Most plumbing companies rely on word of mouth and hope. That’s not a strategy for lead generation for plumbers, that’s a gamble. The plumbing businesses pulling 40+ new service calls…

Table of Contents

Empty rooms generate zero revenue. That’s the brutal math every hotelier faces daily.

Lead generation for hotels solves this problem by building a consistent pipeline of potential guests before they book elsewhere.

OTAs like Booking.com and Expedia charge 15-30% commission per reservation. Direct lead capture cuts these costs and puts you in control of the guest relationship.

This guide covers the channels, tools, and tactics that fill rooms profitably.

You’ll learn how to capture leads through your website, nurture prospects with email sequences, and measure what actually drives bookings.

Whether you run a boutique property or manage a chain, these strategies apply.

What is Lead Generation for Hotels

Lead generation for hotels is the process of attracting potential guests and collecting their contact information before they complete a booking.

It covers everything from capturing email addresses on your website to qualifying corporate travel accounts for group bookings.

The goal is building a hotel sales pipeline filled with prospects you can nurture toward confirmed reservations.

Unlike retail or SaaS businesses, hotels deal with perishable inventory. An empty room tonight generates zero revenue tomorrow.

This makes consistent lead flow critical for maintaining healthy occupancy rates throughout the year.

Boutique hotels, resort properties, business hotels, and chain properties like Marriott International or Hilton Hotels all rely on systematic guest acquisition to fill rooms.

The hospitality industry faces unique pressure from Online Travel Agencies. Platforms like Booking.com and Expedia charge 15-30% commission per booking.

Direct lead generation reduces dependency on these channels and protects your RevPAR (Revenue Per Available Room).

Types of Hotel Leads

Not all leads carry the same value. Understanding categories helps you allocate marketing budget effectively.

Direct Booking Leads

Come through your hotel website, phone calls, or walk-ins. These convert at higher rates and cost nothing in commission fees.

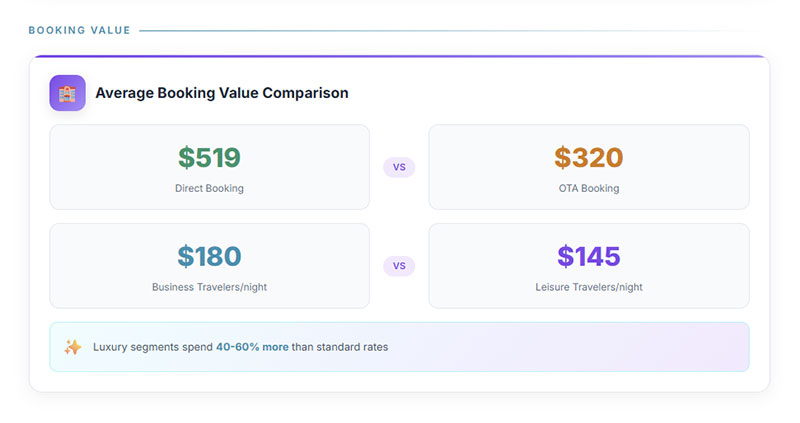

According to SiteMinder, hotel websites generated an average of $519 per booking in 2024, well above OTAs at $320. Direct website bookings increased 8.5% year-over-year, the fastest growth among all channels.

Build systems that drive traffic to your site. Invest in SEO, metasearch campaigns, and loyalty programs that reward direct bookings.

Corporate Leads

Represent business travelers and companies needing regular accommodation. They book repeatedly and often at negotiated rates.

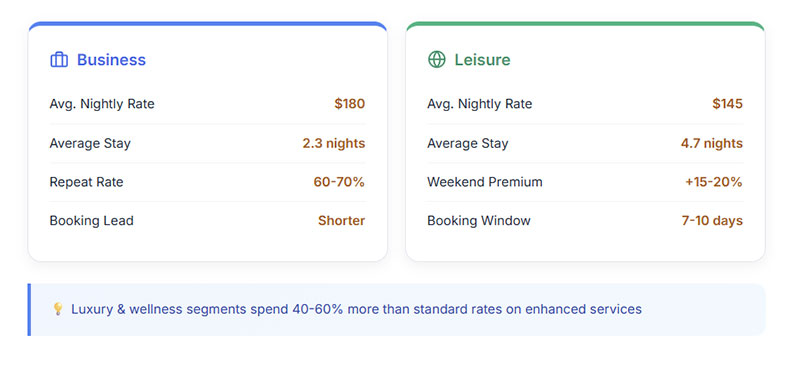

According to Prostay, business travelers spend $180 per night average versus $145 for leisure travelers. According to SiteMinder, booking lead times averaged 32 days in 2024, giving you time to nurture corporate relationships.

Target companies within 10 miles of your property. Offer corporate rate programs with volume discounts and flexible cancellation policies.

Event Planning Leads

Search for venues for conferences, weddings, and corporate retreats. High average booking value but longer sales cycles.

These leads plan 12-18 months ahead for destination weddings and major conferences. They book dozens of rooms plus meeting space.

Respond fast when event inquiries arrive. According to Prostay, peak booking season (June-August) accounts for 35% of annual check-ins.

OTA-Generated Leads

Arrive through Expedia Group, TripAdvisor, or Hotels.com. You pay commission but gain visibility.

OTAs bring reach you can’t match alone. But commissions eat profit. Balance channel mix carefully.

According to SiteMinder, direct bookings saw zero declines across all markets for the first time in 2024, while Asian OTA channels like Trip.com and Agoda climbed in 40% and 35% of markets respectively.

Group Booking Leads

Need multiple rooms for tours, sports teams, or family reunions. Volume offsets the discount typically required.

According to 80 Days, website conversion rates average 0.73% while booking engine conversion rates reach 3.28%. Once groups enter your booking process, conversion jumps significantly.

Set minimum room requirements (10+ rooms) and require deposits. Build packages with catering and meeting space to increase average booking value.

How Hotel Lead Generation Differs from Other Industries

Seasonality drives everything. Beach resorts peak in summer while ski lodges fill in winter.

Demand Fluctuations:

Your lead generation strategies must account for these patterns.

According to Prostay, summer months (June-August) account for 35% of annual check-ins. According to SiteMinder, 85% of markets saw Friday as the most expensive night, with Sunday cheapest in 65% of cases.

Adjust ad spend seasonally. Increase budget 60 days before peak season starts. Scale back during known slow periods.

Booking Window Variance:

Business travelers book days ahead. Destination weddings plan 12-18 months out.

