Most people abandon forms. Not because they don’t want what’s on the other side, but because the form itself gets in the way. And that’s the frustrating part. You’ve done…

Table of Contents

Technology buyers don’t fill out forms on a whim.

They research for months, consult buying committees, and evaluate dozens of vendors before requesting a demo.

Lead generation for technology companies demands a different playbook than traditional B2B marketing.

CTOs, IT directors, and procurement teams expect technical depth, not generic sales pitches.

This guide covers the strategies, tools, and metrics that actually work for SaaS businesses, IT service providers, and enterprise software vendors.

You’ll learn how to build a qualified sales pipeline, choose the right channels for your market, and avoid the mistakes that waste budget and frustrate sales teams.

What is Lead Generation for Technology Companies

Lead generation for technology companies is the process of identifying and attracting potential buyers for software products, IT services, cloud solutions, and hardware systems.

It involves capturing contact information from CTOs, IT directors, procurement managers, and technical decision-makers who have purchasing authority.

Unlike consumer marketing, B2B technology sales require longer nurturing cycles and multiple touchpoints before conversion.

The goal is building a qualified sales pipeline filled with prospects who match your ideal customer profile.

SaaS businesses, cybersecurity firms, cloud computing vendors, and IT service providers all rely on structured lead generation to fuel growth.

Why Do Technology Companies Need Dedicated Lead Generation Strategies

Technology purchases involve buying committees, not single decision-makers.

A typical enterprise software deal requires approval from the CTO, VP of Engineering, IT procurement team, and sometimes the CFO.

Each stakeholder evaluates your solution differently.

TechnologyAdvice found that 86% of IT professionals report 3+ stakeholders on decision committees, with 43% reporting 6+ stakeholders. In large enterprises, nearly 30% report 10+ stakeholders.

Complex Sales Cycles Demand Specialized Approaches

Enterprise software sales cycles run 6-18 months on average.

B2B software sales cycles range from 1-3 months for SMB deals to 9-18 months for enterprise according to Aexus research.

The average B2B sales cycle in 2024 was 25% longer than five years ago.

What prospects need before signing:

- Technical documentation

- Proof of concept demonstrations

- Security audits

- Integration assessments

Generic marketing tactics fail here.

Technical Buyers Research Differently

Developers check GitHub repositories and API documentation before talking to sales.

IT directors read Gartner reports and Forrester Research evaluations.

BlueWhale Research found that 75% of B2B decision-makers research and recommend solution providers independently before vendor contact.

Your lead generation strategies must meet them where they already look.

Product Education Takes Priority

Technology products require explanation.

Buyers need to understand tech stack integration, implementation requirements, and total cost of ownership.

ROI is the most critical factor influencing purchasing decisions across the buying committee according to BlueWhale Research.

Content marketing and webinar registration forms become primary lead capture mechanisms.

Case studies showcasing real-world results and video demos drive engagement throughout the buying journey.

What Are the Most Effective Lead Generation Methods for Technology Companies

Not all channels perform equally for tech companies.

The methods below are ranked by effectiveness for B2B technology sales.

Content Marketing and Gated Resources

Whitepapers, technical guides, and research reports attract high-intent prospects.

Gate premium content behind well-designed lead capture forms to collect contact information. Walker Sands found 44% of B2B organizations gate content, with 62% saying the main reason is to identify qualified leads.

Content marketing generates 3X more leads than traditional marketing while costing 62% less according to Demand Metric.

Around 80% of B2B companies use content marketing for lead generation, with blogs (86%), case studies (42%), and customer success stories (36%) as the most popular formats per G2 data.

Product Demonstrations and Free Trials

Demo requests signal strong buying intent.

Free trial signups let prospects experience your software firsthand, reducing friction in the sales cycle. Product-led growth companies like Slack and Zoom built billion-dollar businesses on this model.

Webinars and Virtual Events

Technical webinars establish expertise while capturing qualified leads.

ViB research found that 31% of marketers would pick events and webinars as their most effective channel, with 37% calling it their most valuable channel.

