Most plumbing companies rely on word of mouth and hope. That’s not a strategy for lead generation for plumbers, that’s a gamble. The plumbing businesses pulling 40+ new service calls…

Table of Contents

Between 75% and 90% of financial services searches start online. Your next mortgage customer, business loan applicant, or wealth management client is researching options right now.

The question is whether they’ll find your institution or a competitor.

Lead generation for banks has shifted dramatically from branch walk-ins and cold calls to digital-first strategies that capture prospects across multiple channels.

Financial institutions that master this shift build consistent pipelines of qualified prospects. Those that don’t watch customer acquisition costs climb while growth stalls.

This guide covers how banks attract, capture, qualify, and convert leads across personal banking, commercial lending, and wealth management segments.

You’ll learn the methods that work, the tools that scale, and the compliance requirements that govern every interaction.

What is Lead Generation for Banks

Lead generation for banks is the process of attracting potential customers who need financial products like mortgages, personal loans, business accounts, or wealth management services.

Banks collect contact information from qualified prospects through digital marketing, branch interactions, and partnership referrals.

The goal is building a sales pipeline filled with individuals and businesses ready to open accounts or apply for credit.

Unlike retail or ecommerce, banking lead generation operates under strict regulatory oversight from agencies like the Consumer Financial Protection Bureau and must comply with TCPA regulations.

Financial institutions segment leads by product interest, creditworthiness, and customer lifetime value.

A mortgage lead differs completely from a commercial lending prospect. Each requires different qualification criteria and nurturing sequences.

Regional banks, credit unions, and national institutions like JPMorgan Chase or Bank of America all compete for the same pool of qualified banking leads.

The institutions that capture prospects efficiently while maintaining compliance gain market share.

Why Do Banks Need Lead Generation

LSA Global reports between 75% and 90% of financial services searches start online.

Prospects research banks, compare rates, and read reviews before ever walking into a branch or calling a loan officer.

Without active customer acquisition strategies, banks lose these digital-first consumers to competitors who show up in search results.

The Cost of Digital Acquisition

Financial services keywords cost $50 or more per click according to O8 Agency data. The competition is brutal.

Invoca research shows the average cost for a financial services lead is $653. CoinLaw reports the average customer acquisition cost in the U.S. is $390 in 2025.

Banks that rely solely on paid advertising burn through marketing budgets fast.

The alternative? Market Business Insights found customer acquisition costs for mobile-first banks were 65% lower than traditional branch-based models.

Scale Limitations of Traditional Methods

Referrals and word-of-mouth only scale so far. Growth plateaus without systematic prospecting.

Drive Research found nearly 1 in 5 consumers are likely to change financial institutions in 2025. Over half of Millennials (58%) and Gen Z (57%) are likely to switch if another institution better meets their banking priorities.

CoinLaw reports customer churn costs U.S. banks $195 billion annually. The cost to retain an existing customer is $75 compared to $390 to acquire a new one.

Digital Transformation Requirements

Mobile banking adoption means customers expect seamless online experiences from first contact through account opening.

Consumer preferences according to recent research:

- 55% use mobile banking as primary access method (Bankrate)

- 77% prefer managing accounts via mobile or computer (ABA)

- 72% more likely to choose banks with well-designed mobile apps (Drive Research)

CoinLaw research shows 80% of millennials prefer digital banking, with 48% indicating they would switch banks if the digital experience isn’t seamless.

O8 Agency data confirms banks expected to spend $30 billion globally on digital advertising in 2025.

How Does Bank Lead Generation Work

Bank lead generation follows a structured process from initial contact to conversion.

The journey starts when a prospect discovers your institution through search, social media, advertising, or referral.

What Are the Stages of Lead Management

Lead capture happens when prospects submit contact information through website forms, chatbots, or branch visits.

CRMside data shows businesses pull in roughly 1,877 new leads each month, but only about 81% qualify as marketing-ready.

Qualification determines whether the prospect matches your ideal customer profile based on financial stability, credit scores, and product fit.

