Half of your donors won’t give again next year. That’s not a guess. The Fundraising Effectiveness Project tracks this, and the numbers haven’t improved much. Lead generation for nonprofits is…

Table of Contents

Most plumbing companies rely on word of mouth and hope. That’s not a strategy for lead generation for plumbers, that’s a gamble.

The plumbing businesses pulling 40+ new service calls per month do things differently. They run Google Local Service Ads, track cost per lead by channel, and respond to inquiries within five minutes. They treat their plumbing customer acquisition like a system, not an afterthought.

This guide breaks down exactly how plumbing companies generate, qualify, and convert leads across every major channel. You’ll find real cost-per-lead benchmarks, the tools that actually move the needle (ServiceTitan, CallRail, Housecall Pro), and the mistakes that quietly drain your ad budget.

Whether you’re a one-truck operation or managing multiple crews, the methods here work at any scale.

What is Lead Generation for Plumbers

Lead generation for plumbers is the process of attracting homeowners, property managers, and commercial clients who need plumbing services, then converting that interest into booked service calls. It covers every channel a plumbing business uses to get the phone ringing, from Google Local Service Ads to referral programs and online booking systems.

Plumbing companies that treat lead generation as a system (not a one-off tactic) consistently fill their dispatch boards. The ones that don’t? They ride a cycle of feast and famine that makes cash flow unpredictable.

A single residential plumbing lead can be worth anywhere from $150 to $3,000+ depending on the job. Emergency plumber calls for burst pipes or sewer line repairs sit at the top of that range. Routine drain cleaning leads and faucet replacements fall toward the bottom.

The real difference between plumbing companies that grow and those that stay flat comes down to how they acquire, track, and convert incoming leads across multiple sources simultaneously.

How Does Lead Generation Work for Plumbing Companies

A plumbing company generates leads through paid advertising, organic local search, third-party platforms like Thumbtack and Angi, direct referrals, and its own website forms. Each source produces leads at different costs and quality levels.

The typical flow: a homeowner searches “plumber near me” or “emergency leak repair,” finds a business through Google Maps Pack or a Local Service Ad, and either calls directly or fills out an online estimate request form. According to Semrush, there are roughly 246,000 monthly U.S. searches for “plumbers near me” alone.

What happens after that first contact determines everything.

Speed to lead (how fast your team responds) is the single biggest factor in whether a plumbing lead converts or goes to your competitor down the street. Research from InsideSales.com found that the likelihood of reaching a lead within 5 minutes is 10 times higher than waiting just 10 minutes. And data from Vendasta shows a 391% increase in conversions when leads are contacted within the same minute they submit a request.

Yet a 2024 RevenueHero study of over 1,000 companies found that 63% of businesses didn’t respond to inbound leads at all. The average response time was 29 hours.

Speed-to-Lead Benchmarks for Plumbing Companies

| Response Time | Impact on Conversion |

|---|---|

| Under 1 minute | 391% higher conversion rate |

| Under 5 minutes | 10x more likely to reach the lead |

| 5 to 30 minutes | Up to 100x drop in qualification odds |

| 30+ minutes | Lead likely called your competitor already |

Action step: Set up auto-text or auto-call responses for all form submissions. For emergency calls, answer within three rings or use an AI answering service to capture the lead 24/7.

What Types of Leads Do Plumbers Receive

Residential plumbing leads make up the bulk for most companies: toilet repairs, water heater installations, kitchen remodels, leak detection service calls.

Commercial plumbing leads come from restaurants, office buildings, apartment complexes, and retail spaces. Fewer in volume but higher value, often turning into recurring maintenance contracts. Data from LeadHelpline shows commercial and repiping projects range from $2,000 to $10,000 per job.

Emergency plumbing calls (burst pipes, sewer backups, gas leaks) convert at the highest rate because urgency removes comparison shopping. LeadHelpline’s 2025 data shows emergency plumbing leads convert at 40 to 50%, compared to roughly 10% for shared web form leads. These leads cost more to acquire but close faster.

According to Estatehub’s 2026 benchmarks report, plumbing leads convert higher than any other home service category at 12 to 16%, largely driven by that urgency factor.

