Half of your donors won’t give again next year. That’s not a guess. The Fundraising Effectiveness Project tracks this, and the numbers haven’t improved much. Lead generation for nonprofits is…

Table of Contents

Most financial advisors spend between $3,000 and $10,000 per month on marketing without knowing which channel actually brings in clients.

Lead generation for financial advisors is the difference between a stagnant practice and one that consistently adds $500K+ AUM clients every quarter. But the methods that worked five years ago (buying shared leads from SmartAsset, running generic Google Ads) don’t deliver the same returns in 2025.

This guide breaks down the specific channels, costs, conversion benchmarks, and compliance rules that registered investment advisors and certified financial planners deal with when building a client acquisition pipeline.

From referral program structures to SEC Marketing Rule requirements, every section is built on actual industry data from Kitces Research, the Financial Planning Association, and Schwab Advisor Services.

What Is Lead Generation for Financial Advisors

Lead generation for financial advisors is the process of identifying and attracting potential clients who have a specific need for financial planning, wealth management, or investment advisory services.

It connects certified financial planners, registered investment advisors, and broker-dealer representatives with individuals actively seeking help with retirement planning, estate planning, tax strategy, or asset protection.

Unlike lead generation in retail or e-commerce, the financial advisory version operates under strict regulatory oversight from the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA).

Every ad, landing page, and email sequence has to comply with SEC Marketing Rule 206(4)-1 and FINRA Rule 2210.

The average client relationship in wealth management lasts 10+ years. A single qualified lead converting into a client with $500,000 in assets under management (AUM) can represent $50,000 or more in cumulative revenue. That math changes how you think about acquisition costs.

Most advisory firms operate in one of three models: fee-only (NAPFA-aligned), fee-based, or commission-based. Each model attracts different prospect profiles, and the lead generation strategies that work for a fee-only RIA targeting pre-retirees look nothing like what a wirehouse advisor uses to land corporate 401(k) plans.

What Are the Main Channels Financial Advisors Use to Generate Leads

The client acquisition pipeline follows four stages: prospecting, qualification, nurturing, and conversion. The full cycle typically runs 3 to 18 months.

First Page Sage data puts the average cost per lead in financial services at $653, one of the highest across all industries. The industry’s lead conversion rate sits at just 4.3% (Revnew). That’s why channel mix and lead quality matter more here than in almost any other sector.

Most firms split efforts across five channels: content marketing, referrals, paid ads, LinkedIn, and live events. The right mix depends on niche, AUM targets, and firm structure (independent RIA vs. wirehouse).

How Does Content Marketing Generate Leads for Financial Advisors

Blog posts, market commentary, and guides on topics like Social Security timing or Roth conversion ladders pull organic search traffic from people already researching these questions. Webinars work especially well for pre-retiree audiences.

Broadridge’s 2024 Financial Advisor Marketing Trends Report found that advisors with a defined marketing plan generate 168% more leads per month from their website than those without one.

