are you with our customer support?

Type: Multiple Choice (1-5 scale from “Very dissatisfied” to “Very satisfied”)

Purpose: Measures satisfaction with support experience and identifies service gaps.

When to Ask: Mid to late survey after establishing product experience.

Onboarding Experience

Question: Was it easy to get started with our product?

Type: Multiple Choice (1-5 scale from “Very difficult” to “Very easy”)

Purpose: Evaluates the clarity and effectiveness of your onboarding process.

When to Ask: Early to mid-survey, especially for newer customers.

Value for Money

Question: How would you rate the value for money of our product?

Type: Multiple Choice (1-5 scale from “Poor value” to “Excellent value”)

Purpose: Measures perceived value relative to cost and identifies pricing concerns.

When to Ask: Later in the survey after establishing overall satisfaction.

Pain Points

Question: What frustrated you most during your experience?

Type: Open-ended text field

Purpose: Identifies specific friction points and improvement opportunities.

When to Ask: Mid to late survey after customers have shared positive feedback.

Change Request

Question: If you could change one thing about our product, what would it be?

Type: Open-ended text field

Purpose: Forces prioritization of improvements from the customer perspective.

When to Ask: Late in the survey after customers have shared overall feedback.

Support Responsiveness

Question: How responsive has our support team been to your needs?

Type: Multiple Choice (1-5 scale from “Not responsive” to “Extremely responsive”)

Purpose: Evaluates speed and effectiveness of support interactions.

When to Ask: For customers who have contacted support.

Onboarding Helpfulness

Question: Did you find our onboarding process helpful?

Type: Multiple Choice (Yes, Somewhat, No)

Purpose: Evaluates the effectiveness of your user onboarding experience.

When to Ask: For newer customers who have completed onboarding.

Interface Intuitiveness

Question: How intuitive is our user interface?

Type: Multiple Choice (1-5 scale from “Very confusing” to “Very intuitive”)

Purpose: Measures perceived ease of use and identifies UX improvement opportunities.

When to Ask: After customers have used the product for some time.

Technical Issues

Question: Have you experienced any technical issues? If yes, please describe.

Type: Yes/No with conditional text field

Purpose: Identifies bugs, performance issues, or technical barriers.

When to Ask: Mid to late survey to capture technical feedback.

Resolution Speed

Question: How quickly were your problems solved?

Type: Multiple Choice (1-5 scale from “Very slowly” to “Very quickly”)

Purpose: Measures support efficiency and effectiveness.

When to Ask: For customers who have reported issues.

Closing Questions

Contact Permission

Question: May we contact you to discuss your feedback further?

Type: Yes/No with conditional contact information fields

Purpose: Enables follow-up for clarification or deeper insights on specific feedback.

When to Ask: At the end of the survey.

Additional Feedback

Question: Is there anything else you’d like to share?

Type: Open-ended text field

Purpose: Captures any feedback not covered by previous questions.

When to Ask: At the very end of the survey.

Testimonial Willingness

Question: Would you be willing to provide a testimonial?

Type: Yes/No

Purpose: Identifies potential customer advocates for marketing purposes.

When to Ask: At the end of the survey for promoters (high NPS scores).

Research Participation

Question: Would you participate in a user research session?

Type: Yes/No with conditional availability fields

Purpose: Builds a panel of research participants for future product testing.

When to Ask: At the end of the survey.

Survey Improvement

Question: How can we make this survey more useful to you?

Type: Open-ended text field

Purpose: Improves future survey effectiveness and shows you value their input.

When to Ask: At the very end of the survey.

How to Write Effective NPS Survey Questions

Small wording changes affect response rates and data quality. Get the basics right.

What Makes an NPS Question Clear

Use plain language. Avoid jargon and corporate speak that confuses respondents.

Keep questions short. One idea per question. No double-barreled asks like “How likely are you to recommend and repurchase?”

Test your questions with a small group first. If people ask what you mean, rewrite it.

What is the Correct NPS Scale

Always use the 0-10 scale. Changing it breaks your ability to benchmark against industry standards.

Label the endpoints clearly: 0 = Not at all likely, 10 = Extremely likely.

Some tools let you customize the scale. Do not do this. Consistency matters more than creativity here.