Lead nurturing moves qualified prospects through email campaigns, follow-up calls, and personalized content until they’re ready to convert. CRMside reports nurtured leads generate 20% more sales opportunities.

What Tools Support This Process

Banking CRM software like Salesforce Financial Services Cloud or HubSpot tracks every interaction.

CRM impact according to recent research:

- 17% increase in lead conversions (Veritis)

- 300% increase in conversion rates (DemandSage)

- 8-14 day shorter sales cycles (CRM.org)

Marketing automation handles triggered emails, drip campaigns, and lead scoring based on engagement level.

Integration between systems gives loan officers complete visibility into prospect behavior and preferences.

Nutshell research shows 65% of sales reps with mobile CRM access achieved their annual sales quota, compared to only 22% without mobile CRM.

What Are the Types of Bank Leads

Banks serve diverse customer segments. Each requires different marketing approaches and qualification criteria.

Personal Banking Leads

Individuals seeking checking accounts, savings accounts, personal loans, and credit cards.

These prospects respond to convenience, competitive rates, and mobile forms.

McKinsey reports retail banking leads with 33% of global financial intermediation revenue.

Business Banking Leads

Commercial checking, SBA loans, treasury management, and merchant services.

Decision-makers: business owners, CFOs, financial directors. Longer sales cycles, higher account values.

Market share according to 2024 data:

- 44% of U.S. commercial banking (Mordor Intelligence)

- 28% of global revenue (McKinsey)

Mortgage Leads

Homebuyers and refinancing prospects.

2024-2025 market activity:

- $1.69 trillion originations in 2024, up 12.9% (LendingTree)

- 70% conventional loans (Homebuyer.com)

- 43% increase in refinance applications (MBA)

Exclusive leads sell to one lender. Shared leads go to multiple competitors.

Wealth Management Leads

High-net-worth individuals seeking investment advisory services.

Require personalized outreach through relationship banking rather than mass marketing.

McKinsey found wealth and asset management accounted for 14% of global financial intermediation revenue.

Commercial Lending Leads

Businesses seeking equipment financing, commercial real estate loans, lines of credit.

Market size:

- $2.77 trillion U.S. market in 2023 (HES Fintech)

- $498 billion CRE borrowing in 2024, up 16% (MBA)

Coalition Greenwich found 25% of middle market companies and 16% of small businesses are seeking non-traditional lenders.

What Methods Generate Leads for Banks

Effective lead generation strategies combine digital channels with traditional outreach.

No single method works for every institution. Regional banks succeed with local SEO while national players dominate paid search.

Digital Marketing Performance

Search engine optimization targets prospects actively searching for financial products.

Key channel ROI according to 2024-2025 data:

- SEO: $22 return per $1 spent (DemandSage)

- PPC: $2 return per $1 spent (WordStream)

- Email: $36-$40 return per $1 spent (LoopEx Digital)

HubSpot found websites, blogs, and SEO represented 16% of channels with biggest ROI in 2024. 49% of businesses say organic search brings the best marketing ROI.

Bank Website Lead Capture

Your website is your primary lead generation funnel.

Self-service tools like mortgage calculators and rate comparisons qualify prospects automatically.

Strategic lead capture forms placed on high-traffic pages collect contact information.

Chatbots answer common questions 24/7 and capture lead data when loan officers aren’t available.

Social Media Platforms

LinkedIn Sales Navigator connects business development teams with financial decision-makers.

Facebook Business Manager enables targeted advertising based on life events.

LoopEx Digital reports 40% of B2B marketers cite LinkedIn as the top source for high-quality leads.

Content Marketing

Educational content attracts prospects researching financial decisions.

Blog posts, webinar registration forms, and downloadable guides capture leads.

Financial calculators and assessment tools provide value while collecting prospect information.

Salesmate found companies generate 67% more leads with a successful blog compared to those without.

Partnerships and Referrals

Real estate agents refer mortgage leads. Car dealerships connect buyers with auto loan departments.

