Most surveys collect answers. Few collect anything useful. The difference comes down to the questions you ask. Vague prompts get vague responses. Specific, well-structured feedback survey questions get data you…

Table of Contents

A customer just bought from you. Now what?

Most ecommerce brands miss their best opportunity to learn why people actually clicked “purchase.” The right post-purchase survey questions reveal what analytics dashboards never will.

Customer feedback collected within days of delivery drives real improvements. Better product descriptions. Faster shipping. Fewer returns.

This guide covers the exact questions that measure satisfaction, uncover buying motivations, and identify friction across the shopping experience.

You’ll learn which question types to use, optimal survey timing, and how to boost response rates using tools like Klaviyo, Typeform, and SurveyMonkey.

Stop guessing. Start asking.

What is a Post-Purchase Survey

A post-purchase survey is a customer feedback collection method sent after a transaction to measure satisfaction, understand buying motivations, and identify improvement areas across the shopping experience.

These questionnaires typically arrive via email or SMS within days of order delivery.

The timing matters. Send too early and customers haven’t used the product. Too late and they’ve forgotten the details.

Most ecommerce brands use platforms like Klaviyo, Typeform, or SurveyMonkey to automate distribution. The goal is simple: capture honest opinions while the experience remains fresh.

Unlike generic feedback forms, post-purchase surveys focus specifically on the transaction cycle. They cover product quality, checkout process, shipping speed, and overall satisfaction.

This data feeds directly into customer experience metrics like CSAT (Customer Satisfaction Score) and NPS (Net Promoter Score).

Designing Effective Survey Questions

Question design makes or breaks your post-purchase feedback. Poor questions lead to useless data. Great ones unlock customer insights that transform businesses.

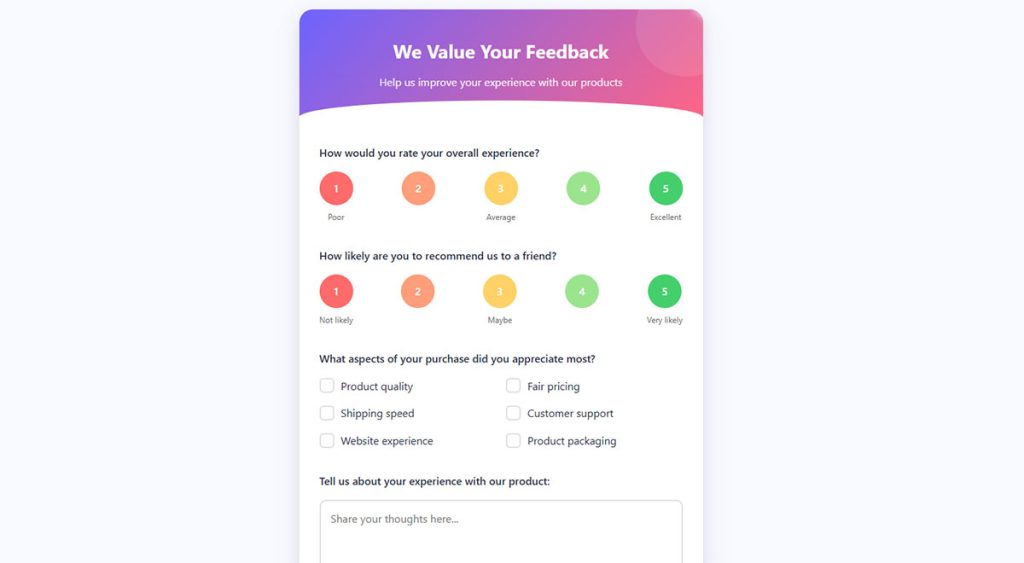

Question Types and Formats

The backbone of any customer feedback form includes several formats:

Multiple choice vs. open-ended questions serve different purposes. Multiple choice options:

- Quick to complete

- Easy to analyze

- Provide quantifiable data

Open-ended questions capture nuanced feedback impossible to predict. They reveal pain points and customer language while gathering product improvement suggestions.

Rating scales provide structured measurement. The Net Promoter Score (NPS) asks “How likely are you to recommend?” on a 0-10 scale. Customer Satisfaction Score (CSAT) measures specific experiences. Likert scales evaluate agreement levels from “strongly disagree” to “strongly agree.”

Binary questions create simple yes/no splits. “Did you find what you were looking for?” Perfect for checkout friction points or mobile shopping experience evaluation.

Picture-based questions boost engagement. Visual feedback tools like JotForm allow customers to mark specific areas of product images or screenshots. These work brilliantly for packaging assessment.

Question Structure Best Practices

Clear language matters. Ask “How satisfied were you with delivery speed?” not “Was our logistical fulfillment timeline adequate?” User experience questions must avoid jargon.