When Should You Send NPS Surveys

Timing depends on survey type and your business model.

Relational surveys: quarterly or bi-annually to track overall trends without causing survey fatigue.

Transactional surveys:

- Post-purchase: 1-3 days after delivery

- Post-support: within 24 hours of resolution

- Post-onboarding: after completing setup milestones

For SaaS products, in-app surveys during active sessions get higher response rates than email. Consider using WordPress survey plugins if your site runs on that platform.

NPS Survey Question Examples by Industry

Generic NPS questions work, but industry-specific wording increases relevance and response rates.

Retail and Ecommerce NPS Questions

- “Based on your recent order, how likely are you to recommend [Store] to a friend?”

- “How likely are you to recommend our products to someone with similar needs?”

- “After your shopping experience today, how likely are you to recommend us?”

- “How likely are you to recommend [Brand] based on product quality and delivery?”

SaaS and Software NPS Questions

- “How likely are you to recommend [Product] to a colleague facing similar challenges?”

- “Based on your experience with [Feature], how likely are you to recommend our platform?”

- “How likely are you to recommend [Software] to other teams in your organization?”

Pair these with onboarding survey questions for new user feedback.

Healthcare NPS Questions

- “How likely are you to recommend [Practice/Hospital] to family or friends?”

- “Based on your appointment today, how likely are you to recommend our care team?”

- “How likely are you to recommend our patient portal to other patients?”

Healthcare surveys require extra attention to privacy. Keep questions focused on experience, not medical outcomes.

Financial Services NPS Questions

- “How likely are you to recommend [Bank/Institution] to a friend or family member?”

- “Based on your recent transaction, how likely are you to recommend our services?”

- “How likely are you to recommend our mobile banking app to colleagues?”

Hospitality NPS Questions

- “How likely are you to recommend [Hotel/Restaurant] to someone planning a similar trip?”

- “Based on your stay, how likely are you to recommend us to friends?”

- “How likely are you to recommend our booking experience to other travelers?”

Send hospitality surveys within 24 hours of checkout while memories are fresh.

NPS Survey Distribution Methods

Where and how you deliver surveys affects response rates dramatically. Match the channel to your audience.

Email NPS Surveys

Most common method. Personalize subject lines; include the NPS question directly in the email body when possible.

Average response rates: 10-30%. Following form design best practices in your email template helps.

In-App NPS Surveys

Best for SaaS and mobile form experiences. Trigger after key actions like completing a task or reaching a milestone.

Response rates often exceed 40% because users are already engaged.

Website NPS Surveys

Use slide-in widgets or modal popups. Trigger based on behavior: time on page, scroll depth, or exit intent.

Keep surveys non-intrusive. A small tab in the corner works better than aggressive popups for most sites.

SMS NPS Surveys

High open rates (90%+) but keep it short. Include a direct link to a one-question survey form.

Best for transactional feedback in retail, hospitality, and service industries.

Common NPS Survey Mistakes

These errors skew your data and annoy respondents.

- Asking too many questions – stick to the NPS question plus 1-2 follow-ups maximum

- Poor timing – surveying before customers experience your product fully

- Leading question wording – “How likely are you to recommend our amazing service?” biases responses

- Skipping the follow-up – numbers without context are useless for improvement

- Not closing the loop – failing to act on or respond to feedback

- Survey fatigue – asking the same customers too frequently

- Ignoring Passives – focusing only on Promoters and Detractors misses conversion opportunities

Work on improving form abandonment rates if completion rates drop below 20%.

How to Analyze NPS Survey Responses

Raw scores mean nothing without proper analysis. Dig into the data.

Calculating Your NPS Score

Count responses in each category. Divide Promoters and Detractors by total responses to get percentages. Subtract Detractors from Promoters.

100 responses: 50 Promoters, 30 Passives, 20 Detractors = 50% – 20% = NPS of 30.

Segmenting NPS Data

Slice your data by customer type, product line, region, purchase value, or customer tenure.

Patterns emerge when you segment. Your overall NPS might be 40, but enterprise customers could be at 60 while SMBs sit at 25.

Use these insights alongside demographic survey questions for deeper analysis.

Tracking NPS Over Time

Measure quarterly at minimum. Plot trends to spot improvements or declines.