According to SiteMinder, average booking windows extended to 32 days in 2024, with cancellations dropping below 20% for the first time.

Build different nurturing sequences for each segment. Send corporate travelers last-minute offers. Send event planners venue tours and planning guides.

Commission Pressure:

OTAs create constant pressure on profit margins that other industries don’t face.

According to Roomstay, the average hotel conversion rate ranges from 1.5% to 2.5% in 2025. Out of every 100 website visitors, only two make bookings.

According to Hospitality Net, independent hotels see even lower rates between 0.5-1.5%. According to 80 Days, the lowest performing independent hotel converted at just 0.01% while the highest reached 6.41%.

Guest Journey Complexity:

Travelers research across multiple sessions, compare dozens of properties, and often abandon bookings before completion.

According to Prostay, mobile conversion rates average 3.2%, slightly higher than desktop’s 2.8%. According to Prostay, 78% of stays were for only one night in 2024, with just 11% for three nights or more.

Implement retargeting campaigns. Track abandoned bookings and send reminder emails within 24 hours. Offer incentives to complete reservations.

Key Differences:

Unlike B2B lead generation with its committee decisions and months-long cycles, hotel bookings happen fast. Most leisure travelers book within 30 days. Most stays last 1-2 nights.

Unlike B2C e-commerce with instant purchases, hotel bookings require trust. Travelers compare reviews, check photos, and verify amenities before committing.

Your competition includes not just other hotels but also Airbnb, vacation rentals, and staying with friends. Every lead you generate faces dozens of alternatives.

Hotel Lead Generation Channels

Multiple channels feed your sales pipeline. Smart hoteliers diversify rather than depending on a single source.

Direct Website Booking Systems

Image source: masgirbau.com

Your hotel website is the most profitable lead generation channel. Zero commission. Full control over the guest experience.

According to SiteMinder, direct bookings generated $519 per booking in 2024, compared to just $320 through OTAs. Direct website bookings increased 8.5% year over year, the fastest growth among all channels.

Mobile Performance:

According to Prostay, mobile conversion rates average 3.2%, slightly higher than desktop’s 2.8%. According to Google, 53% of mobile users abandon sites that take longer than 3 seconds to load.

Every second delay costs conversions. According to WP Rocket, on mobile, each second delay in page load can drop conversions by up to 20%.

Compress images before uploading. Use lazy loading for photos. Test your site speed monthly using Google PageSpeed Insights.

Booking Engine Integration:

A modern booking engine integrates with your property management system and updates availability in real time.

According to Roomstay, hotel website conversion rates range from 1.5% to 2.5% in 2025. According to 80 Days, booking engine conversion rates reach 3.28%, significantly higher than overall website conversion.

Effective landing page forms capture guest information even when visitors aren’t ready to book immediately.

Conversion Factors:

Key factors include page load speed, mobile responsiveness, and clear pricing display.

According to Hospitality Net, improving conversion rates from under 2% should be a top priority. According to Hotel Benchmark, 60% of travelers browse hotel websites on mobile, but only half complete bookings there.

Professional photography and virtual tours increase booking confidence. Travelers want to see exactly what they’re paying for.

Display room photos showing bed details, bathroom fixtures, and actual room dimensions. Add 360-degree virtual tours that let guests explore before booking.

Online Travel Agencies and Metasearch

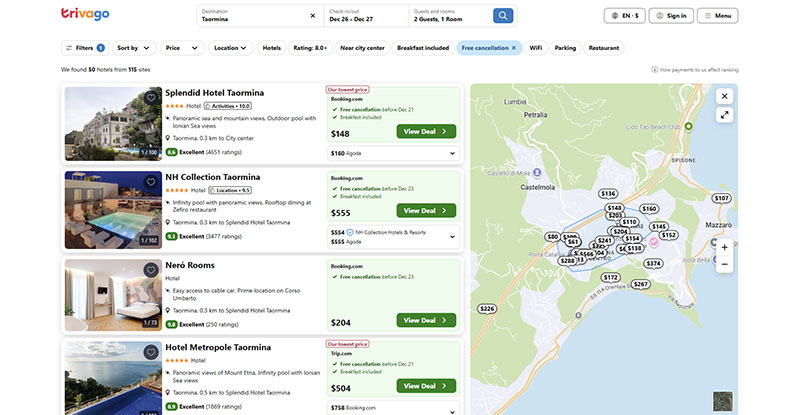

Image source: trivago.com

Booking.com, Expedia, and Agoda dominate accommodation discovery. Ignoring them means losing visibility.

The trade-off is clear. Pay 15-30% commission but access millions of active travelers.

According to SiteMinder, Asian OTA channels like Trip.com climbed in 40% of markets globally during 2024, while Agoda rose in 35%.

Metasearch Performance:

Metasearch platforms like Trivago, Kayak, and Google Hotel Ads aggregate prices across channels.

According to Influencer Marketing Hub, Google Hotel Ads achieve 5-10% CTR, significantly higher than display ads that struggle to crack 1%.

Rate parity policies require showing consistent pricing. Violating these terms risks removal from major OTAs.

Balancing Act:

Balance OTA presence with direct booking incentives. Offer perks like free breakfast or late checkout exclusively on your website.

According to Skift, forecasts suggest direct digital channels will surpass OTAs as the leading hotel distribution method by 2030, potentially generating over $400 billion in hotel gross bookings.

Build packages that can’t be replicated on OTAs. Add late checkout, room upgrades, or spa credits exclusively for direct bookers.

Email Marketing for Hotel Guests

Email delivers the highest ROI of any hospitality digital marketing channel.

According to OptinMonster, email marketing generates $36 for every $1 spent, a 3,600% ROI. According to Influencer Marketing Hub, email is the silent assassin of marketing, quietly outperforming flashier channels.

According to Designmodo, 42% of marketers say email is their most effective channel, far ahead of social media and paid search at 16% each.

Segmentation Strategy:

Segment your database by guest type: business travelers, families, couples, event planners.

According to TheCMO, 73% of B2B buyers prefer email contact, double that of any other method like phone or LinkedIn. According to EmailChef, marketing emails maintain an average 14.1% open rate.

Pre-arrival sequences build anticipation and upsell spa treatments, restaurant reservations, or room upgrades.

Send booking confirmations immediately. Send arrival reminders 48 hours before check-in with upsell offers. Send welcome emails upon arrival with property maps and restaurant menus.

Post-Stay Engagement:

Post-stay follow-up requests reviews and offers return-visit discounts.