Avoid leading questions that bias results. “How amazing was our support team?” pushes respondents toward positive answers. Instead ask “How would you rate our support team?”

Specific language outperforms generalities. “Did you find our checkout process easy to use?” beats “Was your experience good?” Specificity provides actionable consumer insight collection.

Balance positive and negative framing. Include “What did you dislike?” alongside “What did you like?” This approach improves your voice of customer data quality.

Timing and Length Considerations

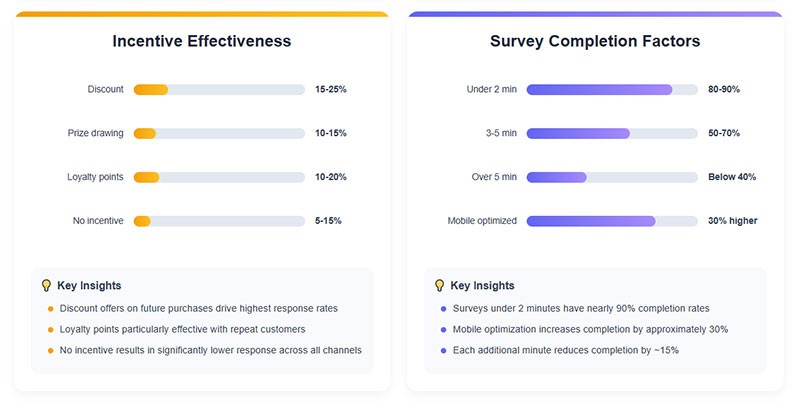

Survey length dramatically impacts completion. The ideal post-sale evaluation contains 5-7 questions. Longer surveys see sharp drop-offs in response rates.

Timing matters equally. Send your purchase experience evaluation:

- Immediately for service feedback

- After delivery for product feedback

- 7-14 days after use for durability feedback

Response rates decline with survey length. Customer effort score measurement shows that each additional question reduces completion by approximately 5-8%.

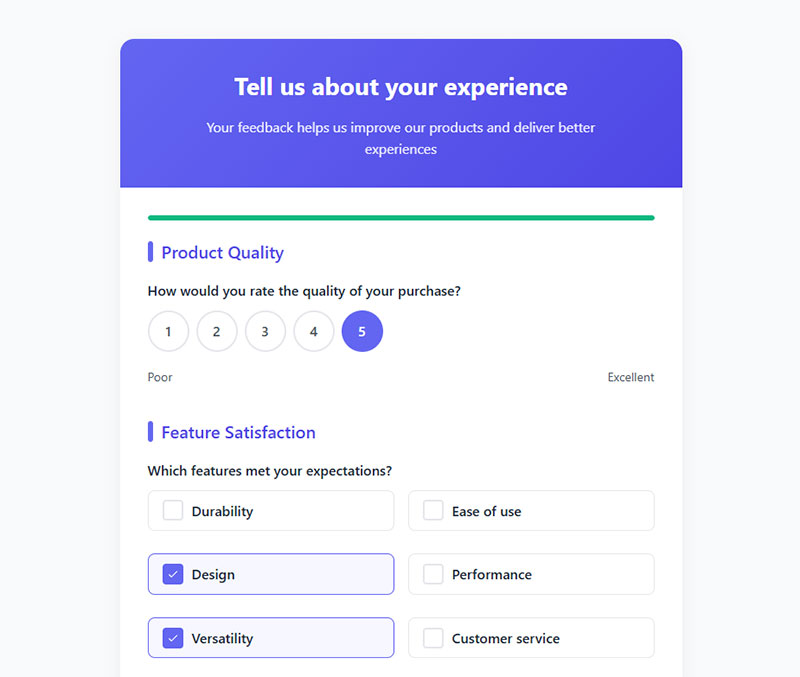

Improve participation through:

- Mobile-friendly design

- Progress indicators

- Estimated completion time

- Skip logic for irrelevant questions

Essential Question Categories

Every comprehensive survey question set needs to cover key areas.

Product Satisfaction Questions

Start with product quality assessment. “How would you rate the quality of your purchase?” establishes a baseline.

Feature satisfaction rating reveals specific strengths and weaknesses. “Which features met your expectations?” followed by “Which features disappointed you?” provides balanced feedback.

Value perception matters enormously. “Do you feel the product was worth the price?” directly measures price satisfaction query results.

Compare your offering against alternatives. “How does our product compare to similar ones you’ve used?” generates competitive comparison insights that marketing teams crave.