More than half (53%) of marketers say webinar landing pages generate the most high-quality leads according to Demand Gen Report.

Partner with industry analysts from Gartner or TrustRadius for added credibility.

Account-Based Marketing

ABM targets specific companies rather than broad audiences.

Tools like Demandbase, 6sense, and Bombora identify accounts showing buyer intent signals. Personalized campaigns to buying committees outperform generic outreach.

LinkedIn and Professional Networks

LinkedIn Sales Navigator provides direct access to technology decision-makers.

HubSpot data shows 89% of B2B marketers use LinkedIn for lead generation, with 62% saying it produces leads effectively. CMI research found 85% of marketers voted LinkedIn as the best-performing social media platform.

Combine organic thought leadership with sponsored content targeting job titles like “VP of Engineering” or “IT Director.”

Developer Communities and Technical Content

Developer marketing requires authenticity.

Publish on GitHub, contribute to open-source projects, and create useful API documentation. Product Hunt launches generate awareness among early adopters and innovation buyers.

Industry Events and Conferences

TechCrunch Disrupt, AWS re:Invent, and vertical-specific conferences deliver face-to-face connections.

HubSpot found 80% of marketers held live events in 2022. EventTrack research shows 91% of consumers would be more inclined to purchase after participating in a brand experience, with 40% becoming more loyal.

Booth traffic converts poorly without proper follow-up systems in place.

Partner and Reseller Channels

AWS Marketplace, Google Cloud Partner programs, and Microsoft Azure partnerships expand reach.

Channel leads often come pre-qualified by the partner relationship.

Search Engine Marketing

Capture demand from buyers actively searching for solutions.

Target keywords like “enterprise CRM software” or “cloud security solutions” with dedicated landing page forms.

Databox found 50% of B2B marketers use Google Ads for lead generation, with nearly 70% believing Google Search Ads are the top-performing channel for conversions from paid traffic.

Email Outreach and Sequences

Outbound prospecting works when personalized to specific pain points.

ViB data shows 83% of B2B marketers say email marketing is important in their strategy, with 33% calling it their most valuable channel. Email marketing generates $36 for every $1 spent according to Litmus research.

Tools like Outreach and Apollo.io automate sequences while maintaining personalization at scale.

How Do B2B Technology Companies Qualify Leads

Not every lead deserves sales attention.

Lead qualification separates tire-kickers from genuine buyers.

BANT and MEDDIC Frameworks

BANT evaluates Budget, Authority, Need, and Timeline.

Gartner found that 52% of sales reps trust BANT for its reliability, with 41% valuing its adaptability. InsideSales research shows companies that effectively implemented BANT saw a 59% increase in conversion rates.

MEDDIC goes deeper: Metrics, Economic Buyer, Decision Criteria, Decision Process, Identify Pain, Champion.

Enterprise deals need more depth.

73% of SaaS companies selling solutions above $100,000 ARR now employ some version of MEDDIC according to sales methodology research.

Cognism’s 2024 report found sales teams using MEDDIC closed 25% more enterprise deals over $100K.

Companies implementing MEDDIC experienced an average win rate increase of 25% per Sales Benchmark Index research.

Lead Scoring Models

Assign point values to prospect actions and attributes.

High-value signals include:

- Pricing page visits

- Demo request submissions

- API documentation access

- Multiple stakeholders from same company

- Return visits within 7 days

Organizations using lead scoring experience a 77% lift in lead generation ROI according to industry research.

Salesforce and HubSpot offer built-in lead scoring capabilities.

Intent Data Signals

Third-party intent data reveals which companies research your category.

ZoomInfo, Clearbit, and Bombora track content consumption across the web. Prioritize outreach to accounts showing active buying signals.

Marketing Qualified vs Sales Qualified Leads

MQLs meet baseline engagement thresholds.

SQLs have been vetted by sales development representatives and confirmed as genuine opportunities.

The average MQL to SQL conversion rate sits at 13%, but top performers using behavioral scoring achieve 40% according to sales data.