Lead Type Comparison

| Lead Type | Avg Job Value | Conversion Rate | Best For |

|---|---|---|---|

| Emergency repairs | $200 – $1,500 | 40 – 50% | Cash flow, fast closes |

| Water heater installs | $800 – $3,500 | 25 – 35% | High margins |

| Drain cleaning | $150 – $500 | 30 – 40% | Volume, upsell opportunities |

| Repiping/commercial | $2,000 – $10,000+ | 15 – 25% | Long-term revenue |

Pro tip: 30% of drain cleaning calls reveal bigger issues like repiping needs, according to LeadHelpline. Make camera inspections standard on every drain job to uncover $3,000 to $10,000 opportunities.

What is the Difference Between Exclusive and Shared Plumbing Leads

Exclusive plumbing leads go to one company only. Shared leads get sold to three, four, sometimes five plumbing businesses in the same service area.

Platforms like HomeAdvisor and Angi historically built their models on shared leads. Google Local Service Ads operate closer to exclusive, since the homeowner picks one provider to call.

The cost difference is significant, but the math tells the real story.

According to LeadHelpline’s 2025 benchmark data:

- Shared web form leads cost $15 to $50 each but convert at roughly 10%, putting your actual cost per won job around $150 to $500

- Exclusive live-transfer calls cost $35 to $150 each but convert at 30 to 50%, bringing cost per won job down to roughly $175 to $300

Service Direct’s data shows the national average CPL for plumbing sits around $92, with competitive states like Texas pushing to $121 or higher.

LocaliQ’s 2025 Home Services Search Ad Benchmarks report found that cost per lead increased for 69% of home services businesses year over year, with an average increase of 10.51%.

Quick ROI Comparison

| Lead Type | Cost Per Lead | Close Rate | Cost Per Won Job |

|---|---|---|---|

| Shared web form | $15 – $50 | ~10% | $150 – $500 |

| Exclusive web form | $50 – $80 | 25 – 35% | $150 – $300 |

| Exclusive live transfer | $35 – $150 | 30 – 50% | $175 – $300 |

| Google LSAs | $25 – $45 | Higher intent | Varies by market |

| Google Search Ads | $70 – $75/lead | 7.33% avg | $500 – $1,000+ |

Action step: Track your actual cost per won job, not just cost per lead. A $75 exclusive lead that closes at 35% costs less per job than a $25 shared lead that closes at 10%. Run a 90-day test splitting budget between shared and exclusive sources, then compare your real numbers.

What Are the Best Lead Generation Methods for Plumbers

No single channel wins. The plumbing companies pulling 40-60 new leads per month typically run three to five sources in parallel, tracking cost per lead and conversion rate for each one.

Aged Lead Store’s 2025 industry benchmarks recommend allocating 5 to 15% of projected revenue to lead generation, adjusting for service type and market competition.