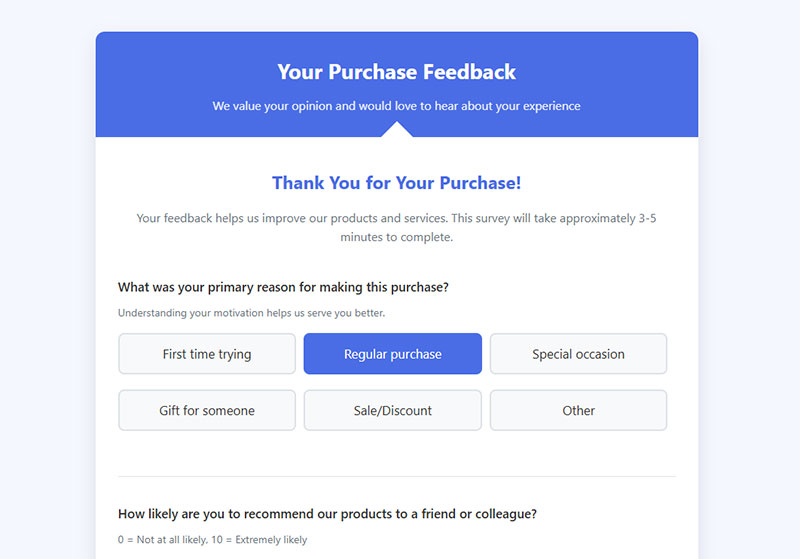

Purchase Experience Questions

Website usability feedback questions assess navigation. “How easy was finding the right product?” identifies site friction.

The checkout process assessment remains critical. “Did you encounter any obstacles while checking out?” finds conversion barriers.

Payment options satisfaction affects completion rates. “Were you able to pay using your preferred method?”

For e-commerce platforms, investigate device differences. “Did you complete your purchase on mobile or desktop?” followed by satisfaction questions uncovers cross-platform issues.

Customer Service Evaluation

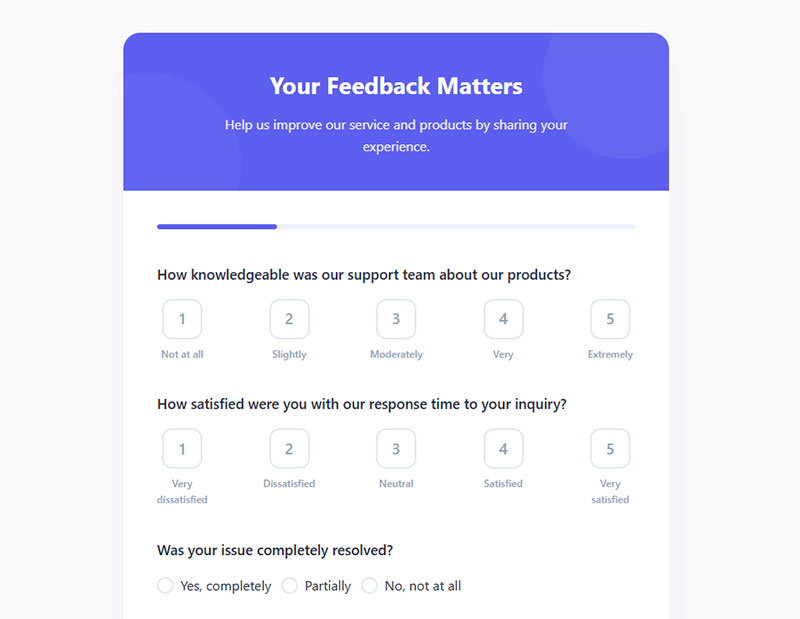

Staff knowledge measurement reveals training gaps. “How knowledgeable was our support team about our products?”

Response time satisfaction directly impacts CSAT measurement. “How satisfied were you with our response time to your inquiry?”

Problem resolution effectiveness questions like “Was your issue completely resolved?” identify service quality indicators.

Compare pre and post-purchase support. “How would you rate support before your purchase compared to after?” highlights inconsistencies in customer support evaluation.

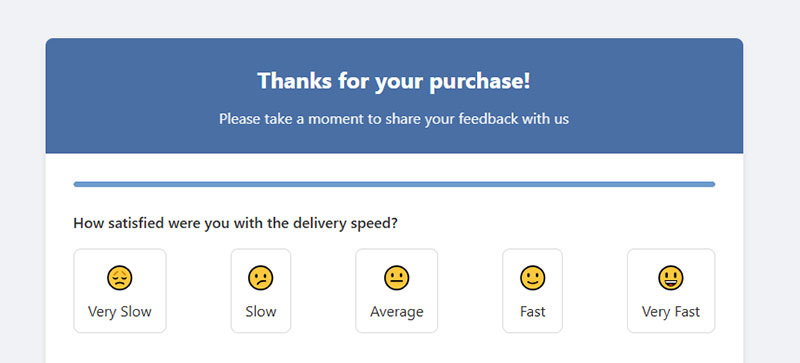

Delivery and Fulfillment Questions

Shipping speed satisfaction determines repeat purchases. “How satisfied were you with the delivery time?”