Clear definitions prevent friction between marketing and sales teams.

What Tools Do Technology Companies Use for Lead Generation

The right tech stack automates repetitive tasks and improves conversion rates.

CRM Platforms

| CRM Platform | Core Deployment Model | Primary Target Segment | Distinctive Capability |

|---|---|---|---|

| Salesforce | Cloud-based SaaS platform with multi-tenant architecture | Enterprise organizations with complex sales operations | AppExchange marketplace with 7,000+ pre-built integrations and extensive customization through Apex code |

| HubSpot CRM | Freemium cloud-based platform with scalable paid tiers | Small to mid-sized businesses prioritizing inbound marketing integration | Native integration between CRM, marketing automation, content management, and customer service tools within unified platform |

| Microsoft Dynamics 365 | Cloud and on-premises hybrid deployment options | Enterprise businesses using Microsoft ecosystem (Office 365, Azure, Teams) | Deep integration with Microsoft products and AI-powered sales insights through Copilot assistant |

| Zendesk Sell | Cloud-based SaaS with mobile-first architecture | Sales teams requiring tight customer support alignment | Native connectivity with Zendesk Support for unified customer interaction history across sales and service touchpoints |

| Pipedrive | Cloud-based SaaS focused on simplicity | Small sales teams and individual sales professionals | Visual pipeline management with drag-and-drop interface and activity-based selling methodology |

| Zoho CRM | Cloud-based with optional on-premises deployment | Budget-conscious small to medium businesses seeking comprehensive features | AI assistant (Zia) with predictive sales analytics and integration with 45+ Zoho business applications |

| Freshsales (Freshworks) | Cloud-based SaaS with API-first architecture | Growing businesses prioritizing lead scoring and email tracking | Built-in phone system with call recording, Freddy AI for deal insights, and behavioral segmentation |

| Monday Sales CRM | Cloud-based work operating system adapted for sales | Teams seeking high customization with project management workflows | No-code customizable boards, columns, and automations with visual project-style sales tracking |

Salesforce dominates enterprise tech companies.

Salesforce holds 23.9% of the global CRM market and serves 83% of Fortune 500 companies according to market research.

HubSpot serves mid-market SaaS businesses with its free tier and marketing automation integration.

HubSpot powers 45.8% of B2B martech stacks with 248,000 paying customers globally.

Both centralize prospect data and track pipeline progression. Research shows businesses using CRM report an average return of $8.71 for every $1 invested.

91% of companies with 10 or more employees use CRM technology.

Marketing Automation

Companies using marketing automation experience an average increase in qualified leads by up to 451% according to industry studies.

76% of companies use some form of marketing automation technology in 2024.

Marketo handles complex nurturing workflows for enterprise teams.

HubSpot and Intercom provide simpler alternatives for growing companies.

Automation triggers personalized email campaigns based on prospect behavior. 80% more leads and 77% higher conversions come from implementing marketing automation per VentureBeat research.

Intent Data Providers

6sense and Demandbase predict which accounts will buy.

Bombora aggregates content consumption data from B2B publishers.

ZoomInfo combines contact data with intent signals.

Sales Engagement Platforms

71% of companies plan to invest in sales engagement platforms by 2025.

Outreach and Apollo.io manage multi-touch sequences.

SalesLoft reports a 394% ROI over three years and over 100 million emails and calls sent monthly through its platform.

Gong records and analyzes sales calls for coaching insights.

Calendly eliminates scheduling friction for demo bookings.

Conversational Marketing

58% of B2B companies actively use chatbots compared to 42% of B2C companies.

Drift and Intercom enable real-time chat with website visitors.

Conversational forms replace static fields with dynamic question flows.

Chatbots qualify leads 24/7 without human intervention. Research from Aberdeen shows businesses using conversational marketing bots report a 21% stronger lead acceptance rate and 36% higher conversion rate.

Businesses using AI chatbots have 3X better conversion into sales than those who use website forms according to 2025 data.

88% of users had at least one conversation with a chatbot in 2025.