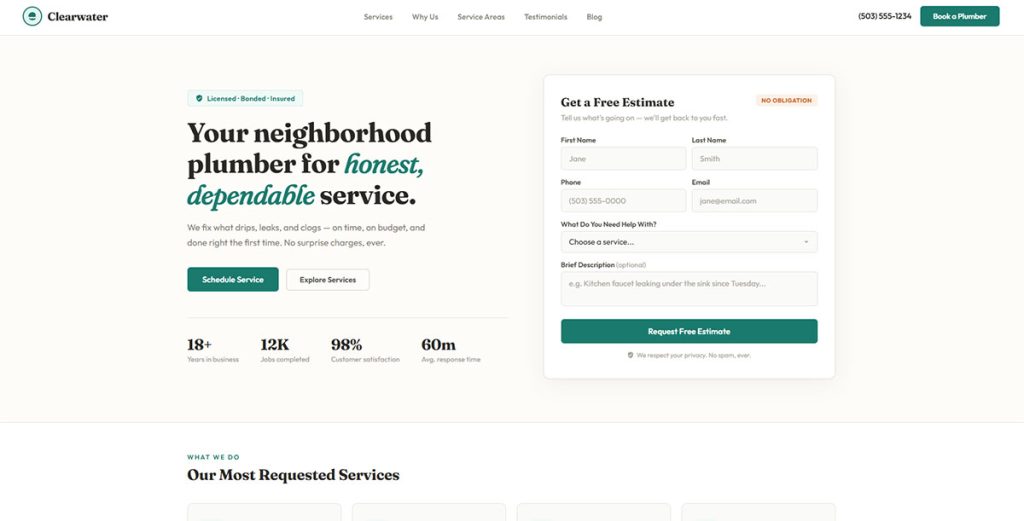

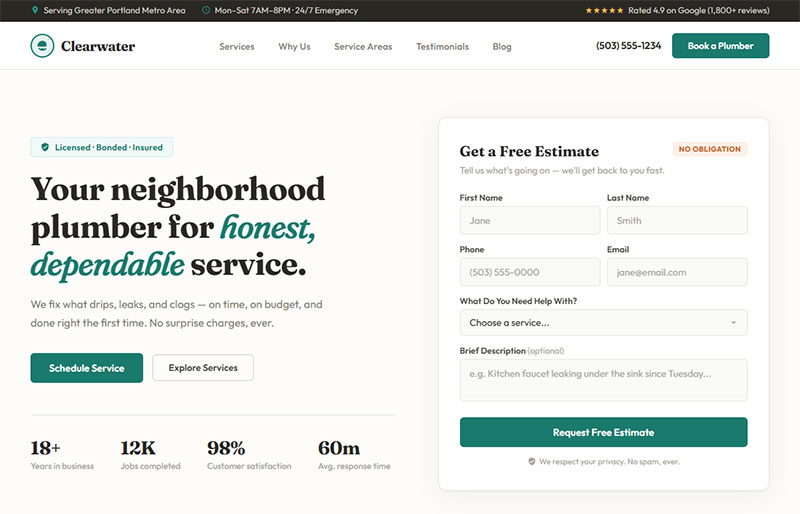

Does a Plumbing Website Generate Leads Without Paid Ads

Yes, and this is where most plumbers leave money on the table. A plumbing website with dedicated service area pages, clear click-to-call buttons, and a fast contact form generates organic leads consistently once local search rankings are established.

The average plumbing website converts at 2 to 5%, according to Plumbing Webmasters’ CRO data. That means for every 100 visitors, only 2 to 5 take action.

But here’s the gap most plumbers miss. Plumbing Webmasters also found that Google Maps clicks to your website convert at rates up to 80%, while PPC traffic converts up to 21x lower than organic visitors. Organic SEO traffic is the highest-converting source you can get.

A few things that move the needle fast:

- Embedding video on service pages can increase conversions by 86%, according to Plumbing Webmasters

- Contact forms with three fields or fewer get completed more often (adding fields weeds out bad leads but also loses good ones)

- Sites that load in under 1 second get the highest conversion rates. A Hotjar 2024 survey found that 70% of visitors leave slow-loading websites

Your Google Business Profile is the front door. Keep it updated with photos of completed jobs, respond to every review, and post weekly updates. Google’s own data shows customers are 2.7x more likely to consider a business reputable when they find a complete Business Profile. Plumber review management alone can shift your Maps Pack ranking.

The contact us page matters more than most plumbers realize. A cluttered or slow-loading page kills conversions. Keep it tight: phone number, short form, service area map, and business hours. That’s it.

How Does Local Search Ranking Affect Plumbing Lead Volume

The Google Maps Pack (those three local listings that appear above organic results) captures roughly 42 to 44% of clicks for local service searches, according to a Backlinko study. Businesses that land in the 3-Pack receive 126% more traffic and 93% more actions (calls, website clicks, directions) than businesses ranked in positions 4 through 10, based on SOCi’s analysis of 12.9 billion data points.

If your plumbing company isn’t in that pack for your core service terms, you’re losing leads to competitors who are.

Three things control Maps Pack placement:

- Proximity to the searcher

- NAP consistency (name, address, phone number across every listing)

- Review signals. A plumber with 200+ Google reviews and a 4.7+ star rating will outrank one with 30 reviews almost every time, assuming similar proximity. SOCi’s data also shows that each 1-star rating increase improves conversions by 44%

Local Service Ads by Google sit above the Maps Pack. They operate on a pay-per-lead model rather than pay-per-click, and they carry a “Google Guaranteed” badge. Home Service Direct’s data shows the Google Guaranteed badge increases trust and click-through rates by 210%.

For plumbing companies, these ads generate some of the highest-intent leads available. The Media Captain’s aggregated data across 100+ clients shows plumbing LSA leads averaging around $69 per lead, with over 90% of those leads coming through phone calls rather than form fills.

LSA Action Checklist

| Step | Details |

|---|---|

| Get Google Guaranteed | Pass background check, verify license and insurance |

| Set service area | Tighten radius to your best-converting zip codes |

| Hit 50+ reviews | Companies with 50+ reviews at 4.7+ stars rank higher |

| Answer within 30 seconds | Responsiveness directly affects your LSA ranking |

| Dispute bad leads | Businesses get about 6 to 7% of LSA spend back in credits |

Do Pay-Per-Click Ads Work for Plumbing Companies

Google Ads remains the fastest way to generate plumbing leads on demand. On The Map Marketing reports that plumber PPC keywords range from $20 to $75 per click depending on your market. “Emergency plumber” and “24 hour plumber near me” sit at the top of that range.