Business associations and chambers of commerce provide access to commercial banking prospects.

Structured referral programs turn satisfied customers into lead generation channels.

Email Marketing

Triggered emails respond to specific prospect actions like downloading a guide.

Drip campaigns nurture cold leads based on their expressed interests.

LoopEx Digital shows 82% of digital marketers globally implement email marketing, with 65% utilizing automated emails.

How Do Banks Qualify Leads

Not every prospect deserves a loan officer’s time. Lead scoring separates serious applicants from tire-kickers.

Banks assess financial stability through income verification, credit scores, and existing debt obligations.

Lead Quality Criteria

Financial stability factors:

- Income level and employment history

- Debt-to-income ratio

- Credit profile (FICO scores, payment history, credit utilization)

Behavioral signals:

- Website visits and email opens

- Content downloads

- Product page engagement

- Timeline readiness

Product alignment determines whether the prospect needs what you offer. A jumbo mortgage prospect needs different qualification than someone applying for basic checking.

Lead Scoring Performance

Landbase found properly scored leads achieve 40% conversion rates versus 11% for unqualified prospects.

Teams using AI-driven scoring see 40% accuracy improvements over traditional methods according to Landbase research.

Key conversion benchmarks from Sales So 2025 data:

- Average MQL to SQL conversion: 13%

- Top performers with behavioral scoring: 40%

- SQLs to opportunities: 20-30%

- Average SQL to customer: 6%

- Top performers SQL to customer: 25%

Lead Scoring Impact

Machine learning models boost conversion rates by 75% compared to traditional scoring according to Predictive Lead Scoring Statistics 2024.

SuperAGI found companies using AI lead scoring experienced 25% average increase in conversion rates.

AI automation reduces manual lead qualification processes by 60-80% per Amra and Elma and Qualimero research.

First Page Sage reports average lead-to-MQL conversion is 31% across all industries.

Scoring Implementation

Assign point values to prospect behaviors and demographics.

High scores trigger immediate outreach from loan officers. Low scores enter automated nurturing sequences.

Data-Mania shows following up within first hour increases conversion rates to 53% versus 17% after 24 hours.

360View identifies key bank qualification criteria: financial stability evaluation, intent signals from digital interactions, timing and urgency assessment, referral influence, and cross-selling opportunities.

What Tools Do Banks Use for Lead Generation

Technology separates efficient lead generation from manual chaos.

The right stack integrates marketing automation, CRM, and analytics into a unified system.

CRM Systems for Lead Management

Salesforce Financial Services Cloud dominates enterprise banking. HubSpot serves mid-market institutions.

Core capabilities you need:

- Contact management with full customer history

- Pipeline tracking across multiple products

- Task automation for follow-up sequences

- Reporting dashboards showing conversion metrics

DemandSage found companies using CRM experience 300% increase in conversion rates. Choose cloud-based platforms for accessibility across teams.

Deploy AI Chatbots for Qualification

Chatbots handle initial prospect inquiries, qualify leads through conversational forms, and schedule appointments without human intervention.

SQ Magazine reports chatbots reduce call center costs by up to 70% and response times by 65%.

Implementation strategy:

- Start with common questions (account types, rates, application requirements)

- Route qualified leads directly to loan officers

- Use 24/7 availability to capture after-hours inquiries

Fullview shows chatbots now handle 70-85% of inbound queries for retail banks. CoinLaw found banks using chatbots see 32% drop in call center volume.

Marketing Automation for Scale

Tools like Marketo and Pardot personalize outreach based on prospect behavior.

Set up triggered campaigns:

- Welcome sequences for new leads

- Product-specific nurture tracks

- Re-engagement for cold prospects

- Rate change notifications

Businesses using generative AI in CRM are 83% more likely to exceed sales goals according to CRM.org.

Predictive Analytics for Prioritization

Identify which prospects are most likely to convert before your team wastes time on dead ends.