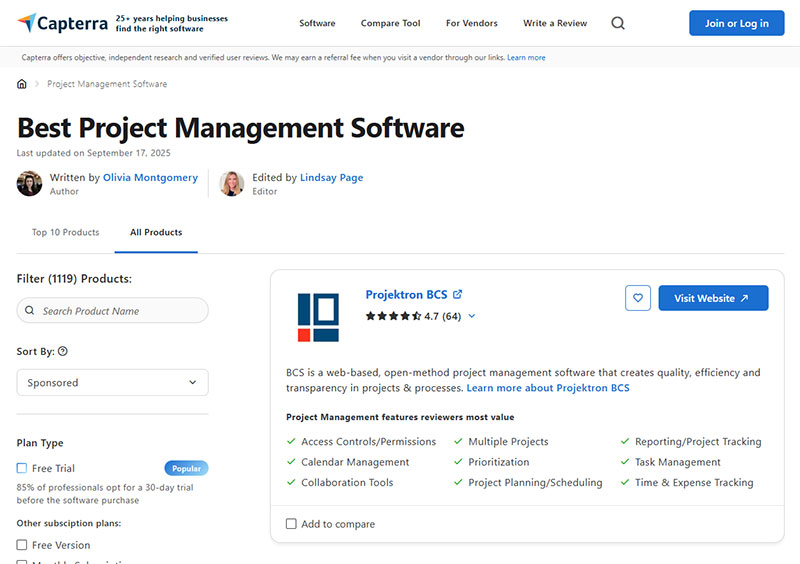

Review and Comparison Sites

G2 and Capterra influence technology purchase decisions.

54% of buyers start their vendor research with category searches on Google, which frequently leads them to review sites like G2 according to Wynter research.

73% of buyers say word-of-mouth suggestions play the biggest role in determining which vendors they’ll consider.

Software review sites (15%) rank as the second-highest source influencing vendor shortlists per G2’s 2025 Buyer Behavior Report.

98% of B2B buyers emphasize the importance of reading reviews before making purchase decisions.

Strong review profiles generate inbound leads from buyers in evaluation mode.

Form and Landing Page Tools

Dedicated WordPress lead generation plugins simplify form creation.

A/B test form length, field types, and button copy to increase form conversions.

Consider multi-step forms for complex qualification questions.

How Does Lead Generation Differ Between SaaS and Hardware Technology Companies

SaaS and hardware sales follow fundamentally different paths.

Your lead generation funnel must reflect these distinctions.

Sales Cycle Length

SaaS moves faster.

SMB deals close in 30-90 days, with a median of 40 days from initial contact. Enterprise SaaS takes 6-9 months for deals exceeding $100,000.

The average B2B SaaS sales cycle has extended to 134 days, up from 107 days in 2022.

Hardware requires patience.

Procurement cycles run 12-24 months, plus implementation planning and physical logistics. 58% of IT professionals report the buying process takes 3+ months for IT product purchases.

Pricing and Payment Models

SaaS leverages low-friction entry.

Monthly or annual subscriptions require minimal initial commitment. Free trials and freemium tiers let prospects self-qualify before talking to sales.

Free trials convert at 25% for B2B SaaS. Freemium models convert 1-10% of free users, with products in the $1K-$5K range seeing 10% median conversion.

60% of SaaS companies now identify as product-led, up from 35% in 2021.

Hardware demands financial commitment.

Capital expenditure approval, budget cycles, and financing arrangements create barriers. 75% of B2B technology buyers must go through an RFP process or get multiple prices from procurement.

Decision-Making Complexity

Buying committees have expanded across both sectors.

The average B2B buying group now includes 10-11 stakeholders. In 2024, 86% of IT professionals reported 3+ stakeholders on their decision committees.

SaaS committees:

- Typically 6-10 decision-makers

- CFO holds final power in 79% of purchases

- Focused on ROI and implementation ease

Hardware committees:

- Include facilities, IT infrastructure, procurement, finance, and executive leadership

- 89% of purchases span two or more departments

- Deals over $250,000 require an average of 19 external stakeholders

Lead Capture Approaches

SaaS relies on product-led acquisition.