Loyalty program integration keeps past guests engaged between trips. Automated birthday and anniversary emails drive emotional connection.

Send review requests within 24 hours of checkout. Send return-visit offers 30 days later with 15% discount codes. Track open rates and adjust send times based on engagement.

Build your list using subscription forms that offer genuine value in exchange for contact information.

Social Media Marketing

Instagram works for visual storytelling. Showcase rooms, amenities, local attractions, and guest experiences.

According to Hoopla Marketing, 61% of people have booked a hotel stay after seeing it featured on their Instagram feed. According to Oysterlink, 32% of consumers have booked accommodations they discovered on TikTok.

Platform Performance:

Facebook excels at retargeting. Pixel-based remarketing reaches people who visited your website but didn’t book.

According to Oysterlink, hospitality ads on Facebook/Instagram average 2-4% CTR. Retargeted hotel ads convert bookings 2-4x better than cold, first-touch ads.

According to Oysterlink, in a 2024 survey, 100% of hoteliers planned to allocate budget to digital media campaigns, with 33% earmarking $50-100K for digital advertising.

Engagement Metrics:

LinkedIn targets corporate travel managers and event planners for B2B lead generation.

According to EHL, the average engagement rate in travel and hospitality is 1.73%. According to Oysterlink, smaller hotel profiles on TikTok see engagement rates above 100%, with video views averaging 89,000 per post.

TripAdvisor combines social proof with direct booking capability. Responding to reviews (positive and negative) builds trust.

Post Instagram Reels showing guest experiences, behind-the-scenes content, and property highlights. Respond to all comments within 4 hours. Track engagement rates weekly.

Influencer Marketing:

Paid social advertising allows geographic and demographic targeting. Reach travelers planning trips to your destination.

According to Oysterlink, 85% of American adults have acted on travel recommendations from influencers. According to Influencer Marketing Hub, influencer content delivers 11x better ROI than traditional banner ads.

According to Oysterlink, 72% of travelers say influencer posts shaped their travel plans when they went on to book trips.

Local SEO and Google Business Profile

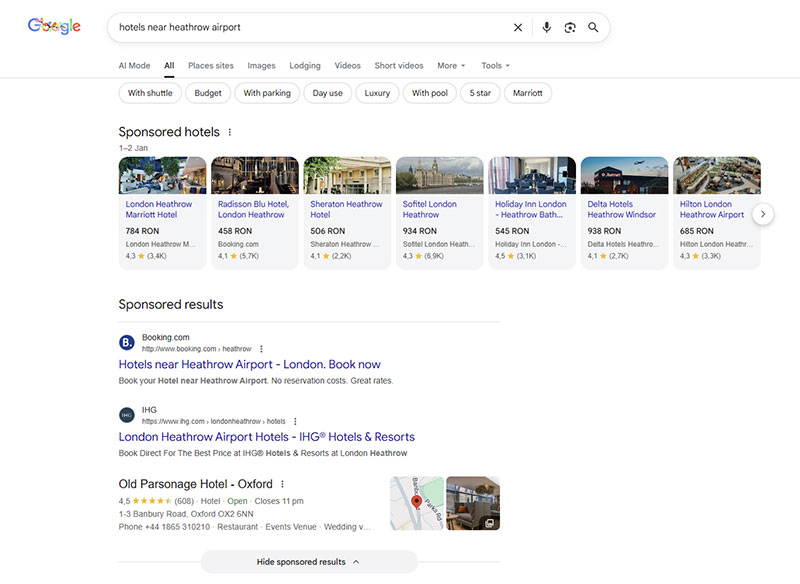

Most hotel searches include location terms. “Hotels near me” and “hotels in [city]” dominate query volume.

Local SEO optimizes your visibility for these searches. It’s how travelers find you on Google Maps.

Profile Management:

Your Google Business Profile displays photos, reviews, pricing, and direct booking links. Keep it updated.

According to Hotelbeds, 95% of web traffic comes from search engines, with only 30% of users clicking past page one. SEO is critical for hotel visibility.

Review management directly impacts local pack rankings. Respond to every review within 24-48 hours.

According to BrightLocal, 84% of consumers trust online reviews as much as personal recommendations. According to DG5 Consultants, according to TripAdvisor’s 2019 study, 90% of consumers read online reviews before booking.

Upload new photos monthly. Update special offers weekly. Respond to reviews within 24 hours with personalized messages addressing specific guest feedback.

Citation Building:

Citations across directories like Yelp, TripAdvisor, and Apple Maps strengthen local authority.

Ensure your NAP (name, address, phone) is identical across all directories. Inconsistent information confuses search engines and lowers rankings.

Content Marketing for Hotels

Blog content targeting “things to do in [city]” and “best restaurants near [landmark]” captures travelers during research phase.

According to Prostay, travelers check approximately 38 websites before booking. Your content positions you as a local expert during this research phase.

Destination guides work as lead magnets when gated behind email capture.

Write neighborhood guides covering restaurants, attractions, and transportation. Create seasonal content about festivals and events. Publish travel tips specific to your location.

Visual Content:

Virtual tours and video walkthroughs reduce booking hesitation. Professional photography is non-negotiable.

According to Oysterlink, hotel Facebook pages post 51% photos and 23% albums, versus only 13% video, even though video drives much higher engagement.

According to Oysterlink, on Instagram, Reels comprise 33% of hotel posts, images 40%, and carousels 27%, with carousel posts slightly outperforming Reels for mid-sized accounts.

Paid Advertising

Google Ads captures high-intent searches like “book hotel [city] tonight” and “hotels near [airport].”

According to WordStream, the average CTR for Google Search ads is 6.42% across industries in 2024. According to WordStream, the overall average cost per lead in Google Ads across all industries is $70.11 in 2025, up 5.13% from 2024.

Performance Benchmarks:

Display network retargeting follows visitors across the web after they leave your site.

According to Store Growers, the average CTR for Google Search ads is 3.17%, while Display ads average 0.46%. According to Store Growers, the average cost per click is $2.69 for search and $0.63 for display.

According to WebFX, the median ROAS for Google Ads is 3.5:1 across industries, meaning $3.50 returned for every $1 spent.

Target high-intent keywords showing booking readiness. Use exact match for “book hotel [city]” type queries. Set bid adjustments +30% for mobile during evening hours when booking intent peaks.

Social Advertising:

Meta Ads Manager enables lookalike audiences based on past guest data. Target travelers similar to your best customers.