AI-driven systems analyze:

- Website behavior patterns

- Email engagement history

- Product page visits

- Form completion rates

CoinLaw shows AI automation reduced operational costs by 13% across major banks in 2025. AI-driven credit risk modeling improved loan approval accuracy by 34%.

What Regulations Affect Bank Lead Generation

Banking operates under strict compliance requirements. One violation can cost millions.

The Office of the Comptroller of the Currency and FDIC monitor marketing practices closely.

TCPA Compliance Requirements

The Telephone Consumer Protection Act requires prior express written consent before calling or texting prospects.

How to stay compliant:

- Document consent with timestamps on every form

- Keep records of when and how consent was obtained

- Process opt-out requests within 10 business days (down from 30 as of 2025)

- Check numbers against Do Not Call registry before dialing

Report Telemarketer shows violations carry $500 per incident, up to $1,500 for willful breaches. No cap on total fines exists.

ActiveProspect warns around 80% of current TCPA lawsuits are class actions. Every call, text, or voicemail counts as a separate violation.

Compliance Alliance notes banks face fines up to $51,744 per violation under FDIC, Federal Reserve, OCC, and NCUA enforcement.

GDPR for International Prospects

European prospects require explicit consent for data collection and processing.

Implementation checklist:

- Use GDPR compliant forms that document consent properly

- Provide clear opt-out mechanisms on every communication

- Store data only as long as necessary

- Enable data portability and deletion requests

Deepstrike reports average GDPR fine reached €2.36 million across 2018-2025. Maximum penalties hit €20 million or 4% of global turnover.

JumpCloud found over 80% of GDPR fines in 2024 were due to insufficient security measures leading to data leaks.

CCPA and State Privacy Laws

California Consumer Privacy Act gives residents rights over their personal data.

Required actions:

- Add “Do Not Sell My Personal Information” link on your website

- Process deletion requests within verification requirements

- Maintain detailed records of data collection and sharing

- Update your form security practices

California Privacy Protection Agency set 2025 penalties at $2,663 per unintentional violation and $7,988 per intentional violation or cases involving minors according to official announcements.

Usercentrics reports CCPA enables consumers to sue for $107 to $799 per person per data breach incident.

Compliance Hub shows American Honda paid $632,500 for CCPA breaches in 2025.

Practical Compliance Strategy

Map your data flows first. Identify every point where you collect prospect information.

Train your team on proper consent documentation. Most violations come from staff not following procedures.

Audit your forms quarterly. Secureframe notes California Privacy Protection Agency announced settlements totaling over $2.3 million in 2025, with largest fine of $1.35 million for improper privacy notices.

What Are Common Bank Lead Generation Challenges

Financial services face unique obstacles that other industries don’t encounter.

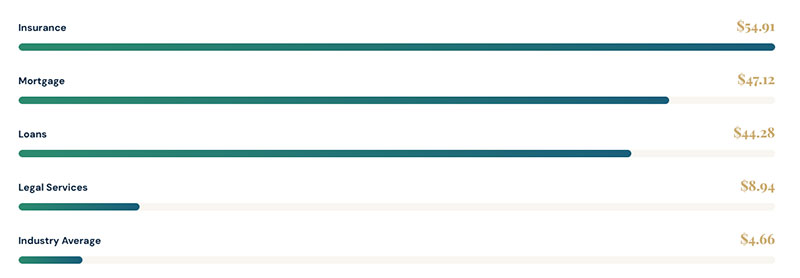

Managing Expensive PPC Costs

Financial services keywords rank among the most expensive on Google Ads.

LocaliQ found average cost per click across all industries reached $4.66 in 2024, up from $4.22 in 2023. Legal services hit $8.94 per click, but financial keywords aren’t far behind.

99firms reports “insurance” keywords cost $54.91 per click, “loans” run $44.28, and “mortgage” hits $47.12.

Budget management strategies:

- Focus on long-tail keywords with lower competition

- Use negative keywords to eliminate wasteful clicks

- Improve Quality Score to reduce per-click costs

- Test Bing Ads where 99firms shows financial CPCs average $1.82 versus Google’s $3.44

High customer lifetime values justify the spend, but WordStream data shows 86% of industries experienced CPC increases in 2024.