Free trials and demo requests dominate. 75% of companies entering product-led growth choose either a free trial or freemium model as their entry point.

Hardware depends on traditional B2B channels.

Trade shows, RFP responses, and direct outreach to procurement teams drive leads.

What Metrics Should Technology Companies Track for Lead Generation

Measurement drives improvement.

Track these demand generation metrics weekly.

Cost Per Lead (CPL)

Total marketing spend divided by leads generated.

B2B technology averages $200 per lead across channels according to 2025 benchmarks. Software development leads cost nearly $600, while B2B SaaS averages $188.

LinkedIn commands a premium at $110 CPL, over 57% higher than Google Search Network’s $70 average.

Demo request CPLs range from $600-$800 based on lead quality and targeting strategy.

Lead-to-Opportunity Conversion Rate

Percentage of MQLs that become sales opportunities.

B2B SaaS achieves 40% MQL to SQL conversion when using behavioral scoring models, far exceeding the 13% overall average.

Top-performing B2B teams convert 25-35% of MQLs to SQLs, while industry averages hover around 18-22%.

Website-sourced leads convert at 31%, referrals at 24% per B2B benchmarks.

Low rates signal misalignment between marketing targeting and sales qualification criteria.

Sales Cycle Length

Days from first touch to closed deal.

Track by lead source, company size, and product line to identify optimization opportunities. The B2B SaaS sales cycle has extended to 134 days in 2025, up from 107 days in 2022.

Customer Acquisition Cost (CAC)

Full cost to acquire one paying customer, including marketing, sales salaries, tools, and overhead.

SaaS targets: 12-18 months CAC payback.

The median CAC payback period reached 18 months in 2024, compared to 14 months the year prior. Companies with ACV over $100K see 24-month median payback periods.

Best-in-class companies achieve payback in under 12 months. The benchmark LTV:CAC ratio remains 3:1 for sustainable growth.

Lead Velocity Rate

Month-over-month growth in qualified leads.

More predictive of future revenue than current pipeline size. Essential for accurate forecasting and capacity planning.

Pipeline Coverage Ratio

Total pipeline value divided by quota.

Technology sales teams need 3-4X coverage to hit targets reliably, with some high-velocity teams operating at 5X for buffer against deal slippage.

How Can Technology Companies Align Sales and Marketing for Better Lead Generation

Revenue operations bridges the gap between teams.

Misalignment wastes leads and creates friction.

Shared Lead Definitions

Document exactly what qualifies as MQL and SQL.

45% of B2B marketers find alignment between sales and marketing teams difficult. The first step toward fixing this is clarity on definitions.

Include specific criteria: job title, company size, engagement actions, and intent signals. Review and update definitions quarterly based on conversion data.

Service Level Agreements

Marketing commits to lead volume and quality targets. Sales commits to follow-up speed and attempt frequency.

Contact new leads within 5 minutes during business hours.

Businesses responding within 5 minutes are 21 times more likely to qualify leads than those waiting 30 minutes. Responding within 1 minute increases conversion rates by 391%.

The average B2B response time is 42 hours. Only 24% of companies follow up within the first hour.

43% of sales reps say what they need from marketing is higher quality leads.

Lead Handoff Processes

Automate routing from marketing automation to CRM.

Include all behavioral data, content consumed, and scoring details in the handoff. Sales reps need context before outreach.

Companies with well-aligned teams boost marketing-generated revenue by 208% and improve customer retention by 36%.

Revenue Attribution Models

First-touch, last-touch, and multi-touch attribution each tell different stories.

Multi-touch models with position-based weighting provide the clearest picture for long B2B sales cycles. 47% of buyers view 3-5 educational pieces of content before engaging with sales reps.

Regular Pipeline Reviews

Weekly meetings between marketing and sales leadership.

Review lead quality feedback, conversion rates by source, and upcoming campaign plans.