Packaging quality matters increasingly. “Did the packaging adequately protect your product?” and “What did you think of our packaging design?” measure both function and impression.

Product condition upon arrival affects return rates. “Did your product arrive in perfect condition?” helps assess shipping damage frequency.

Returns process feedback reveals friction points. “How easy was initiating a return?” and “How quickly did you receive your refund?” measure a critical aspect of the consumer opinion gathering process.

Thoughtful survey design transforms basic questioning into strategic customer relationship management. Use these guidelines to create surveys that generate actionable insights while respecting your customers’ time.

Advanced Question Techniques

Beyond basic questions lie sophisticated techniques that extract deeper customer insights. Smart survey design transforms ordinary feedback into strategic intelligence.

Segmentation-Based Questions

Demographic collection provides context for other responses. Simple questions like “What is your age range?” or “How frequently do you shop online?” help categorize feedback for more meaningful analysis.

IvyForms excels at creating segmented surveys that adapt based on previous answers. This allows for purchase motivation inquiry without overwhelming respondents.

Customer persona identification questions reveal who’s buying and why:

- “What best describes your role?”

- “How do you primarily use our product?”

- “Which features matter most to you?”

Shopping habit indicators help predict future behavior. “How often do you purchase products in this category?” provides purchase reflection context essential for inventory planning.

Competitive Intelligence Questions

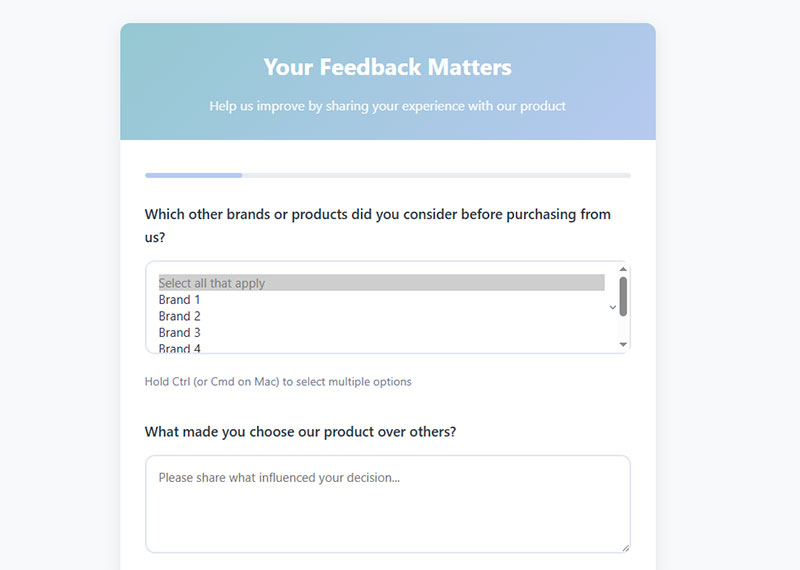

Brand comparison questions deliver critical market positioning data. “Which other brands did you consider?” followed by “Why did you choose us instead?” reveals competitive advantage identification opportunities.

Ask about alternative options considered:

- “Which other products did you evaluate?”

- “What made you choose our product over others?”

- “What features do competitors offer that we don’t?”

Switching behavior indicators help retention efforts. “Have you previously purchased from another brand in this category?” followed by “What prompted your switch?” reveals acquisition triggers.

These competitive comparison questions must be carefully worded. Avoid leading questions that mention specific competitors, as this biases responses and skews sentiment analysis results.

Emotional Connection Questions

Brand perception queries tap into feelings. “What three words would you use to describe our brand?” provides qualitative emotional response data.

Customer Relationship Management systems can track emotional responses over time. This reveals shifting perceptions that quantitative metrics might miss.

Brand values alignment questions matter increasingly. “How important is our environmental commitment to your purchase decision?” measures how corporate values impact buying behavior.

Social proof questions explore community influence. “Did recommendations from others influence your purchase?” followed by “Where did you hear about us?” maps word-of-mouth patterns.

Implementing Survey Insights

Collecting data means nothing without analysis and action. Effective post-purchase survey programs close the feedback loop.

Data Analysis Methods

Quantitative vs. qualitative analysis requires different approaches. Numeric ratings (NPS, CSAT, Customer Effort Score) provide trackable metrics. Open responses need careful coding and categorization.

User testing platforms like Qualtrics offer sophisticated trend identification techniques. Pattern recognition in responses highlights emerging issues before they become widespread.

Priority scoring methods help focus efforts. Weight feedback based on:

- Frequency (how often mentioned)

- Intensity (emotional strength)

- Impact on retention

- Implementation difficulty

Cross-reference survey data with sales metrics. Do customers who report higher satisfaction actually purchase more? Data analytics reveals these connections.