LocaliQ’s 2025 benchmarks (based on 3,200+ campaigns) show the average home services CPL at $90.92, with cost per lead increasing for 69% of home services businesses year over year. Google’s own data from Plumbing & Mechanical Magazine shows a 19% overall increase in cost-per-conversion within Google Ads for home services.

Call-only campaigns work particularly well for plumbing. They skip the landing page entirely and connect the searcher straight to your phone line. Conversion rates on plumbing call-only ads tend to run 15 to 25% higher than standard search ads.

Budget matters, obviously. Most plumbing companies spending less than $1,500/month on Google Ads don’t generate enough data to optimize properly. The sweet spot for a single-location plumber in a mid-sized metro tends to sit between $2,000 and $5,000/month.

PPC Budget Planning Template

| Monthly Budget | Expected Leads (at $70-$90 CPL) | Expected Jobs (at 15-20% close rate) |

|---|---|---|

| $1,500 | 17-21 leads | 3-4 jobs |

| $3,000 | 33-43 leads | 5-9 jobs |

| $5,000 | 56-71 leads | 8-14 jobs |

Action step: Run Google Ads and LSAs together. The Media Captain’s data shows a typical 60/40 budget split between LSAs and standard PPC for their best-performing clients. LocaliQ found that running Facebook ads alongside search ads reduced cost per lead by 3 to 29%.

Can Social Media Generate Leads for a Plumber

Facebook Lead Ads can work for plumbing, but expectations need calibrating. Social media leads are colder than search leads. Someone scrolling Facebook isn’t actively looking for a plumber the way someone Googling “water heater replacement near me” is.

Podium’s research puts the average Facebook ad conversion rate at 9.21% for service businesses. Not bad, but the leads need more follow-up since the intent is lower.

Where Facebook does well: seasonal promotions (water heater tune-ups before winter), bathroom remodel leads, and new construction plumbing bids in partnership with builders or remodelers.

Nextdoor is underused by plumbers. Neighborhood-specific targeting, recommendation requests, and local business pages make it a legitimate source for residential plumbing leads. The platform runs on trust and proximity, which plays directly into how homeowners choose a plumber.

How Do Referral Programs Bring Plumbing Leads

Referrals convert at the highest rate of any lead source. Period.

Plumbing industry data from GlassHouse shows that referred or neighborhood-connected leads close at approximately 80%, compared to just 20 to 40% for advertising-driven leads. A referred plumbing customer is pre-sold on your company because someone they trust recommended you.

Structure matters. A flat $50 referral bonus for existing customers works for some. Others do better with tiered incentives: $25 for the referral, another $25 if the referred customer books a second job.

The partnerships most plumbers overlook: real estate agents, property managers, home inspectors, and insurance adjusters. These people need a reliable plumber they can refer constantly. One solid relationship with a property management company handling 200+ units can generate 5 to 10 plumbing service calls per month without any ad spend.

Lead Channel Comparison

| Channel | Avg Cost Per Lead | Close Rate | Best For |

|---|---|---|---|

| Google LSAs | $40 – $75 | High intent | Emergency + routine calls |

| Google Ads (PPC) | $70 – $90+ | 15 – 20% | On-demand lead volume |

| Organic SEO | Free (after investment) | Highest converting source | Long-term, compounding leads |

| Facebook Ads | Varies | ~9% conversion | Seasonal promos, remodels |

| Referrals | $0 – $50 (bonus) | ~80% | Highest quality, lowest cost |

| Shared lead platforms | $15 – $50 | ~10% | Filling schedule gaps |

Action step: Build a simple tracking spreadsheet. Log every lead by source, cost, and whether it converted to a booked job. Run it for 90 days. The data will show you exactly where to double down and where to cut.

How Much Does a Plumbing Lead Cost

Lead cost varies wildly by source, service type, and geographic market. A plumber in Houston pays a different cost per lead than one in Portland, Maine. Knowing your numbers by channel is the only way to allocate budget intelligently.

Aged Lead Store’s 2025 data shows plumbing lead costs range from $55 to $120 overall, with high-competition states like California, New York, Florida, and Texas pushing costs 20 to 50% above national averages.