SuperOffice saw a 34% increase in revenue by improving sales and marketing alignment. 78% of B2B customers purchase from the vendor that responds first.

What Are Common Lead Generation Mistakes Technology Companies Make

Avoid these errors that drain budget and frustrate sales teams.

Gating Low-Value Content

Requiring email addresses for basic blog posts annoys prospects.

Gate only premium content: original research, comprehensive guides, tools, and templates.

Asking Too Many Form Fields

According to a 2024 HubSpot study, each additional form field decreases conversion rates by an average of 4.1%.

Forms with more than 5 fields in the B2B sector record an average conversion decrease of 30% compared to shorter variants, according to MarketingSherpa Research Institute analysis from 2024.

A 2025 Formstack study of 1,500 B2B decision makers found the average form abandonment rate is 67.8% when more than 7 fields are requested.

Reducing form fields from 11 to 4 can increase conversions by 120-160%.

Start with email only, use progressive profiling to gather more data over time. Focus on form fields that capture high-quality leads without creating friction.

Ignoring Lead Nurturing

Converting a lead typically requires 5-20 touches, according to industry research.

Companies that excel at lead nurturing generate 50% more sales-ready leads at 33% lower cost.

Nurtured leads make 47% larger purchases than non-nurtured leads.

Only 16% of B2B marketers rate their nurture efforts as excellent. 43% say creating engaging, targeted content is their biggest challenge in nurturing.

Set up automated nurturing sequences based on content consumption and engagement patterns.

Treating All Leads Equally

A whitepaper download differs vastly from a demo request in intent.

73% of B2B leads are not sales-ready when they are first generated, according to Forrester Research.

Segment by behavior and route accordingly.

Neglecting Form Performance

Broken forms, slow load times, and poor mobile experience kill conversions.

80% of B2B buyers use their mobile devices during working hours for both research and buying purposes.

Over 50% of individuals prefer mobile devices for online information searches and shopping, according to Scopic Studios research on B2B mobile marketing trends.

Apply mobile form best practices since mobile plays a central role in B2B research and decision-making.

No Lead Source Tracking

Without attribution, you cannot optimize spend.

Tag every campaign, track UTM parameters, and connect to closed revenue in your CRM.

Companies using multi-touch attribution see an average 20% increase in sales opportunities from nurtured leads.

Slow Response Times

Leads contacted within 5 minutes are 21 times more likely to qualify than those contacted after 30 minutes, according to InsideSales.com research.

Responding within 1 minute increases conversion rates by 391%.

The average B2B response time is 42 hours. Only 24% of companies follow up within the first hour.

After 5 minutes, your chances of qualifying a lead drop by 80%.

How Do Technology Startups Approach Lead Generation Differently Than Enterprise Tech Companies

Resource constraints force startups to prioritize differently.

Budget Allocation

Startups lack enterprise marketing budgets.

The average marketing budget for startups should be 11.2% of overall revenue, according to HubSpot research. Early-stage SaaS startups often invest 20-40% or more of revenue into marketing when rapid customer acquisition is the priority.

In contrast, B2B companies allocate 8.4% of revenue to marketing on average, according to Gartner’s 2024 CMO Spend Survey. Median B2B SaaS marketing spend is 8% of ARR, down from 10% in previous years.

Venture-backed SaaS companies spend 58% more on marketing as a percentage of revenue than bootstrapped counterparts.

Focus on high-ROI channels: content marketing, founder-led sales, and community building over paid advertising. Content marketing costs 62% less than traditional marketing while generating 3X more leads.

Channel Selection

Enterprise companies run multi-channel campaigns across events, paid media, ABM, and content.

Startups pick 2-3 channels and master them before expanding.

Product Hunt launches, developer communities, and inbound content work well with limited resources.

58% of B2B marketers report an increase in sales and revenue thanks to content marketing. In B2B SaaS, the average ROI from SEO is 702%, with a break-even time of just 7 months.

Sales Team Structure

Startups use founders and small SDR teams for outbound prospecting.