Turning Feedback into Action Plans

Creating actionable improvement plans requires structure. For each major issue identified:

- Document specific problems

- Brainstorm potential solutions

- Evaluate implementation requirements

- Set measurable success metrics

Set clear goals based on feedback. “Improve shipping speed satisfaction by 15% within 90 days” provides better direction than “fix shipping problems.”

Assign specific responsibility for each improvement area. Customer experience management requires clear ownership of action items with defined timelines.

Develop realistic implementation schedules. Quick wins build momentum, while structural changes may require longer timelines with interim measurement.

Closing the Feedback Loop

Communicate changes to respondents. Nothing builds loyalty faster than telling customers “You spoke, we listened.” Email updates on improvements directly address pain points raised in their purchase journey feedback.

Follow up with survey participants through:

- Direct email acknowledgment

- “You helped us improve” campaigns

- Before/after comparisons

Measure the impact of implemented changes through repeat surveys. Track satisfaction scores on specific dimensions before and after improvements to confirm effectiveness.

Build continuous improvement cycles using Voice of Customer programs. Regular post-purchase survey questions establish baseline metrics that track progress over time.

Converting user experience feedback into tangible improvements delivers measurable ROI. Each enhancement in product quality, service delivery, or website usability drives customer lifetime value growth and strengthens consumer opinion gathering systems.

Survey Distribution Strategies

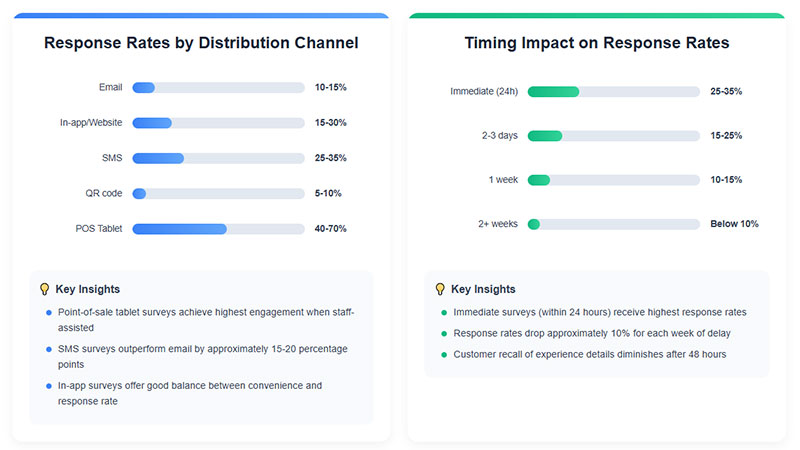

Distribution can make or break your post-purchase feedback collection efforts. Strategic delivery dramatically impacts response rates.

Channel Selection

Email survey best practices start with compelling subject lines. “Your feedback shapes our future” outperforms “Please complete our survey.” Personalization in the email boosts open rates by 26% according to customer insight collection metrics.

Time your purchase experience evaluation emails strategically:

- 1-3 days after delivery for product feedback

- Immediately after support interactions

- Mid-morning on weekdays for highest open rates

Website survey integration captures feedback while experience remains fresh. Embedded survey tools like Qualtrics trigger based on:

- Purchase completion

- Return visits

- Cart abandonment

- Time on page

SMS survey considerations require extreme brevity. Limit mobile surveys to 2-3 critical customer experience measurement questions with clear opt-out instructions. Response rates for order fulfillment questions via SMS often exceed email by 3-4x.

Social media surveys work well for audience segments comfortable with these platforms. Instagram polls and Facebook surveys generate high visibility but potentially biased sampling.

Incentive Strategies

Discount codes drive completion. “Share your thoughts and get 15% off your next purchase” creates dual benefits—feedback and repeat sales. Aligning incentives with customer loyalty programs multiplies effectiveness.

Loyalty points or rewards leverage existing programs. “Earn 500 points for completing our product satisfaction inquiry” works especially well for frequent buyers.

Charitable donations appeal to values-driven customers. “We’ll donate $5 to charity for each completed survey” aligns with brand perception questions and social identity positioning.

Contest entries generate excitement. “Complete our feedback for a chance to win” drives higher participation from price-sensitive segments. SurveyMonkey data suggests prize draw incentives improve consumer opinion gathering rates by 15-30%.

Targeting and Personalization

Customer segmentation enables targeted questioning. New customers receive different checkout process assessment questions than repeat buyers. This approach respects the buyer’s experience level with your brand.

Purchase-specific question customization shows respect for customer time. Asking about specific products purchased rather than your entire catalog demonstrates attention to the individual shopping experience evaluation.