Compare against your own historical data first. Industry benchmarks help but your trajectory matters more.

Set alerts for significant drops. A 10-point decline signals something changed.

NPS Survey Tools

The right platform simplifies collection, analysis, and action.

- Qualtrics – enterprise-grade with advanced analytics; steep learning curve

- SurveyMonkey – user-friendly with built-in NPS templates; good for mid-size teams

- Delighted – purpose-built for NPS; simple interface, fast setup

- Medallia – comprehensive experience management; best for large organizations

- Typeform – conversational format increases engagement; design-focused

- AskNicely – automation and workflow features; integrates with CRMs

- Hotjar – combines NPS with heatmaps and session recordings

- Wootric – in-app micro-surveys; real-time dashboards

- CustomerGauge – B2B focused with account-level tracking

- Retently – multi-channel distribution; affordable for startups

Most tools offer free trials. Test 2-3 before committing.

For WordPress sites, explore dedicated feedback form solutions that integrate with your existing setup.

FAQ on NPS Survey Questions

What is a good NPS score?

Scores above 0 are acceptable, 30-70 indicates strong customer loyalty, and 70+ is world-class. Industry matters though. B2B software averages around 40, while airlines hover near 35. Compare against your own historical data first, then benchmark against competitors.

How often should I send NPS surveys?

Relational surveys work best quarterly or bi-annually. Transactional surveys go out after specific interactions like purchases or support calls. Avoid surveying the same customer more than once per quarter to prevent survey fatigue and maintain response rates.

What is the difference between relational and transactional NPS?

Relational NPS measures overall brand perception over time. Transactional NPS captures feedback after specific touchpoints like purchases, onboarding, or support interactions. Use both together for complete visibility into the customer journey and satisfaction metrics.

How many questions should an NPS survey have?

Keep it to three questions maximum: the core NPS rating, one open-ended follow-up asking why, and optionally one closed-ended question about specific areas. Longer surveys kill response rates. Understanding different types of survey questions helps you choose wisely.

What follow-up questions work best after the NPS rating?

Ask “What is the primary reason for your score?” for all respondents. For Detractors, ask what would improve their experience. For Promoters, ask what they value most. These feedback survey questions turn scores into actionable insights.

Can I customize the 0-10 NPS scale?

No. Changing the scale breaks benchmarking capability and invalidates comparisons with industry standards. Bain & Company and Satmetrix designed the 0-10 scale specifically for consistency. Customize your follow-up questions instead while keeping the core Net Promoter Score question intact.

What is eNPS and how does it differ from customer NPS?

Employee NPS measures workforce satisfaction and loyalty using the same methodology. The question becomes “How likely are you to recommend this company as a workplace?” High eNPS often predicts better customer experiences. Pair it with employee satisfaction survey questions for deeper insights.

When is the best time to send NPS surveys?

For transactions, send within 24-48 hours while the experience is fresh. For SaaS, trigger after users complete key milestones. Avoid Mondays and Fridays for email surveys. Mid-week, mid-morning typically yields highest response rates for most industries.

How do I calculate my NPS score?

Subtract the percentage of Detractors (0-6 ratings) from the percentage of Promoters (9-10 ratings). Passives (7-8) count toward total respondents but do not affect the calculation. The result ranges from -100 to +100. Simple formula, powerful metric.

What tools are best for running NPS surveys?

Delighted and Wootric specialize in NPS. Qualtrics and Medallia suit enterprises needing advanced analytics. SurveyMonkey and Typeform work for smaller teams. Most offer free trials, integrations with CRMs like HubSpot, and automated feedback collection workflows.

Conclusion

Well-crafted NPS survey questions turn passive data collection into a growth engine for your business.

Start with the standard Net Promoter Score question. Add one solid follow-up. Time it right.

Segment your responses by customer type, track trends quarterly, and close the feedback loop by acting on what you learn.

Tools like Qualtrics, Delighted, and SurveyMonkey handle the mechanics. Your job is asking the right questions at the right moments.

The companies with the highest customer retention rates treat NPS as an ongoing conversation, not a checkbox exercise.

Pick one survey type from this guide. Launch it this week. Measure, adjust, repeat.

Your customers are already forming opinions. Now you have the questions to capture them.