And costs keep climbing. LocaliQ’s 2025 benchmarks (based on 3,200+ campaigns) found that cost per lead increased for 69% of home services businesses, averaging a 10.51% year-over-year jump. Google Ads data from Plumbing & Mechanical Magazine shows a 19% overall increase in cost-per-conversion for home services.

What is the Average Cost Per Lead for Plumbers by Channel

Here’s what most plumbing companies can expect to pay per lead across the major sources:

These ranges reflect 2024-2025 data across mid-sized U.S. markets. Larger metros like Los Angeles, Chicago, and Dallas push the upper end. Rural and smaller suburban markets often fall below these ranges.

The number that actually matters: A $50 Thumbtack lead converting at 15% costs $333 per customer. A $75 Google LSA lead converting at 50% costs $150 per customer. Track cost per won job, not just cost per lead.

What Factors Change the Price of Plumbing Leads

Service type is the biggest variable. Emergency plumber calls and sewer line repair inquiries cost more because the job value is higher and competition for those clicks is fierce.

Seasonality hits hard. Water heater repair leads spike in winter when incoming water temperatures drop from 65-75°F to 35-45°F, forcing heaters to work significantly harder. That seasonal demand creates bidding wars on Google Ads every November through February. Ronkot confirms that winter months drive up lead prices in colder regions due to frozen pipes and heating system failures.

Other factors that shift your effective CPL:

- Competition density in your zip code. Google LSA adoption jumped from 28% of contractors in 2021 to roughly 70% in 2026, per Talk24. More bidders means higher prices

- Time of day. After-hours and emergency plumbing calls cost more on paid platforms

- Landing page performance. A plumber with a 20% form conversion rate pays half the effective cost of one converting at 10%, even if the click cost is identical. Plumbing Webmasters’ data shows contact forms with three fields or fewer get completed at significantly higher rates

- Geographic market. Aged Lead Store data shows competitive states (CA, NY, FL, TX) run 20-50% above national averages. Less competitive markets see plumbing leads in the $45-$90 range

- Customer touchpoints. CAMP Digital’s Google data shows home services customers now average 5.5 touchpoints before converting, up from 4.9. That means your cost isn’t just the first click

Seasonal Lead Cost Calendar

| Season | Lead Cost Trend | Why |

|---|---|---|

| Winter (Nov-Feb) | Highest | Frozen pipes, water heater failures, emergency calls surge |

| Spring (Mar-May) | Moderate-High | Outdoor plumbing, post-winter repairs, remodel season starts |

| Summer (Jun-Aug) | Moderate | Steady demand, sewer backups, irrigation issues |

| Fall (Sep-Oct) | Lowest | Pre-winter maintenance, lower emergency volume |

Action step: Front-load your SEO and review-building efforts during fall (lower-cost months) so you’re ranking well before winter demand spikes. Increase paid ad budgets 20-30% for November through February to capture peak emergency traffic.

How Do Plumbers Qualify Incoming Leads

Not every lead is worth dispatching a truck for. Qualifying leads before scheduling saves drive time, fuel, and the frustration of showing up to a job that doesn’t match what the customer described.

Research from Landbase shows that 67% of lost sales stem from not properly qualifying leads before pursuit. And Trustmary data indicates that 79% of marketing leads fail to convert without proper nurturing. The qualification step is where most plumbing companies leak revenue.

CAMP Digital’s research also found that up to 30% of calls to home services businesses are irrelevant. Filtering those out before dispatching a truck changes your entire cost structure.

What Questions Should a Plumber Ask a New Lead

Five pieces of information separate a qualified plumbing lead from a tire kicker:

- What specific plumbing service is needed (leak, clog, installation, replacement, inspection)

- Property address and whether it’s within your service area

- Urgency level: is water actively running, or can this wait for a scheduled appointment

- Property type: residential, commercial, multi-unit

- Whether they own the property or need landlord/property manager approval

A good intake form on your website can capture most of this before your team even picks up the phone. That pre-qualification step alone can save 3-5 hours per week in wasted dispatch.

Plumbing Webmasters’ CRO data confirms that forms with three fields or fewer get higher completion rates, but adding more fields filters out low-quality leads. The right balance depends on your lead source. If most leads come from organic SEO (already high-quality), keep forms short. If you’re running broad paid campaigns, add a qualifying question or two.