Personalized introductions dramatically impact completion rates. “John, your recent purchase of X matters to us” feels more engaging than generic appeals for feedback.

Response-adaptive question paths prevent irrelevant questions. If a customer rates delivery poorly, smart surveys automatically probe for specific shipping speed satisfaction issues.

Measuring Survey Effectiveness

Robust measurement systems ensure your post-purchase survey questions deliver value.

Response Rate Metrics

Calculating response rates requires clear definitions. Track:

- View-to-start ratio

- Start-to-completion percentage

- Average completion time

- Abandonment points

Industry benchmarks vary widely. E-commerce post-sale evaluation typically achieves 5-15% completion rates, while high-end purchase experience surveys may reach 25-30% with proper incentives.

Survey fatigue indicators signal problems. Watch for:

- Declining response rates over time

- Increased abandonment at specific questions

- Shorter answers to open-ended questions

- Less thoughtful feedback

Methods to improve participation include:

- Progressive disclosure (revealing questions gradually)

- Mobile optimization

- Visual progress indicators

- Estimated completion time display

Quality of Feedback Metrics

Data completeness matters more than volume. Measure the percentage of optional fields completed and word count for open responses to gauge engagement quality.

Response thoughtfulness assessment requires human review initially. Look for:

- Specific details vs. generic comments

- Actionable suggestions

- Emotional language indicating genuine connection

- Multiple points of feedback

Actionable feedback percentage measures value. Track how many responses generate specific improvement opportunities versus general satisfaction indicators.

Feedback diversity ensures representation. Monitor demographic spread of respondents against your overall customer base. Underrepresented segments may need targeted outreach or different purchase reflection questions.

Impact on Sales Metrics

Correlating survey insights with sales requires sophisticated customer relationship management. Track whether customers who complete feedback forms return to purchase again at higher rates.

Measure customer retention improvements by segment. Does addressing specific pain points identified in customer effort score surveys reduce churn in affected customer groups?

Track repeat purchase behavior among survey respondents vs. non-respondents. Data analytics often reveals survey participants exhibit 20-40% higher loyalty rates, even before implementing improvements.

Calculate ROI by measuring:

- Cost per completed survey

- Value of insights generated

- Revenue from resulting improvements

- Retention value of the feedback loop itself

The most effective voice of customer programs connect post-purchase survey questions directly to business outcomes. When customer experience measurement drives strategic decisions, the entire organization becomes more customer-centric.

Why Do Post-Purchase Surveys Matter for Ecommerce

Post-purchase surveys provide direct customer insights that reduce return rates, increase repeat purchases, and identify friction points in the checkout process.

Here’s the thing. Customer acquisition costs keep climbing. Retaining existing buyers costs 5x less than finding new ones.

Survey data reveals why people don’t come back.

Maybe packaging arrived damaged. Maybe sizing ran small. Maybe the delivery took 12 days instead of 5. You won’t know unless you ask.

The benefits break down into four areas:

- Retention improvement – identifying dissatisfied customers before they churn

- Product development – gathering real feedback on quality, features, and expectations

- Operations fixes – spotting recurring issues with shipping, packaging, or fulfillment

- Marketing insights – understanding which channels and messages drive purchases

Brands using structured feedback collection see measurable improvements in customer lifetime value. The connection between asking and acting creates loyalty.

What Are the Types of Post-Purchase Survey Questions

The 5 main types of survey questions include satisfaction rating questions, open-ended feedback questions, product quality questions, delivery experience questions, and purchase motivation questions.

Each type serves a different analytical purpose.

Rating questions give you quantifiable data. Open-ended questions reveal context and emotion. Product questions validate your descriptions. Delivery questions audit your logistics. Motivation questions inform your marketing.

Smart surveys mix these formats. Too many open-ended questions and completion rates drop. Too many rating scales and you miss the nuance.

What Are Satisfaction Rating Questions

Satisfaction rating questions use numerical scales (1-5 or 1-10) to measure customer happiness with specific purchase aspects.

The Likert scale dominates this category. CSAT surveys typically ask respondents to rate satisfaction from “Very Dissatisfied” to “Very Satisfied.”

NPS questions take a different approach, asking “How likely are you to recommend us?” on a 0-10 scale. Learn more about crafting effective NPS survey questions for your brand.

What Are Open-Ended Feedback Questions

Open-ended feedback questions allow customers to describe their experience in their own words, providing qualitative data about pain points and positive moments.

These questions work best when limited to 1-2 per survey. More than that and response rates tank.

Character limits help. Keeping responses under 500 characters encourages focused answers rather than rambling. Consider following best practices for creating feedback forms to balance depth with completion rates.

What Are Product Quality Questions

Product quality questions assess whether items met customer expectations regarding materials, functionality, sizing, and appearance compared to product descriptions.