Enterprise tech companies deploy specialized roles: SDRs, AEs, solution engineers, and customer success managers.

Market Positioning

Startups target early adopters who tolerate imperfect products.

Enterprise vendors sell stability, security certifications, and established customer references.

Messaging and lead magnets must reflect these different buyer priorities.

Technology Stack

Startups use affordable tools: HubSpot free tier, Apollo.io, Calendly.

The most successful startups spend over 25% of their marketing budget on marketing technology, according to GetApp research.

Enterprise teams invest in Salesforce, Marketo, 6sense, and Gong.

Scale your stack as revenue grows, avoid over-engineering early.

Speed vs Process

Startups iterate quickly, testing messaging and channels weekly.

Enterprise companies move slower with approval processes, brand guidelines, and compliance reviews.

High-growth companies are 3X more likely than slower-growing peers to dynamically reallocate resources throughout the year based on performance data, according to McKinsey 2024 research.

Use startup agility as a competitive advantage against slower incumbents.

FAQ on Lead Generation For Technology Companies

What is the best lead generation channel for SaaS companies?

Content marketing combined with product-led growth delivers the highest ROI for most SaaS businesses.

Free trials, demo requests, and gated whitepapers capture high-intent prospects while building authority with technical decision-makers like CTOs and IT directors.

How long does the B2B technology sales cycle typically last?

SMB deals close in 30-90 days.

Enterprise software sales take 6-18 months due to buying committees, security reviews, procurement processes, and integration assessments required before contract signing.

What tools do technology companies use for lead generation?

Salesforce and HubSpot handle CRM.

Marketo manages marketing automation.

ZoomInfo and 6sense provide intent data.

Outreach and Apollo.io power sales sequences.

Drift enables conversational marketing.

How do you qualify leads for enterprise software sales?

Use BANT or MEDDIC frameworks to assess Budget, Authority, Need, and Timeline.

Implement lead scoring based on job title, company size, engagement actions, and third-party intent signals from providers like Bombora.

What is a good cost per lead for technology companies?

B2B tech CPL ranges from $50 for content downloads to $500+ for demo requests.

Varies by vertical, target company size, and lead quality expectations.

Focus on cost per opportunity, not just CPL.

How do you generate leads for cybersecurity companies?

Threat intelligence reports, compliance guides, and security assessment tools work as lead magnets.

Target CISOs and IT security directors through LinkedIn, industry conferences, and Gartner-aligned content.

What metrics should technology companies track for lead generation?

Track cost per lead, lead-to-opportunity conversion rate, sales cycle length, customer acquisition cost, lead velocity rate, and pipeline coverage ratio.

Connect all metrics to closed revenue for accurate attribution.

How do startups approach lead generation differently than enterprise tech companies?

Startups focus on 2-3 high-ROI channels with limited budgets.

Product Hunt, developer communities, and founder-led sales replace expensive ABM platforms.

Speed and iteration matter more than process perfection.

What is account-based marketing for technology companies?

ABM targets specific companies rather than broad audiences.

Tools like Demandbase and 6sense identify accounts showing buyer intent.

Personalized campaigns to buying committees outperform generic outreach by 40%.

How do you align sales and marketing for better lead generation?

Define MQL and SQL criteria together.

Create service level agreements for lead follow-up timing.

Hold weekly pipeline reviews and use multi-touch revenue attribution to measure true marketing impact.

Conclusion

Lead generation for technology companies requires patience, precision, and the right infrastructure.

You cannot shortcut the buyer journey when enterprise deals involve multiple stakeholders and months of evaluation.

Focus on building topical authority through content that speaks to technical buyers.

Invest in tools like Salesforce, HubSpot, or Marketo to automate nurturing and track attribution.

Align your marketing and sales teams around shared definitions of qualified leads.

Measure what matters: customer acquisition cost, pipeline coverage, and lead velocity rate.

Start with 2-3 channels that match your resources and master them before expanding.

The technology companies winning at demand generation today are those treating lead capture as the beginning of a relationship, not a transaction.