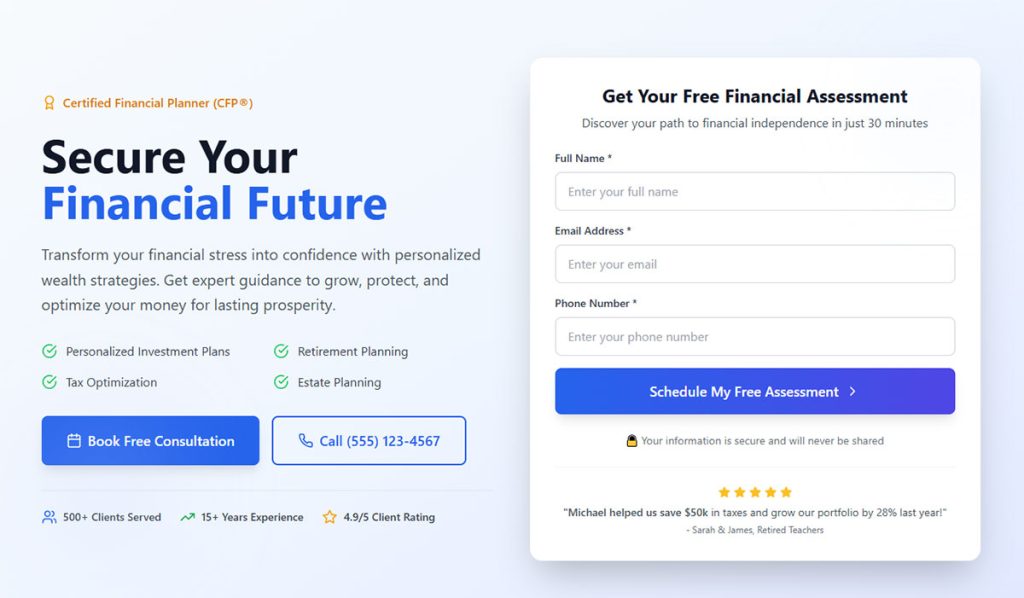

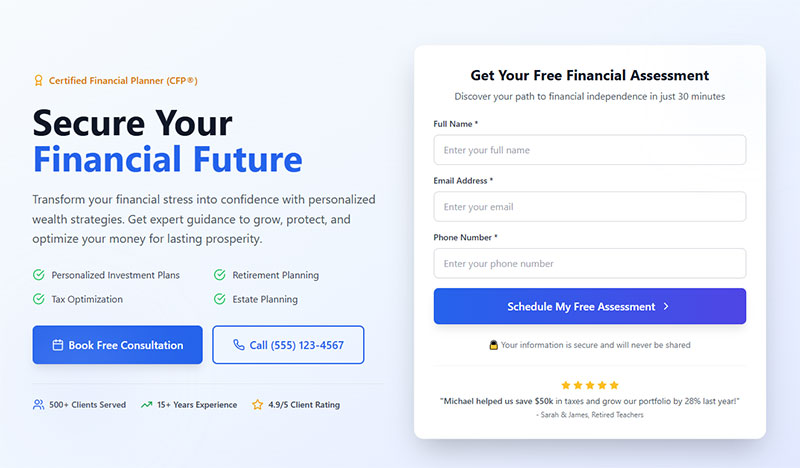

The key is pairing content with a proper lead magnet gated behind a lead capture form: retirement readiness checklists, tax planning worksheets, or Social Security optimization guides all convert well.

To implement:

- Pick one topic your ideal client is actively searching

- Create a one-page downloadable tied to it

- Gate it behind a form (name, email, phone)

- Follow up with a 3-email automated sequence

How Do Referral Programs Work in Financial Advisory Lead Generation

Two referral sources drive most growth: existing clients and Centers of Influence (COIs) – CPAs, estate attorneys, divorce attorneys, insurance agents, and business brokers.

Schwab’s 2024 RIA Benchmarking Study found referrals account for 67% of new clients and new assets at RIA firms. Broadridge data shows referred leads convert in 1.7 months vs. 3.6 months for marketing-sourced leads.

One often-missed driver: the 2024 YCharts Advisor-Client Communication Survey found 89% of clients said communication frequency directly influenced whether they’d refer someone.

COI outreach template:

“Hi [Name],

I work primarily with [niche].

When you’re working with a client who needs [trigger event], I’d welcome an introduction.

Happy to do the same for your clients who need [their service].”

How Does Paid Advertising Attract Financial Planning Clients

Google Ads targeting “financial advisor near me” or “retirement planner [city]” captures high-intent clicks. Facebook and Instagram work better for awareness and webinar registrations. LinkedIn suits B2B wealth management, including 401(k) plan prospecting and executive financial planning.

| Channel | Avg. CPL | Best For |

|---|---|---|

| Google Search | $12–$50 CPC | High-intent local prospects |

| Facebook / Instagram | $15–$40 | Webinar signups, awareness |

| LinkedIn Ads | Higher CPM | Executive and B2B targeting |

All ads must meet FINRA compliance standards: no promissory language, no guaranteed returns, proper disclosures on all performance claims.

How Do Financial Advisors Use LinkedIn for Lead Generation

LinkedIn Sales Navigator lets advisors filter by job title, company, geography, and recent job changes — a reliable trigger for rollover and planning needs.

Broadridge’s 2024 survey shows 68% of advisors now invest in LinkedIn as a marketing tool, and 4 in 10 have directly added clients through it. LinkedIn and Facebook rank as the two highest-converting social channels for advisors.

Consistent posting builds credibility. Direct outreach works when it references a specific trigger event, not a generic connection request.

Posting framework:

- 3–4 posts per week: one market insight, one planning tip, one anonymized client situation

- Respond to every comment within 24 hours

How Do Seminars and Workshops Generate Leads for Financial Planners

Dinner seminars targeting adults 55–70 within a 15-mile radius still produce results. A typical event costs $3,000–$8,000 (venue, food, direct mail) and yields 20–40 attendees, 8–15 booked appointments, and 2–5 new clients. Virtual webinars cost less but convert lower without the in-person trust factor.

Broadridge data shows 32% of marketers cite events and webinars as their most effective lead generation channel.

Post-event follow-up is where most advisors lose leads. A CRM like Wealthbox or Redtail automates the drip sequence.