According to Oysterlink, 41% of hoteliers believe data-driven digital ad campaigns are effective for reaching new audiences, and 40% have seen improved guest engagement.

Cost per acquisition varies wildly by market. Luxury properties in competitive destinations pay $50+ per booking.

Build custom audiences from your email list. Create lookalike audiences at 1-3% similarity. Test different creative formats, rotating ad images every 7 days to prevent fatigue.

Lead Capture Methods for Hotels

Getting traffic means nothing without capturing contact information. Every visitor is a potential future guest.

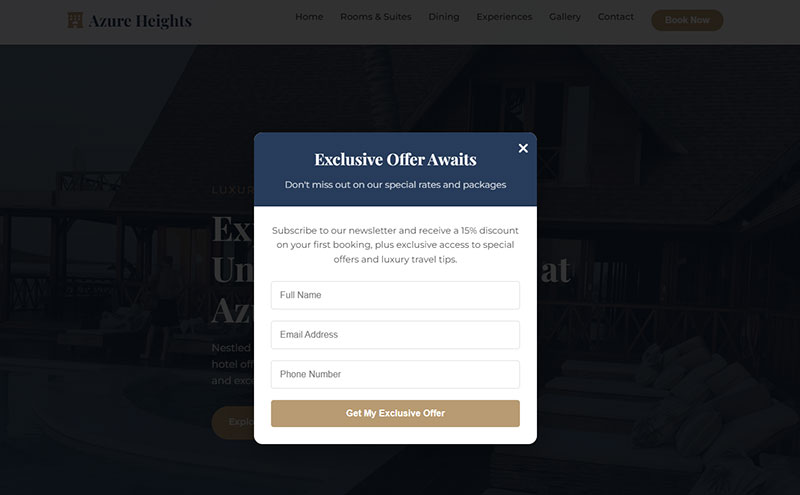

Website Forms and Pop-ups

Strategic website form placement increases capture rates without annoying visitors.

According to OptiMonk, the average popup conversion rate is 11.09% in 2024. The top-performing 10% of popup campaigns averaged 19.77%, five times higher than average.

Exit Intent Performance:

Use exit intent popups to catch abandoning visitors with last-minute offers.

According to Getsitecontrol, exit-intent popups can convert up to 7% of abandoning visitors into email subscribers with discounts, and save 13.5% of potentially lost sales with checkout incentives.

According to Popupsmart, exit-intent technology can help recover 10-15% of departing visitors when the offer matches why they’re leaving.

Display exit popups offering exclusive direct booking discounts (10-15% off). Trigger when cursor moves toward close button. Keep copy brief with clear value proposition.

Form Field Optimization:

Keep fields minimal. Name, email, and travel dates are enough for initial capture.

According to Wisepops, popups with only one signup field have the highest conversion rate of 4.3%, followed by four fields at 3.45%.

According to Wisepops, popups displayed between 11-15 seconds perform well, balancing user experience with conversion opportunity.

Test timing variations. Show popups after 15 seconds on homepage, 30 seconds on room pages. Never show on booking engine pages to avoid interrupting purchase flow.

Lead Magnet Impact:

According to Amra and Elma, adding lead magnets to popup forms raised mobile conversion from 3.8% to 7.7%, and desktop from 1.8% to 4.7%, a 100-155% lift.

According to Getsitecontrol, popups with images convert 4.3% of visitors versus 2.63% without images, a 63.49% increase.

Lead Magnets for Hospitality

Effective types of lead magnets for hotels include:

Content-Based Magnets:

Downloadable city guides and local attraction maps.

According to GetResponse, 47% of marketers in 2024 said video and text lead magnets were their best-performing opt-in types.

Create neighborhood guides with restaurant recommendations, hidden gems, and transportation tips. Include maps with walking distances. Update quarterly with seasonal content.

Discount Incentives:

Exclusive discount codes for direct bookings.

According to Getsitecontrol, popups with lead magnets converted 7.73% of visitors on mobile and 4.7% on desktop, versus 3.83% mobile and 1.84% desktop without lead magnets.

Offer 15% off direct bookings for email subscribers. Set expiration dates (30 days) to create urgency. Track redemption rates monthly.

Event-Specific Resources:

Wedding planning checklists for venue inquiries.

Corporate travel policy templates.

Loyalty program enrollment with instant perks.

According to Amra and Elma, quizzes convert at 20-40% depending on personalization. They’re perfect for segmenting leads before they hit your inbox.

Match the lead magnet to visitor intent. Business travelers want different content than honeymoon planners.

Segment by referral source. LinkedIn traffic gets corporate travel guides. Wedding blogs get venue comparison checklists. Create dedicated landing pages for each segment.

Chatbots and Live Chat

Automated chatbots handle common questions: availability, pricing, amenities, check-in times.

According to Mindful Ecotourism, 40% of travelers globally are already using AI-based tools for trip planning and booking in 2025. According to WebFX, 22% of global consumers have used AI chatbots to plan travel, including hotel bookings.

Availability and Timing:

Qualification questions route serious inquiries to your reservations team.

According to Mindful Ecotourism, 60% of travelers are open to chatbots or AI assistants in booking or travel management, and 83% are more likely to book when AI-enhanced services are offered.

According to Mindful Ecotourism, the AI in tourism market was valued at $3.37 billion in 2024 and is projected to hit $13.87 billion by 2030, with a 26.7% annual growth rate.

24/7 availability matters. International travelers browse outside your business hours.

Program chatbots to ask: “When are you planning to visit?” “How many guests?” “Which room type interests you?” Route qualified leads (specific dates + budget match) to human agents during business hours.

Conversion Impact:

According to Hospitality Net, hotels with AI chatbots see a 25% increase in direct bookings.

According to Mindful Ecotourism, travel agencies report chatbots handle up to 80% of customer inquiries, and many report improved booking conversion after AI adoption.

Set chatbot goals: 30% inquiry resolution rate, 15% lead capture rate, 5% direct booking rate. Review conversation logs weekly to identify common questions and update responses.

Front Desk Lead Collection

Train staff to ask about future travel plans during check-in and checkout.

According to Revinate’s 2025 Hospitality Benchmark Report, the platform analyzed 383 million guest records and 5.9 million calls from hoteliers in North America, APAC, and EMEA during 2024.

Corporate Account Identification:

Guests booking multiple rooms or extended stays often represent corporate accounts worth pursuing.

According to Prostay, business travelers spend $180 per night average versus $145 for leisure travelers. Corporate leads book repeatedly at negotiated rates.