The gap between expectation and reality drives most returns. These questions surface that gap early.

Common formats include photo accuracy ratings, size/fit assessments, and material quality scores. For deeper guidance on survey questions about product quality, focus on specific attributes rather than general impressions.

What Are Delivery Experience Questions

Delivery experience questions evaluate shipping speed, packaging quality, tracking accuracy, and condition of items upon arrival.

Logistics problems destroy repeat purchase intent faster than product issues. A crushed box feels personal.

Questions cover carrier satisfaction, estimated vs actual delivery dates, and packaging adequacy. This data helps negotiate with fulfillment partners and identify regional shipping problems.

What Are Purchase Motivation Questions

Purchase motivation questions identify why customers chose your brand, which marketing channels influenced their decision, and what factors drove the purchase.

The classic “How did you hear about us?” lives here. So do competitor comparison questions and decision factor rankings.

Attribution data from these questions often contradicts analytics platforms. Someone might click a Google ad but report that a friend’s recommendation drove the purchase. Both matter for different reasons.

How Many Questions Should a Post-Purchase Survey Have

A post-purchase survey should contain 3 to 7 questions to maintain completion rates above 30% while gathering sufficient data for analysis.

Every additional question drops completion by roughly 5-10%. The math works against long surveys.

Mobile respondents abandon faster than desktop users. Keep mobile surveys under 5 questions. Following mobile form best practices significantly impacts response rates.

Industry benchmarks suggest:

- 3 questions – 40%+ completion rate

- 5 questions – 30-35% completion rate

- 7 questions – 25% completion rate

- 10+ questions – below 15% completion rate

Quality beats quantity. Three well-crafted questions yield more actionable data than ten mediocre ones. Focus on avoiding survey fatigue to protect long-term response rates.

When to Send a Post-Purchase Survey

The optimal timing for post-purchase surveys is 3 to 7 days after delivery for product feedback and immediately after checkout for purchase experience feedback.

Different goals require different timing:

- Checkout experience – within 1 hour of purchase

- Delivery satisfaction – 1-2 days after delivery confirmation

- Product quality – 5-7 days after delivery (time to use it)

- Overall satisfaction – 3-5 days after delivery

Email remains the dominant channel. SMS works for younger demographics but has higher opt-out rates.

Avoid weekends. Tuesday through Thursday mornings see the highest open rates for transactional emails.

What Are the Best Post-Purchase Survey Questions to Ask

The 15 most effective post-purchase survey questions measure satisfaction, product quality, delivery experience, and likelihood to repurchase.

These questions are tested across thousands of ecommerce brands using platforms like Hotjar, Delighted, and Qualtrics. Mix rating scales with strategic open-ended prompts.

Satisfaction Questions

- How satisfied are you with your recent purchase? (1-5 scale)

- How likely are you to recommend us to a friend or colleague? (0-10 NPS scale)

- How would you rate your overall shopping experience? (1-5 scale)

These tie directly to your Customer Satisfaction Score and Net Promoter Score tracking. For related formats, explore customer service survey questions.

Product Experience Questions

- Did the product match the photos and description on our website?

- How would you rate the quality of your purchase? (1-5 scale)

- Was the sizing/fit what you expected? (Yes/No/Partially)

Product questions surface expectation gaps before they become returns or negative reviews on Trustpilot.

Delivery Questions

- How satisfied were you with the shipping speed? (1-5 scale)

- Did your order arrive in good condition?

- How would you rate the packaging? (1-5 scale)

Fulfillment feedback helps negotiate with carriers and identify regional logistics problems.

Purchase Motivation Questions

- How did you first hear about us? (Multiple choice)

- What almost stopped you from completing your purchase?

- What was the main reason you chose us over competitors?

Attribution data from question 10 often contradicts Google Analytics. Both perspectives matter for marketing decisions.

Repeat Purchase Questions

- How likely are you to purchase from us again? (1-5 scale)

- What would make your next experience even better? (Open-ended)

- Is there anything else you’d like us to know? (Open-ended)

These final questions capture intent and surface issues your structured questions missed.

How to Improve Post-Purchase Survey Response Rates

Increasing post-purchase survey response rates requires optimized timing, mobile-friendly design, incentive offers, and personalized subject lines.

Subject line personalization alone can boost open rates by 26%. Include the customer’s name and reference their specific order.

Tactics that work:

- Incentives – 10% off next purchase, loyalty points, entry into giveaways

- Progress indicators – show “Question 2 of 5” to set expectations

- One-click starts – embed the first question directly in the email

- Mobile optimization – large tap targets, minimal scrolling

Smart form design reduces friction. Use conditional logic to skip irrelevant questions based on previous answers.

Keep surveys under 2 minutes. Anything longer kills completion rates regardless of incentives.