What is Lead Scoring for a Plumbing Business

Lead scoring assigns a value to each incoming inquiry based on how likely it is to become a paying job. Most plumbing CRMs like ServiceTitan and Housecall Pro support some version of this.

Landbase data shows that properly qualified leads convert at 40%, compared to just 11% for unqualified ones. That’s nearly a 4x difference from the same lead volume.

A simple three-tier system works for most plumbing operations:

| Tier | Lead Type | Response Target | Action |

|---|---|---|---|

| Hot | Active emergencies, booked appointments | Under 5 minutes | Call immediately, dispatch if possible |

| Warm | Estimate requests, callback inquiries | Within 2-4 hours | Call + send text confirmation |

| Cold | Price shoppers, out-of-area, unreturned voicemails | Within 24 hours | Automated text follow-up, add to nurture |

The data on response time is clear. Research from InsideSales.com shows that leads contacted within 5 minutes are 10x more likely to be reached than those contacted at 10 minutes. A Vendasta study found a 391% increase in conversions when leads are contacted within the first minute.

Yet a 2024 RevenueHero study of over 1,000 companies found that 63% of businesses didn’t respond to inbound leads at all. Average response time was 29 hours. That gap is your competitive advantage.

An automated text-back system (“Thanks for contacting [Company]. We’ll call you within 10 minutes.”) buys you time while signaling professionalism.

FAQ on Lead Generation For Plumbers

How do plumbers get more leads?

Plumbers get more leads by combining Google Local Service Ads, an optimized Google Business Profile, and a fast-loading website with click-to-call buttons. Referral programs with real estate agents and property managers add consistent volume without ad spend.

What is the average cost per lead for plumbers?

The average cost per lead for plumbing companies ranges from $15 to $100+ depending on the channel. Thumbtack and shared leads sit lower. Google Ads and exclusive plumbing leads cost more but convert at higher rates.

Are Google Local Service Ads worth it for plumbers?

Yes. Google Local Service Ads run on a pay-per-lead model at $25-$50 per lead, carry a Google Guaranteed badge, and appear above standard search results. They produce some of the highest-intent plumbing leads online available.

How fast should a plumber respond to a new lead?

Within five minutes. Plumbing companies that respond in under five minutes convert leads at 8x the rate of those responding in 30 minutes. An automated text-back system from tools like Podium or Broadly helps bridge the gap.

What is the best CRM for plumbing companies?

ServiceTitan leads for larger operations with dispatching and lead tracking built in. Housecall Pro and Jobber work well for smaller plumbing businesses. FieldEdge is another solid option with QuickBooks integration for contractors.

Do Facebook ads work for plumbing companies?

Facebook Lead Ads generate plumbing leads at $20-$65 per lead, but they’re colder than search-based leads. They work best for seasonal promotions like water heater tune-ups and bathroom remodel leads, not emergency service calls.

How do plumbers track where their leads come from?

Call tracking software like CallRail assigns unique phone numbers to each marketing channel. Combined with Google Analytics and a plumbing CRM, this shows exactly which source produces leads and at what cost per acquisition.

What is a good conversion rate for plumbing leads?

A strong plumbing company converts 25-40% of inbound leads into booked jobs. Phone calls convert higher than form fills. Emergency plumber calls convert at 50%+ because urgency removes the comparison shopping step entirely.

Should plumbers buy leads from HomeAdvisor or Angi?

It depends on your market. Angi and HomeAdvisor sell shared leads at $15-$85 each, meaning multiple plumbers receive the same inquiry. Conversion rates are lower than exclusive sources, but the cost per lead entry point is accessible for newer companies.

How can a plumbing website generate more leads?

Add dedicated service area pages, a visible phone number on every page, and a short lead generation form above the fold. Fast mobile load times and strong Google reviews push organic plumber website conversion rates significantly higher.

Conclusion

Lead generation for plumbers comes down to building a system, not chasing one-off tactics. The plumbing companies that grow predictably run multiple lead sources, measure everything, and fix what underperforms.

Start with Google Business Profile and Local Service Ads. Add a plumbing landing page that loads fast on mobile with a clear website form built for lead generation. Track every call through CallRail or a similar platform. Know your plumbing lead conversion rate by channel.

Then layer in referral partnerships, Nextdoor, and retargeting campaigns as your plumbing sales pipeline matures.

Speed to lead, lead scoring, and a solid home service CRM like Jobber or ServiceTitan separate the plumbing businesses that stay booked from those still waiting on the next phone call. The data is clear. Act on it.