Sustaining Long Sales Cycles

Mortgage decisions take months. Commercial lending involves multiple stakeholders and extensive due diligence.

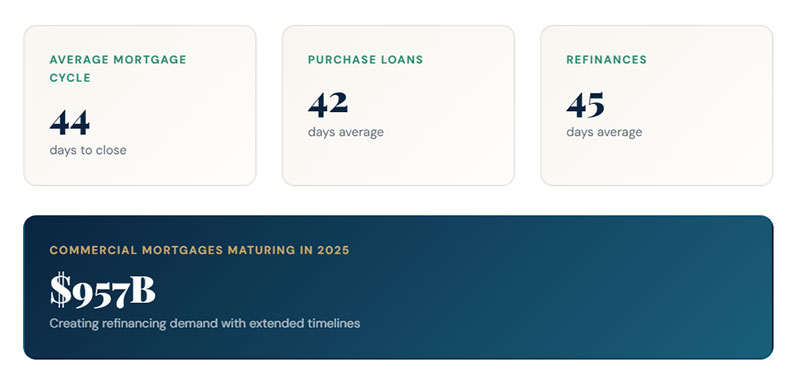

Freddie Mac found average mortgage closing cycle time hit 44 days in 2020, with purchase loans taking 42 days and refinances 45 days.

MBA projects $957 billion in commercial mortgages maturing in 2025, creating refinancing demand but extended timelines.

Lead nurturing tactics:

- Build automated email sequences for 60-90 day cycles

- Segment prospects by product type and timeline

- Provide educational content at each decision stage

- Use CRM to track engagement and trigger follow-ups

CommLoan reports CRM systems help close deals 30 percent faster according to SuperOffice research.

Navigating Compliance Bottlenecks

Every piece of marketing content requires legal review. Fair Lending Act and Community Reinvestment Act add complexity.

Documentation requirements slow down campaigns that competitors in unregulated industries launch overnight.

Streamlining compliance:

- Create pre-approved content templates

- Build compliance checklist for each campaign type

- Invest in RegTech tools that flag issues automatically

- Train marketing team on basic compliance requirements

MBA data shows total mortgage origination volume expected to increase to $2.3 trillion in 2025, up from $1.79 trillion in 2024. Competition will intensify.

Overcoming Trust Barriers

Prospects research extensively before contacting banks. They compare rates across dozens of institutions.

Building credibility faster:

- Display security certifications prominently

- Showcase client reviews and testimonials

- Provide transparent rate information

- Offer educational content without hard sells

Focus Digital research shows high-competition industries require 3.4x more investment per click than low-competition sectors. Every advantage matters.

How to Measure Bank Lead Generation Success

Metrics tell you what’s working and what’s wasting budget.

Track performance at every stage of the funnel from initial capture through closed accounts.

Essential KPIs to Monitor

Cost per lead: Total marketing spend divided by leads generated

Lead quality score: Average qualification rating of incoming prospects using criteria like income level, credit score, and product fit

Time to conversion: Days from first contact to account opening

Customer acquisition cost: Full expense of gaining one new customer

Swaystack reports retail consumer banks average $561 per customer, commercial banks reach $760, and investment banks hit $882 per new client.

First Page Sage found CAC varies significantly by channel and product type. Credit unions report average Member Acquisition Cost of $428 per new member according to Swaystack.

Venturz shows banking CAC ranges from $20 for checking accounts to $150+ for credit cards or loans.

Calculate CAC Accurately

Use this formula: Total marketing and sales expenses / Number of new customers acquired

Include all costs:

- Ad spend across all channels

- Marketing team salaries

- Sales staff compensation

- Technology and software costs

- Agency fees

Amra and Elma reports fintech CAC averages $1,450 due to intense competition and long sales cycles. Track your CAC against these benchmarks.