Train front desk to identify corporate indicators: expense account payments, multiple room bookings, frequent Monday-Thursday stays. Ask: “Does your company travel to our area regularly?”

CRM Data Entry:

CRM data entry must happen immediately. Details forgotten are opportunities lost.

According to Cloudbeds, CRM integrations save time and reduce errors by eliminating manual data entry, allowing staff to focus on essential tasks.

According to Shiji Group, without a proper CRM system, hotels risk losing valuable data and loyalty. According to Hotel Tech Report, the cost of guest acquisition is constantly rising, making repeat bookings critical.

Build guest profiles during check-in. Record: room preferences (bed type, floor level), amenities used (spa, restaurant, gym), special requests, celebration dates (birthdays, anniversaries).

Staff Training Requirements:

According to OSSisto, comprehensive training ensures all team members understand how to access guest data, automate communication, and leverage CRM tools.

According to Little Hotelier, if CRM isn’t user-friendly, front desk and sales teams won’t use it, leading to lost productivity and messy guest records.

Hold monthly training sessions covering: CRM data entry, lead qualification criteria, corporate account indicators, upsell opportunities. Role-play common scenarios.

Implementation Checklist:

Create standard questions for check-in: “First time visiting our area?” “What brings you to town?” “Planning to return?”

Set up CRM fields for: travel purpose (business/leisure/event), company name, decision-maker status, repeat visit likelihood.

Track conversion metrics: leads captured per month, corporate accounts identified, repeat bookings from front desk leads.

Review CRM data weekly with sales team. Flag high-value leads for follow-up within 48 hours of checkout.

Lead Qualification in the Hotel Industry

Not every inquiry deserves equal attention. Qualification separates tire-kickers from serious prospects.

Guest Intent Signals

Booking window timing reveals urgency. Same-week searches convert faster than six-month-out browsing.

According to Boutique Hotelier, most leisure bookings now arrive within 7-10 days, with a large portion inside 72 hours. According to Prostay, business travelers typically book with shorter lead times, while leisure bookings peak around weekends and holidays.

Timing Analysis:

According to SiteMinder, average booking windows extended to 32 days in 2024. However, according to Boutique Hotelier, 70% of spa revenue has moved online with short booking windows when weather forecasts are favorable.

Score leads by booking window: 0-7 days (10 points, high urgency), 8-30 days (7 points, moderate urgency), 31-90 days (5 points, planning phase), 90+ days (3 points, early research).

Budget Indicators:

Room type interest indicates budget. Suite inquiries signal higher spending potential.

According to Business Dojo, luxury and wellness segments spend 40-60% more than standard rates on enhanced services and amenities.

According to Prostay, business travelers spend $180 per night average versus $145 for leisure travelers. According to Prostay, weekends bring 15-20% higher rates than weekdays in most markets.

Track suite vs. standard room inquiries. Suite requests get +5 points. Requests for multiple rooms get +3 points per additional room. Accessibility needs indicate serious consideration rather than casual browsing.

Commitment Signals:

Special requests (anniversary packages, accessibility needs) show commitment to booking.

According to Prostay, business travelers usually stay 2.3 days, while leisure visitors average 4.7 days. Longer stay inquiries (3+ nights) indicate higher booking value.

Score special requests: celebration packages (+8 points), accessibility needs (+7 points), specific dietary requirements (+6 points), ground transportation inquiries (+5 points).

Corporate vs. Leisure Lead Scoring

B2B leads from corporate travel managers require different scoring criteria than vacation planners.

According to HFTP, group room nights are projected to scale new heights in 2024. According to Hospitality Net, global business travel is on track to recover with a 14% uptick over the previous year.

Group Booking Value:

Group booking indicators: multiple room requests, meeting space inquiries, catering questions.

According to Prostay, meetings and event bookings were up 28% in 2024. According to HFTP, 80% of companies cite that face-to-face meetings are essential for building strong relationships.

According to HFTP, the average daily rate for group hotel bookings rose from $297 in 2022 to $321 in 2024.

Build group scoring model: 5-10 rooms (+15 points), 10-25 rooms (+25 points), 25+ rooms (+40 points). Add meeting space needs (+10 points), catering requirements (+8 points), AV equipment needs (+5 points).

Repeat Business Potential:

Corporate leads take longer to close but deliver repeat business worth 10-50x initial booking value.

According to Business Dojo, corporate clients and frequent business travelers exhibit the highest repeat booking rates, often exceeding 60-70% annually due to negotiated rates and consistent travel patterns.

According to Business Dojo, loyalty program members show 40-50% repeat booking rates versus 15-20% for non-members.

Corporate Lead Qualification:

According to HFTP, short-term booking windows have become the new norm for group bookings, with the segment not returning to long lead times.

Score corporate indicators: company email domain (+10 points), expense account mention (+8 points), corporate rate inquiry (+12 points), travel manager title (+15 points).

Ask qualification questions: “Does your company require regular accommodations in our area?” “What’s your typical monthly room night volume?” “Do you have a preferred hotel program?”

B2B Sales Investment:

According to Business Dojo, corporate and group bookings require significant upfront sales efforts and relationship building but deliver high-value long-term contracts.

According to Business Dojo, a single conference group can generate revenue equivalent to 3-5 individual bookings when including all services (rooms, food, beverages, meeting facilities).

Calculate lifetime value: Corporate account booking 20 room nights monthly at $180 per night = $3,600 monthly = $43,200 annually = $216,000 over five years.

Lead Nurturing for Hotels

Guest acquisition doesn’t end at capture. Nurturing moves prospects toward confirmed reservations.

Email Sequences for Unconverted Leads

Booking abandonment emails recover 10-15% of lost reservations when sent within 24 hours.

According to Revinate, most properties lose 98% of website visitors to booking abandonment, but recovery campaigns convert at 10% versus 1% for standard emails. According to Hotel Online, the cart abandonment rate for hotels is 80%, with some analyses showing 84% of online hotel bookings are abandoned.

Abandonment Recovery Performance:

According to CartStack, booking abandonment emails can recover anywhere between 10-20% of lost bookings. According to Revinate, cart abandonment campaigns achieve 66% open rates and 10% conversion rates.

Send first abandonment email within 1 hour of cart abandonment. Send second reminder at 24 hours with urgency messaging. Send third email at 72 hours with incentive (complimentary upgrade, late checkout).

Revenue Impact:

According to Revinate, Ambiente Sedona drove close to $264,000 in direct bookings from their cart abandonment drip campaign alone. According to Revinate, French Lick Resort booked 1,690 room nights in 2024 using outbound calling alongside email automation.