Follow-up sequence:

- Day 1: Personal thank-you email by name

- Day 3: Send the resource mentioned at the event

- Day 7: Soft meeting invite (“15-minute call for your specific questions”)

- Day 14: Final follow-up before moving to a long-term nurture track

What Types of Leads Do Financial Advisors Target

Not every lead is worth pursuing. Advisors segment prospects based on investable assets, planning complexity, and life stage triggers.

What Is a Qualified Lead for a Financial Advisor

A qualified lead typically meets a minimum asset threshold ($250,000–$500,000 in investable assets for most RIAs), has an active planning need, and has shown intent through a specific action: downloading a guide, attending a webinar, or requesting a consultation.

According to WiserAdvisor, digital leads for financial advisors average $750K in investable assets in 2025, with the vast majority exceeding $250K in AUM potential.

Common life stage triggers that signal buying intent:

- Approaching retirement (age 55–65)

- Receiving an inheritance

- Selling a business

- Going through a divorce

- Changing jobs with a 401(k) rollover decision

What Is the Difference Between Warm Leads and Cold Leads in Financial Advisory

The conversion gap between lead types is significant.

| Lead Type | Conversion Rate | Source |

|---|---|---|

| Referral leads | 40–60% | Industry benchmarks |

| Seminar leads | 15–25% | Industry benchmarks |

| Purchased leads (SmartAsset, WiserAdvisor) | 2–8% | Industry benchmarks |

Referral leads cost almost nothing per lead but require years of relationship building. Purchased leads cost $20–$100 each but need high volume to produce results. The acquisition math always favors referrals — but referrals alone rarely scale fast enough.

How Much Does Lead Generation Cost for Financial Advisors

First Page Sage data puts the average blended CPL for financial services at $653, one of the highest across all industries. Costs shift based on channel, geography, and target client profile. An advisor in Manhattan pays 3–4x what someone in Boise pays for identical Google Ads targeting.

What Is the Average Cost Per Lead in the Financial Services Industry

| Channel | Avg. Cost Per Lead |

|---|---|

|

Referral leads |

$0–$50 relationship cost, not ad spend |

|

SEO / organic content |

$10–$40 amortized over content lifespan |

|

Facebook / Instagram |

$15–$60 |

|

|

$50–$150 |

|

Google Ads |

$75–$250 |

|

Third-party services SmartAsset, Zoe Financial, Paladin Registry

|

$20–$100 |

|

Seminars / workshops |

$100–$500 |

How Do Financial Advisors Calculate Lead Generation ROI

The formula centers on client lifetime value (CLV). According to Kitces research, advisory firms typically run 90–97% annual client retention rates, which means the average client relationship spans 10–20+ years.

CLV example (conservative):

- Client AUM: $500,000

- Advisory fee: 1% annually = $5,000/year

- Avg. client tenure: 15 years = $75,000 gross revenue

- At 20–25% profit margin: $15,000–$18,750 net CLV per client

If your blended cost per acquired client is $1,500, that’s a 10:1 to 12:1 return on marketing spend over the client’s lifetime.

The comparison that changes how advisors think about spend:

A $200 purchased lead converting at 5% = $4,000 per acquired client. A $50 referral lead converting at 50% = $100 per acquired client.

Same budget. Completely different outcome. That’s why the most effective advisory firms treat referral pipeline development as a core marketing function, not a passive byproduct of good service.

Which Lead Generation Companies Work with Financial Advisors

Several third-party platforms connect financial advisors with pre-qualified prospects. Quality, exclusivity, and pricing vary significantly across providers.

How Do Lead Generation Services for Financial Advisors Compare

| Platform | Model | Lead Cost | Exclusivity | Best For |

|---|---|---|---|---|

| SmartAsset AMP | Pay-per-lead + subscription | $200+ / lead |

Shared (up to 3) |

High-volume firms with sales infrastructure |

| Zoe Financial | Revenue share on AUM | Not public |

Exclusive matches |

RIAs targeting $500K–$1M+ prospects |

| WiserAdvisor / Paladin | Subscription + per-lead | $60–$120 / lead |

Shared (2–3) |

Advisors wanting SEO + lead gen combined |

| Dave Ramsey SmartVestor | Referral program | Not public |

Varies by area |

Advisors open to moderate-asset, debt-focused clients |

| NAPFA / Fee-Only Network | Directory listing | Low / subscription |

Non-exclusive directory |

Fee-only RIAs wanting high-intent inbound leads |

SmartAsset matched advisors with over 50,000 investors per month in 2024 and helped close an estimated $34 billion in AUM in 2023, using a 4% assumed close rate. That said, SmartAsset itself notes advisors typically need 5–6 months and 60+ leads before seeing consistent conversions.

Zoe Financial runs a selective vetting process (reportedly accepting roughly 5 out of every 100 applicants) and charges on an ongoing revenue-share basis rather than per lead. One advisor documented on the Kitces podcast closed 25% of Zoe-sourced leads, compared to typical third-party platform rates of 2–8%.