Track ROI by Channel

Connect your CRM to marketing platforms through Zapier or native integrations.

Attribute closed accounts back to original lead sources:

- Tag every lead with source information

- Track conversion rates by channel

- Calculate revenue per channel

- Compare CAC across different sources

Focus Digital recommends segmenting CAC by service type and loan size to find profitable campaigns.

Conversion rate benchmarks help you gauge performance against industry standards.

Monitor LTV to CAC Ratio

Target 4:1 ratio for most banking products. Spend up to $1 acquiring customers who generate $4+ in lifetime value.

First Page Sage advises if your ratio is 1:2 or 1:3, scale back campaigns until you lower CAC or raise LTV.

Swaystack found nearly 40% of credit unions spend $1 million to $5 million annually on marketing, with half going to digital channels.

Set Up Attribution Tracking

Use Google Analytics to track:

- Which pages prospects visit before converting

- How many touchpoints it takes to close

- Drop-off points in your funnel

Matomo reports finance mobile apps have 3% user retention at 30-day mark. Optimize your onboarding process to improve these numbers.

Review Performance Weekly

Don’t wait for month-end reports. Check metrics at least weekly:

- Lead volume trends

- Cost per lead fluctuations

- Conversion rate changes

- CAC by channel performance

Cornerstone Advisors warns 40% of credit union executives don’t track their acquisition costs at all. Don’t be one of them.

Lead Nurturing for Banks

Most prospects aren’t ready to buy immediately. Nurturing keeps your institution top-of-mind until they are.

Build Effective Drip Campaigns

Automated email sequences deliver relevant content based on prospect interests and behaviors.

Segment by product interest:

- Mortgage prospects receive rate updates and homebuying tips

- Business banking leads get cash flow management content

- Personal banking prospects see account benefits and tools

Growleads found automated emails achieve 52% higher open rates, 332% higher click rates, and 2,361% better conversion rates than standard campaigns.

Sender reports lead nurturing emails generate 8% CTR compared to 3% CTR for general email sends.

Design Multi-Touch Sequences

Email, phone calls, direct mail, retargeting ads, and LinkedIn outreach all play roles.

Zendesk shows nurtured leads make 47% larger purchases than non-nurtured leads. WPForms found lead nurturing emails get 4 to 10 times the response rate compared to standalone blasts.

Channel mix strategy:

- Start with educational email content

- Follow up with phone calls for high-value prospects

- Use retargeting ads to stay visible

- Send direct mail for commercial relationships

Amra and Elma report companies excelling at lead nurturing generate 50% more sales-ready leads at 33% lower cost.

Determine Optimal Sequence Length

Match campaign duration to typical decision timelines. Don’t give up too soon.

Chameleon Sales Group notes 80% of deals need at least five follow-ups, yet almost half of sales reps give up after one attempt.

Recommended durations:

- Checking accounts: 30-45 days

- Credit cards: 60-90 days

- Personal loans: 90-120 days

- Mortgages: 12-18 months

- Commercial lending: 18-24 months

Continue until the prospect converts, opts out, or goes cold (no engagement for 60+ days).

Track Engagement Signals

Monitor which touchpoints drive the best response to refine your approach.

Key metrics to watch:

- Email open rates (target 25%+ per Amra and Elma)

- Click-through rates (aim for 8% on nurture emails per Sender)

- Response rates to calls

- Content download frequency

WPForms data shows personalized emails improve click-through rates by 14% and conversion rates by 10%.

Set Up Behavioral Triggers

Respond automatically when prospects take specific actions.

Trigger examples:

- Rate calculator use: Send mortgage comparison guide

- Pricing page visit: Follow up with product specialist call

- Email link click: Advance to next sequence stage

- Form abandonment: Send reminder with incentive

Growleads reports lead scoring can boost conversions by 79% when properly implemented.

Personalize at Scale

Generic messages get ignored. Customize content based on prospect data.

Amra and Elma shows nurtured leads reduce sales cycles by 23%. Email marketing delivers $36 return for every $1 spent according to UpLead.