According to Hotel Tech Report, one multi-property hotel chain expects $4.4 million in recovered revenue in its first year using booking recovery platforms.

Track abandonment by stage: homepage exit (98% loss), booking engine entry (80% loss), checkout page (final opportunity). Calculate recovery value: 1,000 monthly abandoners x 10% recovery x $250 ADR x 2 nights = $50,000 monthly recovered revenue.

Seasonal Promotions:

Seasonal promotions re-engage cold leads. “Planning your summer getaway?” hits inboxes in March.

According to Prostay, summer months (June-August) account for 35% of annual check-ins. According to SiteMinder, peak season has stretched into September, with spring bookings picking up.

Build seasonal email cadence: Send winter escape offers in November, spring break promotions in January, summer vacation campaigns in March, fall foliage packages in July.

Event-Based Triggers:

Event-based triggers (local festivals, conferences) create timely reasons to book.

According to HFTP, 80% of companies cite face-to-face meetings as essential for building relationships. According to Prostay, meetings and event bookings were up 28% in 2024.

Monitor local event calendars 90 days ahead. Send targeted campaigns to past guests: “Concert season returns to [city]” or “Tech conference coming June 15-17, book now.”

Retargeting Strategies

Pixel-based remarketing through Google Analytics and Meta shows ads to past website visitors.

According to Oysterlink, hospitality ads on Facebook/Instagram average 2-4% CTR. Retargeted hotel ads convert bookings 2-4x better than cold, first-touch ads.

Performance Metrics:

Dynamic room ads display the exact room types visitors viewed. Personalization increases click-through rates.

According to CartStack, 59% of customers say tailored engagement based on previous interactions is “very important” to winning their business. According to Hotel Online, Ovolo Hotels achieved a 52x ROI within two months using cart abandonment triggers highlighting free cancellation.

Install retargeting pixels on all pages. Create audiences: homepage visitors (7-day window), room page viewers (14-day window), booking engine abandoners (30-day window, highest priority).

Audience Building:

Lookalike audiences built from guest databases find new prospects matching your ideal customer profile.

According to Business Dojo, corporate clients and frequent business travelers exhibit repeat booking rates exceeding 60-70% annually. According to Business Dojo, loyalty program members show 40-50% repeat booking rates versus 15-20% for non-members.

Upload customer list to Meta Ads Manager. Build 1-3% lookalike audiences from top 25% of guests by lifetime value. Test separate audiences for business travelers vs. leisure guests.

Campaign Structure:

Create ad sets by funnel stage: awareness (brand messaging), consideration (room features + pricing), decision (limited-time offers + urgency).

Set frequency caps at 3 impressions per week to avoid ad fatigue. Rotate creative every 14 days. Test video tours vs. static room images.

Loyalty Programs as Lead Nurturing Tools

Tier structures (Silver, Gold, Platinum) encourage repeat bookings to unlock better perks.

According to Oysterlink, hotel loyalty memberships hit 675 million in 2024, up 14.5%, outpacing 6.7% room growth. According to CBRE, there are now 137 loyalty members per available room, a 7.4% increase.

Occupancy Impact:

According to International Investment, loyalty members accounted for 52.8% of occupied rooms in 2024, a two-percentage-point increase year-over-year. According to CBRE, loyalty programs delivered 12% more room nights year-over-year.

According to Business Dasher, loyalty members booked 62% of Marriott and Hilton room nights. According to P3 Hotel Software, large hotel chains generate up to 60% of their total revenue through loyalty programs.

Member Value:

Point systems create switching costs. Guests accumulating points rarely try competitors.

According to Business Dasher, loyal customers spend 22.4% more than sporadic customers and stay 28% longer. According to Points Crowd, 30-60% of hotel revenue comes from loyalty members.

According to Oysterlink, average liability per member fell 5.3% from $18.85 to $17.85 in 2024, reflecting members redeeming points as fast as they earn them.

Tier benefits by level: Silver (5% points bonus, free WiFi), Gold (10% bonus, room upgrades, late checkout), Platinum (20% bonus, suite upgrades, lounge access, guaranteed availability).

Direct Booking Incentives:

Member-exclusive rates give direct booking incentives over OTA pricing.

According to SiteMinder, direct bookings generated $519 per booking in 2024 versus $320 through OTAs. According to Business Dojo, loyalty program investments generate strong ROI through increased repeat bookings, higher spending per stay, and reduced reliance on expensive external channels.

According to Points Crowd, 60% of travelers consistently book with one brand or credit card to maximize benefits, with 67% of Millennials prioritizing loyalty programs.

Offer members: 10% off BAR (best available rate), complimentary breakfast (saves $25-30 per night), points multipliers (2x points on direct bookings), early booking discounts (additional 5% for 30+ day advance bookings).

Program Growth Strategy:

According to Points Crowd, Hilton Honors grew membership by 147% since 2018, reaching 210 million members. According to Business Dasher, Marriott Bonvoy leads with 228 million members.

According to Business Dasher, 44% of consumers say loyalty programs influence their hotel selection. According to CBRE, loyalty program fees grew 4.4% in 2024, outpacing total revenue growth of 2.7%.

Promote at check-in: “Join now and earn 1,000 bonus points.” Send enrollment emails to non-member bookers within 24 hours of checkout. Offer double points for first stay after joining.

Engagement Tactics:

According to CBRE, average room nights per member declined 4% to 1.0 from 1.1, suggesting members are less active. The challenge is converting “retail travelers” into repeat guests.

Send monthly points balance emails with redemption suggestions. Alert members when near free night threshold: “Just 2,000 more points for a free stay!” Offer status challenges: “Stay 5 nights in 90 days, earn Gold status.”

Track key metrics: enrollment rate (target 30% of guests), active member rate (booked within 12 months, target 60%), repeat booking rate (target 70% for Gold/Platinum), points redemption rate (target 80% redeemed within 18 months).

Measuring Hotel Lead Generation Performance

Data drives improvement. Track these metrics to optimize your hospitality marketing funnel.

Key Metrics

Cost Per Lead

Total marketing spend divided by leads captured.

According to WordStream, the overall average cost per lead in Google Ads is $70.11 in 2025. According to HubSpot, email marketing delivers the lowest CPL at $53, followed by webinars at $72.

CPL by channel: Email $53, webinars $72, paid search $70, social ads $85.

Calculate monthly: $10,000 marketing spend / 200 leads = $50 CPL. Track each channel separately. Set targets based on customer lifetime value.