NAPFA and the Fee-Only Network generate lower volume but deliver some of the highest-intent prospects available. These are people actively searching for vetted fiduciary advisors, not consumers who filled out a general financial tool and got matched automatically.

Five factors to compare before choosing a platform:

- Lead exclusivity (shared vs. exclusive)

- Geographic targeting precision

- Minimum AUM filters

- Pricing model (pay-per-lead vs. subscription vs. revenue share)

- Compliance support

The platform decision depends heavily on practice structure. Solo RIAs with a defined niche typically do better with NAPFA, Zoe, or a proper lead generation funnel built on their own website. Larger firms with dedicated sales teams can absorb the lower conversion rates from high-volume platforms because they have the infrastructure to work 50+ leads per month.

The same platform-versus-organic tradeoff applies across professional services. Law firms, accountants, and insurance agents face the exact same cost-per-lead math and the same question of whether to buy leads or build their own pipeline.

FAQ on Lead Generation for Financial Advisors

What is the best way for financial advisors to generate leads?

Referral programs through Centers of Influence (CPAs, estate planning attorneys) produce the highest conversion rates at 40-60%. Combining COI networking with consistent content marketing and a well-built landing page form creates a sustainable multi-channel pipeline that doesn’t depend on any single source.

How much does lead generation cost for financial advisors?

Costs range from $0-$50 for referral leads to $75-$250 for Google Ads leads. Third-party platforms like SmartAsset SmartAdvisor charge $20-$100 per lead. Seminar-based prospecting runs $100-$500 per lead depending on venue, geography, and direct mail costs.

Are purchased leads worth it for financial advisors?

Purchased leads from platforms like WiserAdvisor or Zoe Financial convert at 2-8%. That’s low. But firms with dedicated sales teams and CRM automation through Redtail Technology or Wealthbox can make the volume work if their cost per acquisition stays under client lifetime value.

What compliance rules apply to financial advisor lead generation?

The SEC Marketing Rule (Rule 206(4)-1) and FINRA Rule 2210 govern all advertising. Advisors can now use client testimonials under specific disclosure conditions. Every ad, email, and social post must avoid promissory language and include required disclaimers.

How do financial advisors get leads from LinkedIn?

LinkedIn Sales Navigator lets advisors filter prospects by job title, company size, and recent job changes. Posting thought leadership content 3-4 times weekly builds credibility. Personalized outreach referencing specific trigger events (retirement, job change) outperforms generic connection requests significantly.

What is a good lead-to-client conversion rate for financial advisors?

Industry benchmarks from Kitces Research show 10-30% overall, depending on lead source. Referral leads convert at 50%+. Seminar leads hit 15-25%. Purchased or shared leads from third-party services sit at 2-8%. The source determines the math.

How do financial advisors build a lead generation funnel?

Top of funnel uses blog content and paid ads for awareness. Middle of funnel captures emails through downloadable lead magnets like retirement checklists. Bottom of funnel drives consultation bookings through email drip sequences and direct calls to action.

What CRM systems do financial advisors use for lead management?

Wealthbox, Redtail Technology, and Salesforce Financial Services Cloud are the top three. HubSpot CRM works for smaller RIAs. These platforms automate follow-up sequences, track compliance documentation, and manage the full prospect-to-client lifecycle with drip campaign functionality.

How does niche specialization improve lead quality for advisors?

Advisors targeting specific groups (federal employees, physicians, divorce financial planning) attract higher-intent prospects. A Certified Financial Planner specializing in 401(k) rollovers for tech workers converts better than a generalist because the messaging matches the prospect’s exact situation.

How long does it take for financial advisor lead generation to produce results?

Paid advertising generates leads within days. Organic content marketing and SEO take 6-12 months to build consistent traffic. Referral networks require 1-3 years of relationship building. Most advisory firms see meaningful pipeline results after 6 months of consistent multi-channel effort.

Conclusion

Lead generation for financial advisors comes down to building a repeatable system, not chasing individual tactics. The advisors who grow consistently are the ones who combine referral networks, targeted digital marketing, and compliant content into a single pipeline.

Track your cost per acquired client, not just cost per lead. A $200 lead means nothing if it never books a discovery meeting.

Build your website forms for lead generation around specific prospect segments. Pre-retirees with 401(k) rollover decisions respond differently than business owners planning exits. One-size-fits-all forms and messaging waste budget.

Invest in a CRM like Salesforce Financial Services Cloud or Wealthbox to automate follow-up sequences and stay compliant with FINRA advertising rules.

The firms adding 20+ new clients per year aren’t doing anything exotic. They’re doing the basics well, measuring what works, and cutting what doesn’t. Start there.