Personalization tactics:

- Reference their specific product interest

- Acknowledge their location or industry

- Match content to their engagement level

- Time sends based on their behavior patterns

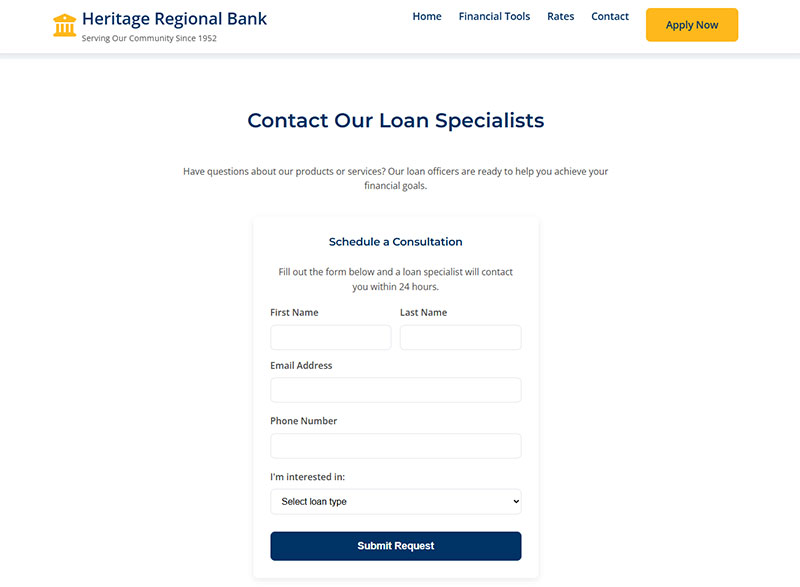

Best Practices for Bank Lead Capture Forms

Forms are where prospects become leads. Poor form design kills conversions.

Balance Fields vs. Completion Rates

Start with essential fields only: name, email, phone, and product interest.

WPForms found reducing form fields from 4 to 3 can increase conversion rate by almost 50%. Amra and Elma reports the same reduction boosts conversions by up to 50%.

UserGuiding data shows reducing fields from 11 to 4 can increase conversions by 120%.

Add qualification fields strategically:

- Income range (for loan products)

- Credit score estimate (for rate quotes)

- Timeline to purchase (for prioritization)

- Current banking relationship (for competitive offers)

HubSpot research reveals 30% of marketers get highest conversion rates from forms with 4 fields.

Implement Multi-Step Forms

Break long applications into digestible chunks with progress indicators.

WPForms found only 40% of marketers use multi-step forms, but their conversion rate is 86% higher than single-page forms.

Structure by complexity:

- Step 1: Basic contact info (name, email, phone)

- Step 2: Product details (loan amount, account type)

- Step 3: Qualification info (income, employment)

- Step 4: Final details and submission

Progress bars reduce abandonment by showing how close prospects are to finishing.

Optimize Form Elements

Clear form error messages help users fix mistakes without frustration.

Form validation catches invalid entries before submission, improving data quality.

Best practices:

- Use autofill to speed completion (Zuko found autofill increases conversion by 10%+)

- Label fields above inputs, not beside them

- Match field width to expected answer length

- Avoid CAPTCHAs (WPForms shows they reduce conversion by 40%)

Zuko data reveals password fields have 10.5% abandonment rate, highest of any field type.

Place Forms Strategically

Product pages, landing page forms, and rate comparison tools capture high-intent visitors.

Location priorities:

- Above the fold on product pages

- Dedicated landing pages for campaigns

- Rate calculator results pages

- Blog posts about specific products

WPForms found content above the fold captures 57% of page-viewing time.

Exit intent popups recover abandoning visitors. Popupsmart reports average popup conversion rate of 3.09%.

Enable Instant Booking

Let prospects schedule calls immediately after form submission.

Chili Piper found letting customers book meetings immediately after form fill doubles inbound conversion rate from 30% to 66.7%.