Lead-to-Booking Conversion Rate

Percentage of leads becoming confirmed reservations.

According to Roomstay, conversion rates vary dramatically by source. Google Hotel Ads convert at 4.17% while blog traffic converts at just 0.2%.

High-intent sources: Google Hotel Ads 4.17%, Facebook Display 3.21%, TripAdvisor metasearch 2.34%, organic search 1.55%, blog traffic 0.2%.

According to Revinate, booking abandonment recovery campaigns convert at 10% versus 1% for standard emails.

Track your funnel: Website visitors to leads (2-3%), leads to booking engine (30%), booking engine to completion (20%).

Customer Acquisition Cost

Full cost to acquire one paying guest.

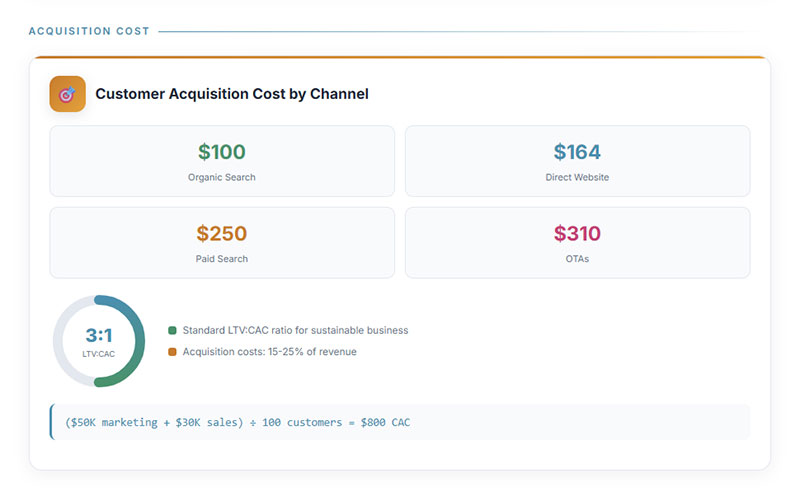

According to Flyweel, the standard LTV:CAC ratio is 3:1 or greater for sustainable business models. According to Hotel Tech Report, acquisition costs average 15-25% of revenue per customer.

CAC calculation: ($50,000 marketing + $30,000 sales) / 100 customers = $800 CAC

Compare by channel: Organic search $100, direct website $164, paid search $250, OTAs $310.

Average Booking Value

Revenue per reservation including upsells.

According to SiteMinder, direct bookings generated $519 per booking in 2024, well above OTAs at $320. According to Prostay, business travelers spend $180 per night versus $145 for leisure travelers.

Example calculation: Base room ($200 x 2 nights = $400) + breakfast upgrade ($30 x 2 = $60) + spa service ($150) = $610 total booking value.

According to Business Dojo, luxury segments spend 40-60% more than standard rates. Track upsell conversion rates separately to identify opportunities.

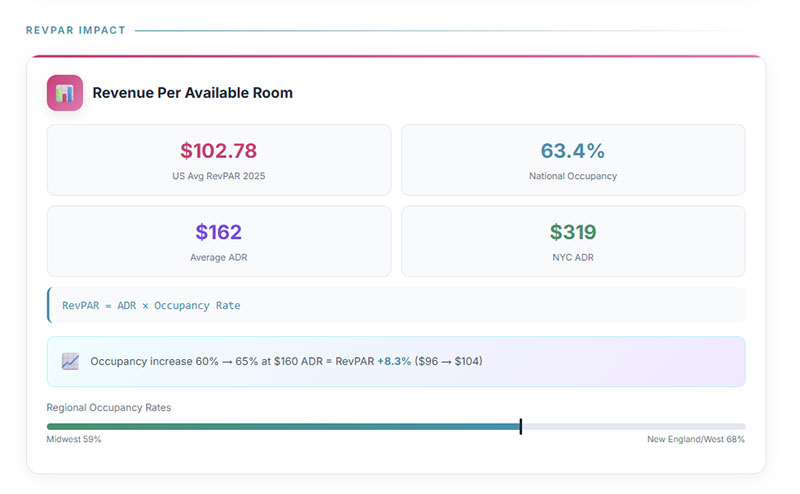

RevPAR Impact

How lead generation affects Revenue Per Available Room.

According to TakeUp AI, the average U.S. hotel RevPAR in 2025 is $102.78, with nationwide occupancy at 63.4% and ADR at $162.

RevPAR formula: ADR x Occupancy Rate OR Total Room Revenue / Available Rooms

Example: Lead generation increases occupancy from 60% to 65% while maintaining $160 ADR. RevPAR rises from $96 to $104 (+8.3%).

According to Asian Hospitality, luxury hotels achieved RevPAR between $210-$450 in 2024. According to Hotelogix, New York reached ADR of approximately $319 with nearly 6% growth.

Regional Benchmarks

According to TakeUp AI, regional occupancy varies from 59% in Midwest to 68% in New England and West.

According to STR, Top 25 Markets consistently outperform the rest of the country in occupancy, ADR, and RevPAR growth. According to Asian Hospitality, NYC led with 84.3% occupancy in 2024.

Benchmark against industry standards from STR and Phocuswright research. Compare your property to competitive set monthly.

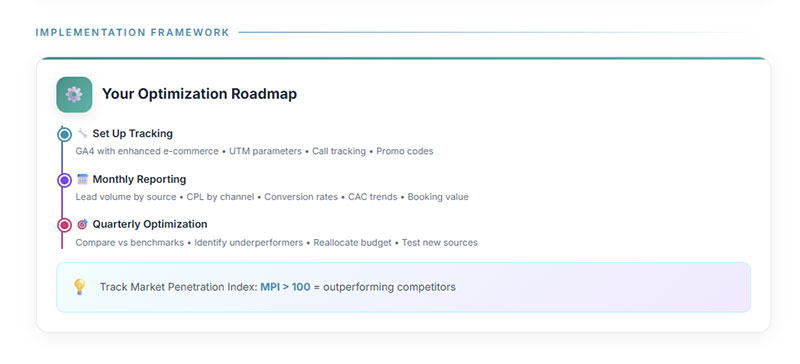

Track Market Penetration Index: MPI above 100 = outperforming competitors.

Attribution Challenges

Multi-touch booking journeys make attribution tricky. Guests see ads, read reviews, visit OTAs, then book direct.

According to Prostay, travelers check approximately 38 websites before booking. According to Navan, travelers consume 303 minutes of travel content in the 45 days prior to booking.