What Tools Send Post-Purchase Surveys

The 7 main post-purchase survey platforms include Klaviyo, Typeform, SurveyMonkey, Hotjar, Delighted, Google Forms, and native ecommerce platform tools.

Tool selection depends on your tech stack and budget:

- Klaviyo – best for Shopify stores, deep ecommerce integration, automated flows

- Typeform – beautiful conversational forms, higher engagement, mid-tier pricing

- SurveyMonkey – robust analytics, enterprise features, established platform

- Hotjar – combines surveys with heatmaps and session recordings

- Delighted – NPS-focused, simple setup, automated follow-ups

- Google Forms – free, basic features, manual distribution

- Yotpo/Bazaarvoice – review-focused with survey capabilities

WordPress users should explore dedicated WordPress survey plugins for tighter CMS integration. You can also learn how to create a survey form from scratch.

Most platforms offer Zapier integrations for connecting survey data to your CRM, Salesforce, or HubSpot.

How to Analyze Post-Purchase Survey Results

Analyzing survey data involves calculating response rates, segmenting by customer type, identifying trends over time, and connecting feedback to operational changes.

Start with these key metrics:

- Response rate – surveys completed / surveys sent

- Completion rate – finished surveys / started surveys

- NPS score – % promoters minus % detractors

- CSAT average – mean satisfaction rating across responses

Segment data by purchase value, product category, customer tenure, and acquisition channel. First-time buyers and repeat customers often report different experiences.

Track trends monthly, not daily. Small sample sizes create noise. Look for patterns across 100+ responses before acting.

The real value comes from closing the loop. When someone reports a problem, follow up personally. When patterns emerge, fix the root cause. Survey programs fail when data sits in dashboards instead of driving decisions.

Connect survey feedback to related feedback survey questions across other touchpoints for a complete customer journey view.

FAQ on Post-Purchase Survey Questions

What is the purpose of a post-purchase survey?

A post-purchase survey collects customer feedback after a transaction to measure satisfaction, identify product issues, and understand buying motivations.

This data reduces return rates and improves repeat purchase likelihood.

How many questions should a post-purchase survey include?

Keep surveys between 3 to 7 questions for optimal completion rates.

Shorter surveys (3-5 questions) achieve 35-40% response rates. Anything beyond 10 questions drops completion below 15%.

When is the best time to send a post-purchase survey?

Send product feedback surveys 3-7 days after delivery. Checkout experience surveys work best within 1 hour of purchase.

Tuesday through Thursday mornings see highest email open rates.

What types of questions work best in post-purchase surveys?

Mix satisfaction rating questions (1-5 scales), open-ended feedback prompts, product quality assessments, delivery experience ratings, and purchase motivation questions.

Balance quantitative data with qualitative insights.

How do I increase post-purchase survey response rates?

Offer incentives like discount codes or loyalty points. Use personalized subject lines, embed the first question in email, and optimize for mobile devices.

Keep total completion time under 2 minutes.

What is an NPS question in a post-purchase survey?

Net Promoter Score questions ask “How likely are you to recommend us?” on a 0-10 scale.

Scores 9-10 are promoters, 7-8 passive, and 0-6 detractors. Calculate NPS by subtracting detractor percentage from promoter percentage.

Should I use open-ended or multiple choice questions?

Use both. Multiple choice questions provide quantifiable data for tracking metrics like CSAT scores.

Limit open-ended questions to 1-2 per survey to capture context without killing completion rates.

What tools can I use to send post-purchase surveys?

Popular platforms include Klaviyo, Typeform, SurveyMonkey, Hotjar, and Delighted.

Shopify stores often use Klaviyo for automated flows. Google Forms works for basic needs with zero budget.

How do I analyze post-purchase survey results?

Track response rates, CSAT averages, and NPS scores monthly. Segment data by customer type, product category, and acquisition channel.

Look for patterns across 100+ responses before making operational changes.

Can post-purchase surveys help reduce return rates?

Yes. Product quality questions reveal expectation gaps before they become returns.

Identifying sizing issues, photo accuracy problems, and material complaints helps fix product listings and reduce costly reverse logistics.

Conclusion

The right post-purchase survey questions transform anonymous transactions into actionable customer insights.

You now have the framework. Question types that measure satisfaction. Timing strategies that boost response rates. Tools like Shopify integrations, Hotjar, and Delighted that automate the entire process.

But data alone changes nothing.

The brands winning at customer retention close the feedback loop. They fix the shipping delays customers report. They update product photos that mislead buyers. They follow up personally when someone scores below a 6.

Start with 3-5 questions. Track your Customer Satisfaction Score and NPS monthly. Segment by buyer behavior and purchase value.

Your customers already know what needs fixing. You just have to ask.