Implementation steps:

- Integrate calendar scheduling tool

- Show available times on confirmation page

- Send confirmation email with calendar invite

- Enable live chat for immediate questions

Responding within first minute increases conversions by 391% according to Chili Piper data.

Test and Optimize

Run A/B tests on form variations regularly.

WPForms shows marketers who run A/B tests report conversion rates 10% higher than those who don’t.

Test these elements:

- Number of fields

- Field order

- Button text and color

- Form placement

- Multi-step vs. single page

WordStream landing page benchmarks: average pages convert at 2.35%, top 25% at 5.31%, top 10% at 11.45%.

Add Trust Signals

Security badges and privacy statements increase form completion.

Include near forms:

- SSL certificate indicators

- Privacy policy links

- “We never share your information” messages

- Bank regulatory disclosures

Strategic contact us page design ensures prospects can always reach you through multiple channels.

FAQ on Lead Generation For Banks

What is lead generation for banks?

Lead generation for banks is the process of attracting potential customers interested in financial products like mortgages, personal loans, business accounts, and credit cards. Banks capture prospect information through digital marketing, website forms, and branch interactions.

How much does bank lead generation cost?

Costs vary significantly by channel and product type. Financial services keywords on Google Ads run $50+ per click. Cost per lead ranges from $20 for basic checking accounts to $200+ for commercial lending prospects.

What are the best lead generation channels for banks?

Top channels include SEO, content marketing, paid search through Google Ads, LinkedIn for B2B prospects, email campaigns, and referral partnerships with real estate agents and business associations. Mix channels based on target segments.

How do banks qualify leads?

Banks assess prospects using lead scoring based on credit profiles from Equifax, Experian, and TransUnion, income verification, product fit, engagement level, and timeline. High scores trigger immediate loan officer outreach.

What CRM systems do banks use for lead management?

Salesforce Financial Services Cloud dominates enterprise banking. HubSpot serves mid-market institutions. Both integrate with marketing automation tools like Marketo and Pardot for lead nurturing and pipeline tracking.

What compliance rules affect bank lead generation?

Banks must follow TCPA regulations requiring consent before calls or texts. GDPR governs European prospects. CCPA covers California residents. The Consumer Financial Protection Bureau monitors all marketing practices.

How long does it take to convert banking leads?

Conversion timelines vary by product. Checking accounts convert in days. Personal loans take weeks. Mortgages require months. Commercial lending involves multiple stakeholders and extensive due diligence, often spanning 6-12 months.

What conversion rate should banks expect?

Industry averages range from 2-5% for cold leads to 15-25% for qualified, nurtured prospects. Rates depend on lead source quality, product complexity, and follow-up speed. Mortgage leads typically convert higher than credit cards.

How do banks nurture leads that aren’t ready to buy?

Automated drip campaigns deliver relevant content based on prospect interests. Email sequences, retargeting ads, and periodic phone outreach maintain engagement. Nurturing campaigns for mortgages often run 12-18 months until prospects convert.

What tools help banks capture more leads online?

Effective tools include well-designed lead capture forms, chatbots for 24/7 engagement, mortgage calculators, rate comparison tools, and exit-intent forms that recover abandoning visitors.

Conclusion

Lead generation for banks requires balancing aggressive customer acquisition with strict regulatory compliance from the FDIC and Consumer Financial Protection Bureau.

The institutions winning today combine digital marketing, CRM automation through platforms like Salesforce, and strategic partnerships to build sustainable pipelines.

Your banking CRM software should track every touchpoint. Your loan officers need qualified prospects, not cold lists.

Focus on increasing form conversions on your website. Implement proper lead scoring based on FICO data and engagement signals.

Nurture prospects through automated drip campaigns tailored to mortgage leads, business banking prospects, and wealth management clients.

Test channels systematically. Measure cost per lead and conversion rates religiously.

The banks that treat lead generation as a disciplined process rather than random marketing will capture market share while competitors struggle with rising acquisition costs.