OTA vs. Direct Attribution

Did the OTA listing drive brand awareness that led to direct booking? This requires careful tracking.

According to SiteMinder, direct bookings saw zero declines across all markets for the first time in 2024. According to Skift, direct digital channels are forecast to surpass OTAs by 2030, potentially generating over $400 billion in hotel gross bookings.

Track the guest journey: Install UTM parameters on all marketing URLs. Use attribution tools to identify first-touch vs. last-touch channels. Survey guests asking “How did you first hear about us?”

Brand vs. Non-Brand Search

Shows whether you’re capturing new demand or just your existing audience.

According to Prostay, 95% of web traffic comes from search engines, with only 30% of users clicking past page one.

Set up separate campaigns: Brand keywords track awareness conversion (your hotel name, variations). Non-brand keywords capture new demand (city + hotel type). Monitor brand search volume as awareness indicator.

Attribution Models

First-touch attribution credits the first interaction (awareness building).

Last-touch attribution credits the final interaction (conversion).

Multi-touch attribution distributes credit across journey touchpoints.

Time-decay attribution gives more credit to interactions closer to conversion.

According to Revinate, 98% of website visitors abandon without booking, but recovery campaigns using multi-channel messaging convert at 10%.

Track the full path: paid social (awareness) → organic search (consideration) → email (decision) → direct booking (conversion).

Implementation Framework

Set up tracking: Google Analytics 4 with enhanced e-commerce tracking, UTM parameters on all campaigns, call tracking numbers by channel, promo codes for offline attribution.

Monthly reporting: Lead volume by source, cost per lead by channel, conversion rates by segment, CAC trends, booking value analysis, RevPAR impact.

Quarterly optimization: Compare actual vs. benchmarks, identify underperforming channels, reallocate budget to highest ROI sources, test new lead sources, refine attribution model.

Common Lead Generation Mistakes Hotels Make

Avoiding these errors saves budget and accelerates results.

Over-reliance on OTAs. Commission fees eat margins. Diversify toward direct channels.

Poor website UX. Slow load times, confusing navigation, and broken booking engines kill conversions.

Ignoring mobile. Over 60% of travel searches happen on smartphones. Mobile optimization is mandatory.

Neglecting reviews. Unanswered negative reviews damage trust. Respond to everything on TripAdvisor and Google.

Weak follow-up. Leads go cold fast. Contact inquiries within hours, not days.

No segmentation. Sending identical emails to business travelers and families wastes everyone’s time.

Tools and Software for Hotel Lead Generation

The right tech stack automates repetitive tasks and improves conversion rates.

CRM systems: Salesforce for Hospitality, HubSpot CRM, and hotel-specific platforms like Event Temple track guest interactions.

Property management integration: Cloudbeds, Mews Systems, and Oracle Hospitality connect booking data with marketing systems.

Email platforms: Mailchimp handles campaigns and automation for properties of all sizes.

Channel managers: SiteMinder syncs inventory and rates across OTAs, preventing overbooking.

Analytics: Google Analytics 4 tracks website behavior and conversion paths.

Distribution: Amadeus IT Group and Sabre Corporation connect hotels to global distribution systems for corporate bookings.

If your hotel runs on WordPress, WordPress lead generation plugins add contact forms and capture functionality without custom development.

Consider form design carefully. Clean, simple forms convert better than cluttered alternatives.

Implement proper form security to protect guest data and maintain trust.

FAQ on Lead Generation For Hotels

What is a lead in the hotel industry?

A hotel lead is any potential guest who shows interest before booking. This includes website visitors who submit inquiries, email subscribers, corporate travel managers requesting rates, and event planners asking about venue availability.

How do hotels generate leads online?

Hotels capture leads through website booking engines, website forms for lead generation, email marketing, social media advertising, and Google Hotel Ads. OTAs like Expedia and Booking.com also drive leads, though with commission costs attached.

What is the average cost per lead for hotels?

Hotel cost per lead ranges from $5-50 depending on market, property type, and channel. Luxury properties in competitive destinations pay more. Direct website leads cost less than paid advertising or OTA-generated inquiries.

How can hotels reduce dependence on OTAs?

Invest in direct booking channels: optimize your website for local SEO, build an email list, offer exclusive perks for direct reservations, and use retargeting ads. Rate parity rules limit pricing differences, so compete on value instead.

What lead magnets work best for hotels?

Downloadable city guides, exclusive discount codes, wedding planning checklists, and loyalty program sign-ups perform well. Match offers to visitor intent. Business travelers want different lead magnet ideas than vacation planners.

How do hotels qualify leads effectively?

Score leads based on booking window, room type interest, group size, and special requests. Corporate leads requesting multiple rooms or meeting space signal high value. Use your CRM to track interactions and prioritize follow-up.

What is a good lead-to-booking conversion rate for hotels?

Industry benchmarks suggest 2-5% for website visitors and 10-20% for qualified leads in your hotel sales pipeline. Rates vary by property type, season, and lead source. Direct inquiries convert higher than cold traffic.

How important is mobile optimization for hotel lead generation?

Critical. Over 60% of travel searches happen on smartphones. Slow-loading pages and clunky mobile forms kill conversions. Google prioritizes mobile-friendly sites in search rankings, affecting your visibility on destination queries.

Should hotels use chatbots for lead capture?

Yes, for handling common questions and qualifying inquiries 24/7. Chatbots answer availability and pricing questions instantly. They route serious prospects to your reservations team. International travelers browsing outside business hours benefit most.

How do hotels nurture leads that don’t book immediately?

Email sequences recover abandoned bookings and re-engage cold leads with seasonal promotions. Retargeting ads through Google Analytics and Meta keep your property visible. Loyalty programs maintain relationships between stays for repeat bookings.

Conclusion

Lead generation for hotels determines whether your rooms stay full or sit empty. The strategies here give you a framework to reduce OTA dependency and build direct guest relationships.

Start with your hotel website. Optimize for local SEO, add strategic lead capture forms, and implement booking abandonment recovery sequences.

Track your cost per lead and conversion rates through Google Analytics. Measure what works. Cut what doesn’t.

Corporate accounts and group bookings deserve dedicated nurturing. These high-value leads drive RevPAR more than one-night leisure stays.

Tools like HubSpot CRM, Cloudbeds, and SiteMinder automate the repetitive work. Your team focuses on closing deals instead of manual data entry.

Consistent guest acquisition separates thriving properties from those bleeding commission fees to Trivago and Kayak.